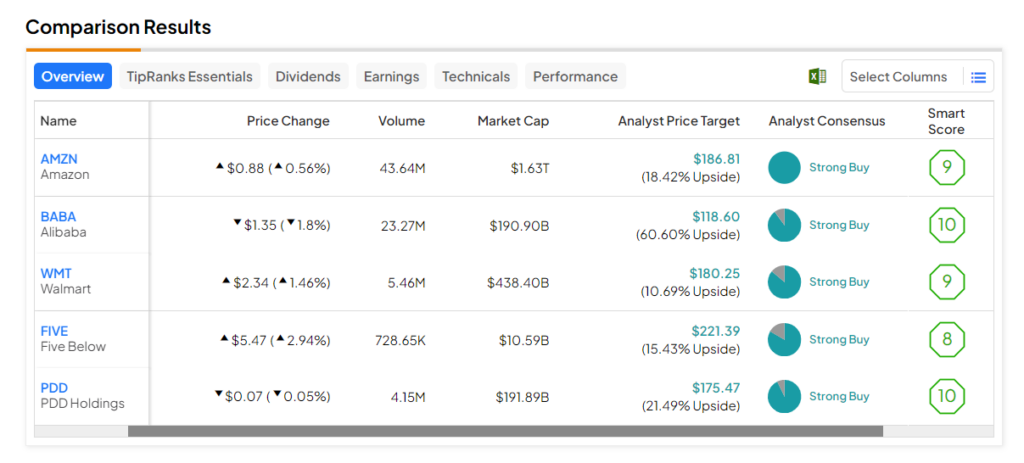

The retail sector includes companies ranging from traditional brick-and-mortar stores to e-commerce giants. The outlook for this sector appears promising, bolstered by expectations of rises in consumer spending amid easing inflationary pressures and the potential for near-term interest rate cuts. To help identify the best retail stocks for your portfolio, we have leveraged the TipRanks Stock Screener tool.

These stocks have received a Strong Buy rating from analysts and boast an Outperform Smart Score (i.e., 8, 9, or 10) on TipRanks, which points to their potential to beat the broader market. Further, analysts’ price targets reflect a solid upside potential of more than 10%.

Here are the five such stocks for investors to consider.

- Five Below (NASDAQ:FIVE) – Five Below is a specialty discount retailer offering various high-quality products, primarily priced below $5, catering to the teen and pre-teen population. FIVE stock’s average price target implies an upside potential of 15.4%. Also, its Smart Score of eight is encouraging.

- PDD Holdings (NASDAQ:PDD) – This Chinese e-commerce platform connects consumers with manufacturers and agricultural producers. PDD stock’s price forecast of $175.47 implies 21.5% upside potential. Moreover, it has an outperforming Smart Score of “Perfect 10.”

- Alibaba (NYSE:BABA) – Alibaba is a Chinese multinational conglomerate specializing in e-commerce, retail, internet, and technology. The stock’s average price target implies an upside potential of 57.7%. Further, it has a Smart Score of “Perfect 10.”

- Walmart (NYSE:WMT) – This multinational retail corporation is known for its extensive chain of hypermarkets, discount department stores, and grocery stores. WMT stock has an average price target of $180.25, which implies a 10.7% upside potential from current levels. It has a Smart Score of nine.

- Amazon (NASDAQ:AMZN)– This multinational technology and e-commerce company is known for its online retail platform, cloud computing services, digital streaming, artificial intelligence, and consumer electronics. AMZN stock has an analyst consensus upside of 18.4% and a Smart Score of nine. Ahead of its Q4 results due on February 1, eight analysts rated the stock a Buy.