Investing in gold stocks can be an attractive option for investors looking to diversify their portfolios and hedge against market volatility. As per a report by J.P. Morgan, gold prices are expected to trend lower in the near term before rising to new highs later in the year. In addition, the firm predicts that the price of gold will hit a peak of $2,300 per ounce in 2025.

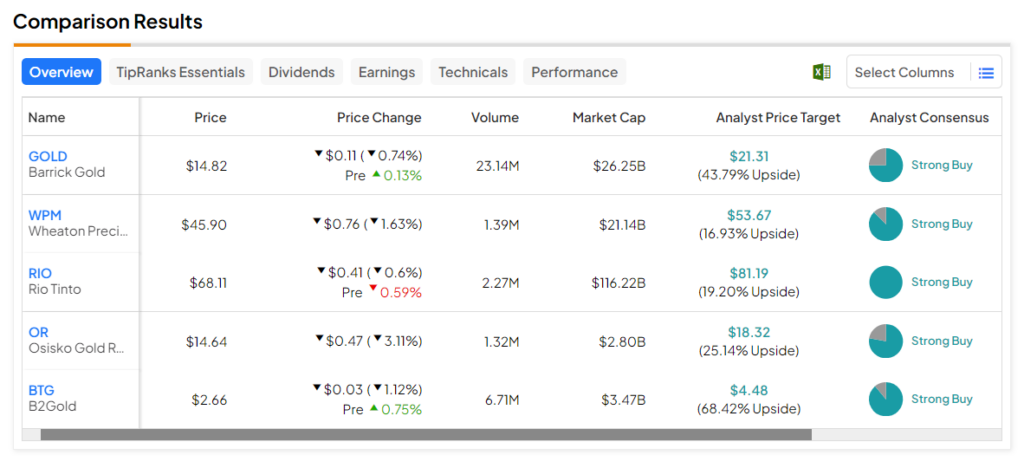

To help identify the best gold stocks for your portfolio, we have leveraged the TipRanks Stock Screener tool. These stocks have received a Strong Buy rating from analysts and reflect an upside potential of more than 15%.

Here are five such stocks for investors to consider.

- Barrick Gold (NYSE:GOLD) – This gold mining company is engaged in the exploration, development, and production of gold and copper properties. GOLD stock’s average price target implies an upside potential of 43.79%.

- Wheaton Precious Metals (NYSE:WPM) – This company is engaged in the purchase of precious metals produced by mining companies. WPM stock’s price forecast of $53.67 implies 16.93% upside potential.

- Rio Tinto (NYSE:RIO) – Rio Tinto is a multinational mining corporation known for its operations in various commodities, including iron ore, aluminum, copper, and diamonds. The stock’s average price target implies an upside potential of 19.2%.

- Osisko Gold Royalties (NYSE:OR) – This royalty and streaming company is focused on precious metals, particularly gold. OR stock has an average price target of $18.32, which implies a 25.14% upside potential from current levels.

- B2Gold (NYSE:BTG) – B2Gold is a Canadian mining company primarily focused on gold exploration and production. BTG stock has an analyst consensus upside of 68.4%. Last week, two analysts rated the stock a Buy.