Investing in utility stocks can offer a reliable source of income and stability to a portfolio. These stocks typically provide consistent dividends and tend to be less volatile than stocks in other sectors. However, it’s essential to consider factors like interest rates, regulatory changes, and the overall economic environment when making investment decisions in the utility sector.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

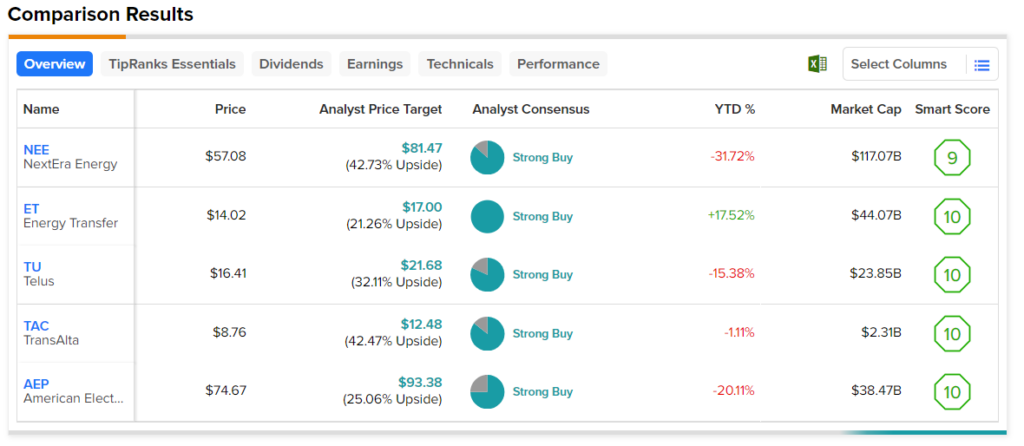

To help investors choose the best utility stocks, we have used TipRanks’ stock screener tool. Using this tool, we shortlisted stocks that have Strong Buy ratings from analysts and price targets that reflect upside potential of more than 20%. Finally, these stocks have an Outperform Smart Score (i.e., 8, 9, or 10) on TipRanks, indicating a relatively high chance of them beating the broader market.

Here are the five key stocks from the utility sector for investors to consider.

- NextEra Energy (NYSE:NEE) – The company acquires, manages, and owns contracted clean energy projects. Analysts currently see upside potential of 42.7% in NEE stock. Also, it has a Smart Score of 9 out of 10. It is worth mentioning that five analysts reaffirmed their Buy ratings on the stock two days ago.

- Telus (NYSE:TU) – While not a true utility company, Telus provides a broad range of telecommunications products and services in Canada, making it as essential as a utility company. TU stock has upside potential of 32.1%, according to analysts. Also, the stock has a ‘Perfect 10’ Smart Score.

- Energy Transfer (NYSE:ET) – The stock has an average price target of $17, which implies 21.3% upside potential from current levels. Further, its ‘Perfect 10’ Smart Score is encouraging. Energy Transfer is a provider of natural gas pipeline transportation and transmission services.

- American Electric Power (NASDAQ:AEP) – This electric utility company stock has an average price target of $93.38, which implies 25.1% upside potential from current levels. Moreover, it has a Smart Score of 10.

- TransAlta (NYSE:TAC) – Analysts currently see upside potential of 42.5% in TAC stock. The stock has a Smart Score of 10. TransAlta is primarily focused on renewable and natural gas-based electricity generation. It recently struck a deal to acquire TransAlta Renewables (TSE:RNW), a renewable energy company.