The painful retreat in stock prices amid high inflation, rising interest rates, and normalization in demand trends led to enormous losses for equity investors in 2022. However, given the selloff, several stocks are extremely cheap and offer massive discounts. For instance, shares of Upstart (NASDAQ:UPST), Farfetch (NYSE:FTCH), and Wayfair (NYSE:W) are down about 91%, 88%, and 81%, respectively, in 2022. Meanwhile, high-flying stocks like Shopify (NYSE:SHOP)(TSE:SHOP) and SoFi Technologies (NASDAQ:SOFI) have lost about 74% and 71% of their value year-to-date.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

While these stocks are trading at a discount, let’s look at TipRanks’ data to understand what the future holds for these companies.

Is UPST a Buy, Sell, or Hold?

Upstart is an AI-based lending platform. The increased cost of funding and higher loan pricing amid credit tightening and the rise in delinquencies have dragged UPST stock lower. Despite the massive decline in its share price, UPST stock has a Moderate Sell consensus rating on TipRanks based on four Hold and seven Sell recommendations.

Moreover, analysts’ average price target of $13.85 implies 1.28% downside potential.

UPST stock also has negative signals from hedge funds and insiders. Hedge funds sold 4.7M UPST stock last quarter. Meanwhile, insiders sold UPST stock worth $144.3K last quarter. Overall, UPST has an Underperform Smart Score of one on TipRanks.

Is FTCH Stock a Buy?

Farfetch is a leading luxury fashion platform. Its stock has lost substantial value due to the macro weakness in China and the closure of operations in Russia. Furthermore, pressure on consumer discretionary spending due to macro headwinds and slowing e-commerce activity remained a drag.

Nevertheless, FTCH stock has received 10 Buys, two Holds, and one Sell for a Moderate Buy consensus rating. Moreover, analysts’ average price target of $12.70 implies a massive upside potential of 225.64%.

In the past three months, hedge funds have bought 4M FTCH stock. Meanwhile, FTCH has an Outperform Smart Score of eight on TipRanks.

What is the Prediction for Wayfair Stock?

Wayfair is an internet-based home furnishings retailer. The normalization of demand trends post-pandemic and pressure on consumer spending weighed on Wayfair stock. Given the challenges, Wayfair stock has a Hold consensus rating on TipRanks based on six Buy, nine Hold, and five Sell recommendations.

Meanwhile, Wall Street analysts’ average price target of $47.56 implies 29.31% upside potential.

The stock has a negative signal from insiders. However, hedge funds are optimistic about Wayfair and bought 69.4K shares last quarter. Wayfair stock sports a Neutral Smart Score of four.

Is Shopify a Buy or Hold?

The normalization of e-commerce demand, tough year-over-year comparisons, valuation concerns, and macro headwinds led to massive selling in Shopify stock. Despite challenges, the easier comparisons and Shopify’s investments in long-term growth have kept analysts optimistic.

SHOP stock has a Moderate Buy consensus rating on TipRanks based on 10 Buy, 12 Hold, and one Sell recommendations. Further, these analysts’ average price target of $40.89 represents 12.99% upside potential.

It’s worth highlighting that the hedge fund managers and insiders are bullish about SHOP stock. Hedge funds acquired 8.9M SHOP stock last quarter (Find out which stock the biggest hedge fund managers are buying right now). Meanwhile, insiders bought SHOP stock worth $8.1M. However, given the uncertain economic environment, SHOP stock has a Neutral Smart Score of five.

What is the Prediction for SoFi Stock?

The negative impact of higher interest rates on loan originations and overall negative investor sentiments on fintech stocks have dragged SoFi’s stock lower. Despite the headwinds, SoFi continues to deliver strong financial performances and is poised to benefit from the approval of the bank charter.

SoFi stock has received seven Buy and four Hold recommendations for a Moderate Buy consensus rating. Meanwhile, Wall Street analysts’ average price forecast of $7.18 implies 54.74% upside potential.

Our data shows that the company’s CEO and Director, Anthony Noto, is accumulating SOFI stock on the dip, which is positive. However, hedge funds sold 6.2M SOFI stock last quarter. It carries a Smart Score of seven, implying a Neutral outlook.

Bottom Line

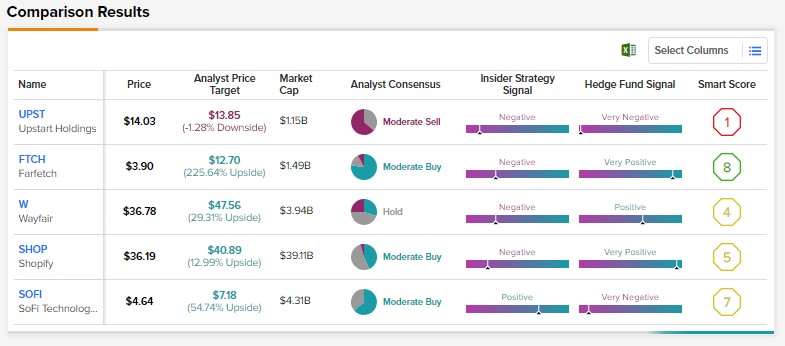

Created with TipRanks’ Stock Comparison tool, here is the summary of how these beaten-down stocks stack up on our valuable datasets.

The data shows that FTCH, SHOP, and SOFI stocks have a Buy consensus rating from analysts. However, only FTCH stock has an Outperform Smart Score on TipRanks. Also, FTCH stock has the highest upside potential based on the analysts’ price target and its closing price on December 21.