Investing in financial stocks, comprising banks, insurance companies, investment firms, and real estate investment trusts (REITs), among others, can be a complex task. While these stocks have the potential to offer significant capital growth and dividend income, they are sensitive to economic fluctuations.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

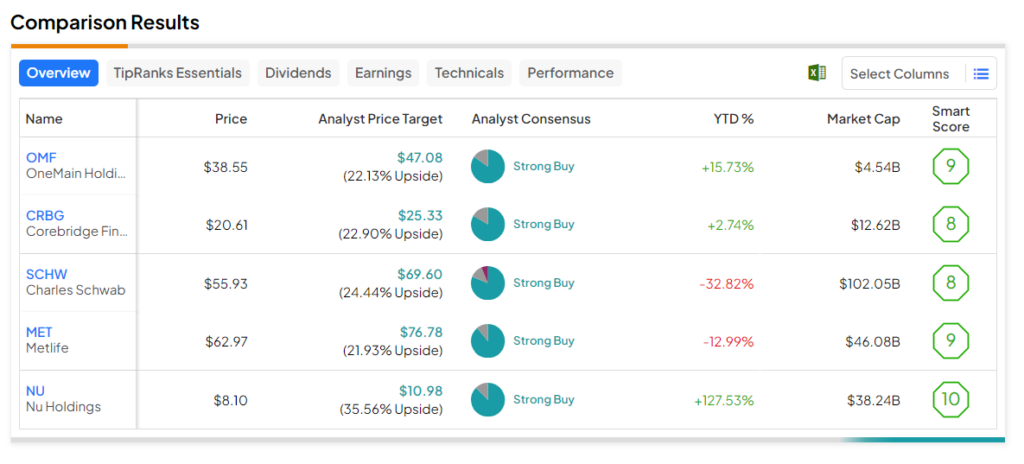

To support investors’ search for the best financial stock, we have leveraged the TipRanks Stock Screener tool. These stocks have received a Strong buy rating from analysts and boast an Outperform Smart Score (i.e., 8, 9, or 10) on TipRanks, which points to their potential to beat the broader market. Further, analysts’ price targets reflect an upside potential of more than 20%.

Here are the five best financial stocks for investors to consider.

- Charles Schwab (NYSE:SCHW) – The company offers wealth management, securities brokerage, banking, asset management, custody, and financial advisory services. Its price forecast of $69.60 implies a 24.4% upside. Also, the stock has a Smart Score of eight.

- Metlife (NYSE:MET) – The global insurance company’s stock has an analyst consensus upside of 21.9%. Also, MET stock has a Smart Score of nine.

- Nu Holdings (NYSE:NU) – The company is engaged in providing digital banking services. NU stock’s price forecast of $10.98 implies a 35.6% upside and has a “Perfect 10” Smart Score.

- Corebridge Financial (NYSE:CRBG) – The company provides retirement solutions and insurance products. CRBG’s average price target implies a consensus upside of 22.9% and carries a Smart Score of eight.

- OneMain Holdings (NYSE:OMF) – This consumer finance company provides origination, underwriting, and servicing of personal loans. The stock’s average price target of $47.08 implies a 22.1% upside potential. Also, its Smart Score of nine is encouraging.