It’s a smart move to add a few high-quality dividend stocks to one’s portfolio. Besides diversification, dividend-paying companies provide regular income, are less volatile (thanks to their ability to generate strong earnings), and reduce the payback period of one’s investment. (See TipRanks’ Dividend Calculator)

Top Dividend Stocks

While several companies pay dividends, only a few can be reliable long-term bets. Using TipRanks’ database, this article zeroes in on five Dividend Kings – companies that have increased dividends for 50+ years in a row. Furthermore, this article focuses on companies with solid earnings growth potential, sustainable payout ratio, and healthy dividend yield.

Coca-Cola (KO)

Dividend yield: 2.95%

Payout ratio: 99.28%

Annual dividend: $1.68

Beverage giant Coca-Cola is popular for its stellar dividend payment history. To be precise, Coca-Cola has uninterruptedly increased dividends for 59 years and paid $7 billion in dividends in 2020. Earlier this year, it announced a 2.4% hike in its annual dividend to $1.68 a share. Coca-Cola stock has a Strong Buy analyst rating consensus, and the average Coca-Cola price target of $60.92 indicates about 8% upside potential to current levels. Furthermore, Coca-Cola stock has positive indicators from financial bloggers and individual investors. Moreover, hedge funds increased their holdings by 653.7K shares in the last quarter. Media sentiment on Coca-Cola stock is also positive. The stock has an ‘Outperform’ Smart Score of 10.

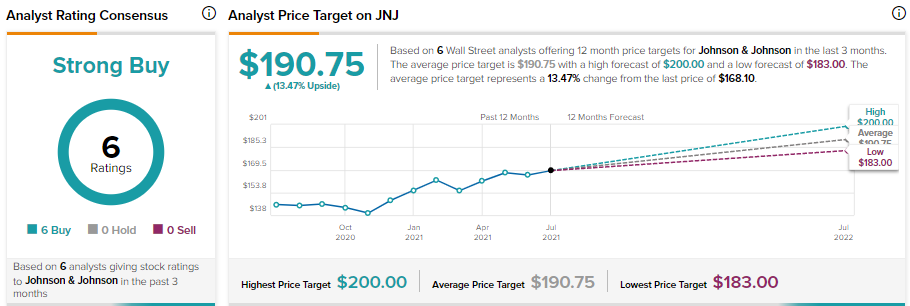

Johnson & Johnson (JNJ)

Dividend yield: 2.43%

Payout ratio: 95.00%

Annual dividend: $4.24

The diversified healthcare company Johnson & Johnson has increased its dividend for straight 59 years. It has recently increased its dividend by 5% to $4.24 a share (on an annual basis). Johnson & Johnson stock has positive indicators from financial bloggers and individual investors. However, hedge funds decreased their holdings by 80.0K shares in the last quarter. The stock has an ‘Outperform’ Smart Score of 8. Furthermore, the consensus among analysts is a Strong Buy. The average Johnson & Johnson price target of $190.75 implies 13.5% upside potential.

Procter & Gamble (PG)

Dividend yield: 2.36%

Payout ratio: 59.57%

Annual dividend: $3.48

Household and personal care products manufacturer Procter & Gamble is among the most reliable dividend-paying companies. It has paid dividend for over 131 years in a row and increased it for 65 consecutive years. Thanks to its strong business and resilient cash flows, Procter & Gamble expects to return $8.0 billion in dividends to its shareholders in FY21. Media sentiment and financial bloggers’ opinions are positive on Procter & Gamble stock. However, hedge funds and insiders have been selling. Nevertheless, consensus among analysts is a Moderate Buy based on 4 buys, 5 Holds, and 1 Sell. The average Procter & Gamble price target of $146.90 implies 4.6% upside potential.

Emerson Electric Company (EMR)

Dividend yield: 2.07%

Payout ratio: 56.87%

Annual Dividend: $2.02 a share

Emerson Electric is a technology and industrial products manufacturer that has a long history of dividend growth. Emerson raised its dividend for 65 consecutive years, reflecting its strong cash generating capabilities. Consensus among analysts is a Moderate Buy based on 8 Buys and 4 Holds. The average Emerson Electric price target of $105.46 implies 8.4% upside potential. Furthermore, financial bloggers’ opinions are favorable on Emerson stock. However, hedge funds have decreased holding by 485.3K shares in the last three months.

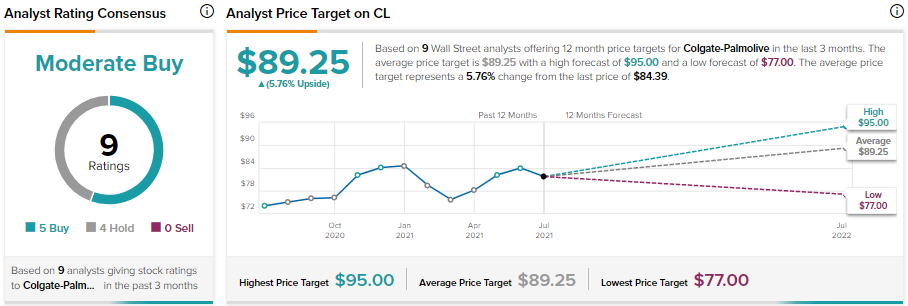

Colgate-Palmolive (CL)

Dividend yield: 2.1%

Payout ratio: 42.77%

Annual Dividend: $1.80 a share

Household products and personal care product manufacturer Colgate-Palmolive has regularly paid dividend since 1895. Moreover, it has increased its dividend for 58 years in a row. The stock has a Moderate Buy rating based on 5 Buys and 4 Holds. The average Colgate-Palmolive price target of $89.25 implies 5.8% upside potential. Furthermore, Colgate-Palmolive stock has an ‘Outperform’ Smart Score of 9 with positive indicators from financial bloggers and hedge fund activities.

The Takeaway

These Dividend Kings have a long track record of returning cash to their shareholders in the form of dividends. Moreover, improving economic conditions and their ability to generate strong profitability indicate that these companies could continue to boost shareholders’ value in the future.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.