Oil is one of the most lucrative sectors for investment, as these companies have enough cash and enjoy steady demand. However, factors such as geopolitical events, supply and demand dynamics, and regulatory changes can significantly impact oil prices. Despite the volatility of the oil sector, there are some top-performing oil stocks that investors can consider. TipRanks offers a Stock Screener tool to help investors select these stocks.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

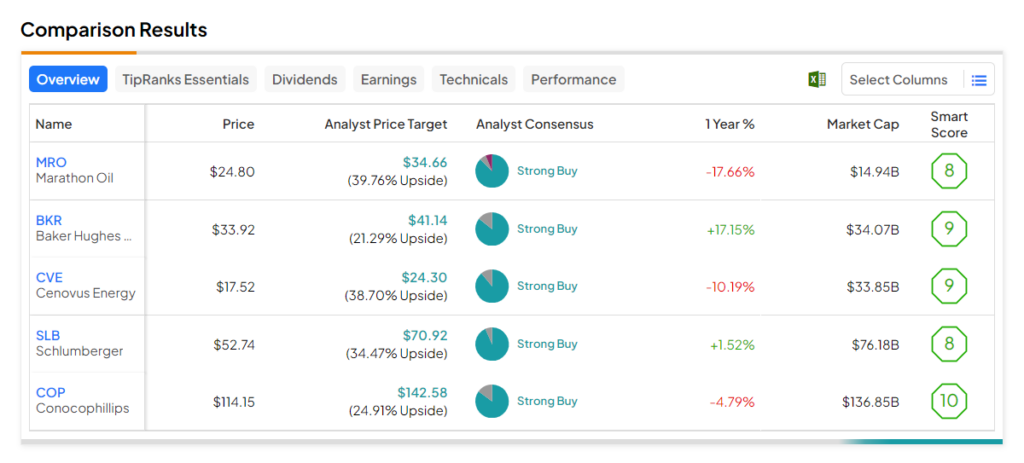

Using this tool, we shortlisted stocks that have a Strong Buy rating from analysts and an Outperform Smart Score (i.e., 8, 9, or 10) on TipRanks, indicating a chance to outperform the broader market. Also, analysts’ price targets reflect an upside potential of more than 20%.

Here are the five key stocks from the oil sector that investors can consider.

- SLB (NYSE:SLB) – The stock has an average price target of $70.92, which implies a 34.47% upside potential from current levels. Also, its Smart Score of eight is encouraging. Following the company’s mixed third-quarter results released on October 20, nine analysts rated SLB stock a Buy.

- ConocoPhillips (NYSE:COP) – Analysts currently see an upside potential of 24.9% in COP stock. Also, it has a Smart Score of “Perfect 10”. Importantly, five Buy ratings were assigned to COP stock following the release of third-quarter earnings on November 2.

- Cenovus Energy (NYSE:CVE) – The stock’s price forecast of $24.30 implies a nearly 39% upside. EOG stock has a Smart Score of nine. CVE stock received five Buy ratings following the release of mixed Q3 results last week.

- Marathon Oil (NYSE:MRO) – MRO stock has an analyst consensus upside of 39.8% and a Smart Score of eight. Four analysts have reiterated a Buy rating on the stock after the company reported its Q3 results on November 2.

- Baker Hughes (NASDAQ:BKR) – BKR stock’s average price target implies a consensus upside of 21.3%. Moreover, it has an outperforming Smart Score of nine. Interestingly, 10 Wall Street analysts rated the stock a Buy after it reported upbeat Q3 results on October 26.