Investing in solar stocks can help diversify investors’ portfolios and provide exposure to a rapidly growing industry. According to a report by Insight Partners, the global solar market is projected to reach a staggering $552.4 billion by 2030, with a compound annual growth rate (CAGR) of 13%. This optimistic trajectory is expected to be fueled by government incentives and rising energy prices.

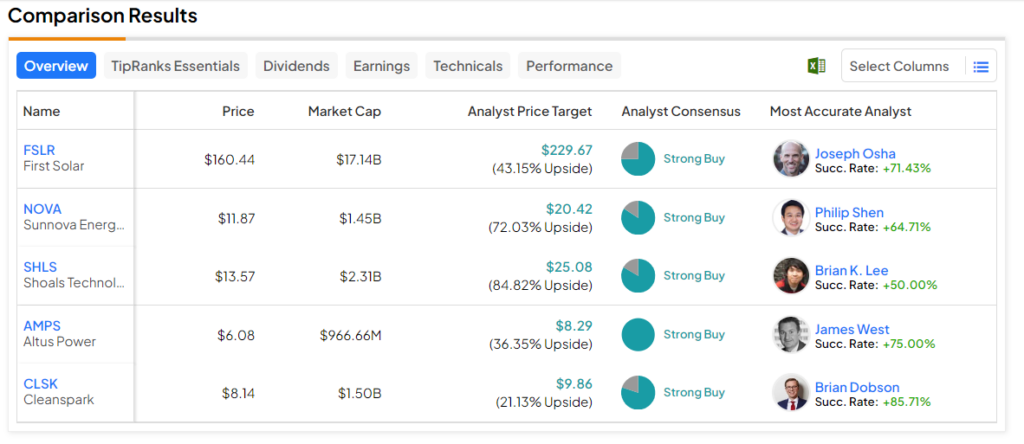

Thus, leveraging the TipRanks Stock Screener tool, we have shortlisted stocks that have received a Strong Buy rating from analysts. Further, analysts’ price targets reflect more than 20% upside potential in the next 12 months.

Here are the five key stocks from the sector that investors can consider.

- First Solar (NASDAQ:FSLR) – The company manufactures solar modules and systems for generating clean and sustainable solar power. Analysts currently see an upside potential of 43.2% in FSLR stock.

- Sunnova (NYSE:NOVA) – Sunnova offers solar and storage solutions to homeowners, helping them generate and manage their clean energy. The stock’s price forecast of $20.42 implies 72% upside potential.

- Shoals Technologies (NASDAQ:SHLS) – SHLS provides innovative products and services to optimize the performance and reliability of solar power systems, including photovoltaic (PV) modules and inverters. The stock has an upside potential of 84.8%, according to analysts.

- Altus Power (NYSE:AMPS) – Altus is a renewable energy company that focuses on developing, owning, and operating clean energy projects. AMPS stock’s average price target implies an upside potential of 36.4%.

- Cleanspark (NASDAQ:CLSK) – This company provides software and control technology to optimize energy resources, including solar, storage, and other distributed energy assets. The stock has an average price target of $9.86, which implies 21.1% upside potential from current levels.