In a recent meeting, shareholders of TransAlta Renewables (TSE:RNW) overwhelmingly agreed to let the company be acquired by TransAlta Corporation (TSE:TA). TransAlta Corporation is an energy producer and utility company, while TransAlta Renewables is its subsidiary focused on renewable energy projects. Under the arrangement, TransAlta will acquire all outstanding shares of RNW not already held by TransAlta and its affiliates. Out of the represented 197,781,015 shares, 98.94% voted in favor of the agreement.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

As part of the deal, RNW shareholders can either receive 1.0337 common shares of TransAlta for each of their shares or opt for $13.00 in cash per share. The transaction, capped at 46,441,779 TransAlta shares and $800 million in cash, is set to close on October 5, 2023. Subsequently, TransAlta Renewables shares will be delisted from the Toronto Stock Exchange.

Is TA Stock a Buy, According to Analysts?

According to analysts, TA stock comes in as a Strong Buy based on six Buys and one Hold rating assigned in the past three months. The average TA stock price target of C$16.81 implies 34.1% upside potential.

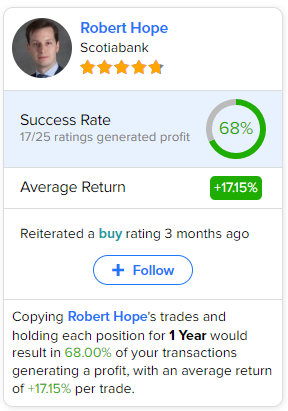

If you’re wondering which analyst you should follow if you want to buy and sell TA stock, the most accurate analyst covering the stock (on a one-year timeframe) is Robert Hope of Scotiabank, with an average return of 17.15% per rating and a 68% success rate. Click on the image below to learn more.