Investing in real estate stocks, particularly Real Estate Investment Trusts (REITs), comes with a host of benefits. These include regular dividend income, tax advantages, portfolio diversification, liquidity as opposed to investing directly in real estate, and potential for capital appreciation. These features make real estate stocks a lucrative choice for investors.

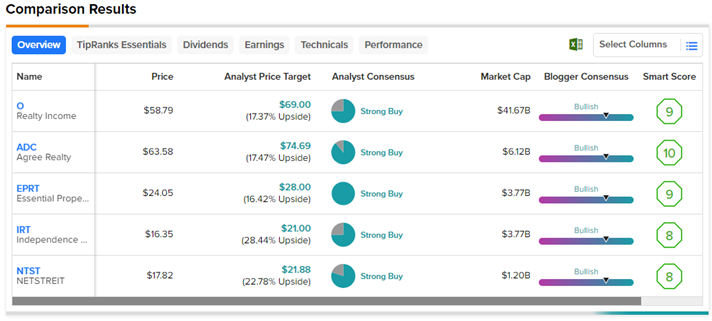

Using TipRanks’ Stock Screener tool, we identified five REIT stocks with the potential to outperform the market. Using this tool, we shortlisted stocks that have a Strong Buy rating from Wall Street analysts. Moreover, the analysts’ price targets reflect decent upside potential from current price levels. Additionally, each of these stocks has a market outperform Smart Score of 9 or a ‘Perfect 10!’

Here are the five key stocks from the REITs sector for investors to consider.

- Agree Realty (NYSE:ADC) – Agree Realty Corp. focuses on the ownership, development, acquisition, and management of retail properties net leased to national tenants, especially retail tenants. ADC stock’s average price target implies an upside potential of 17.5%.

- Essential Properties Realty (NYSE:EPRT) – EPRT stock’s price forecast of $28.00 implies 16.4% upside potential. Essential Properties Realty Trust engages in the acquisition, ownership, and management of single-tenant properties that are net leased on a long-term basis to middle-market companies that operate service-oriented or experience-based businesses.

- Realty Income (NYSE:O) – Realty Income Corporation invests in free-standing, single-tenant commercial properties in the U.S., Spain, and the UK that are subject to triple net (NNN) leases. O stock’s average price target implies upside potential of 17.4%.

- Independence Realty (NYSE:IRT) – IRT stock has an average price target of $21.00, which implies 28.4% upside potential from current levels. Independence Realty Trust acquires, owns, operates, improves, and manages multifamily apartment communities across non-gateway U.S. markets.

- NetSTREIT (NYSE:NTST) – NetSTREIT Corp. acquires, owns, and manages a diversified portfolio of single-tenant, retail commercial real estate subject to long-term net leases, with major exposure to properties leased to tenants operating in the defensive retail industries. NTST stock’s average price target of $21.88 implies 22.8% upside potential.