Shares of the beaten-down financial services company SoFi Technologies (NASDAQ:SOFI) are in the spotlight due to the sudden spike in insider trading. Per TipRanks’ data, the insider confidence signal is positive on SOFI stock. Last quarter, insiders bought SOFI stock worth 7.4M.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

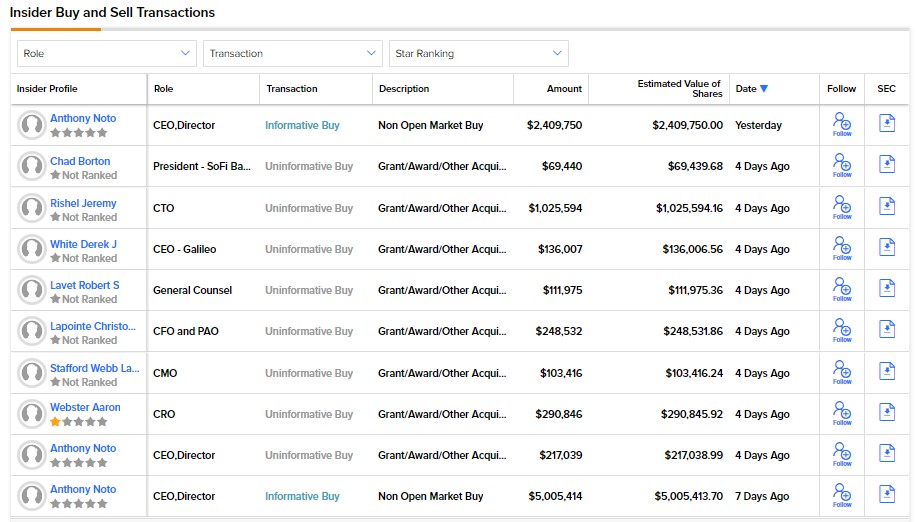

A Snapshot of Recent Insider Trading Activity at SOFI

SoFi’s CEO and Director, Anthony Noto (who owns over 10% of SOFI), is accumulating its stock. Noto bought SOFI stock worth approximately $7.4 million in the last seven days. The graph below shows that Noto’s transactions came in the form of an Informative Buy (insiders using their capital to execute trades).

SoFi stock has lost about 72% of its value year-to-date, and CEO buying the dip is a positive signal. Noto’s big purchases signify his confidence in SoFi’s growth prospects.

TipRanks offers daily insider transactions and a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Is SoFi a Good Long-Term Stock?

Rising interest rates are negatively impacting loan originations, and overall investors’ negative sentiment toward financial technology companies continues to pose challenges for SoFi. Wall Street analysts are cautiously optimistic about SoFi’s stock.

It has a Moderate Buy consensus rating on TipRanks based on seven Buy and four Hold recommendations. Meanwhile, analysts’ average price target of $7.18 implies 62.08% upside potential.