Investors are gearing up for the first-quarter 2022 earnings season, which will be in full swing starting mid-April. The corporate results will reflect the direct and indirect impacts of the Ukraine-Russia war.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This ongoing war is believed to be the primary reason why the major U.S. stock indexes are in red territory year to date. While NYSE is down 2.3%, the NASDAQ and S&P 500 have declined 8.2% and 4.5%, respectively, so far in 2022.

Various other factors that might get reflected in the first-quarter results include supply chain constraints, cost inflation, volatility in oil & gas market, and the Federal Reserve’s hike in interest rates. Meanwhile, new jobs additions and a fall in the unemployment rate are also likely to influence the results.

Industrial Goods is one sector that is highly correlated to the above-mentioned macro factors. Improvement in industrial production, up 7.5% year-over-year in February and 4.1% in January, is a good sign for the sector.

It will interest investors to know how the top three industrial companies, by market capitalization, are placed for the first-quarter earnings season.

United Parcel Service, Inc. (NYSE: UPS)

The package delivery company operates through its headquarters in Atlanta, GA. It also provides solutions related to supply-chain management worldwide. Shares of this $178.7 billion company have declined 3.9% since the beginning of 2022.

UPS delivered better-than-expected in all the quarters of 2021. The company is expected to release its first-quarter results on April 26, 2022.

The consensus estimate is pegged at $2.87 per share for earnings and $23.82 billion for revenues. The bottom-line estimate reflects an improvement of 3.6% from the year-ago adjusted earnings and a fall of 20.1% sequentially.

In the first quarter, factors like improving global economy, hike in planning volume, growth in revenue per piece, and enhanced productivity might have positively impacted the results. However, woes related to the supply chain, cost inflation, labor, and COVID-19 might have played spoilsports.

Recently, Duane Pfennigwerth, an analyst at Evercore ISI, maintained a Buy rating on United Parcel with a price target of $255 (24.26% upside potential).

Based on 11 Buys, eight Holds, and one Sell, the company has a Moderate Buy consensus rating. United Parcel’s average price target of $241.35 reflects 17.61% upside potential from current levels. It scores a 9 out of 10 on Tipranks’ Smart Score rating system.

Union Pacific Corporation (NYSE: UNP)

The $162-billion company provides railroad transportation services for multiple items, including grains, construction products, and industrial chemicals. It is headquartered in Omaha, NE. Shares of Union Pacific are up 4% so far this year.

The railroad company posted weaker-than-expected earnings in three quarters of 2021 but surpassed the consensus estimate in one.

It is slated to release the first-quarter results on April 21, 2022. The consensus estimate for earnings is at $2.52 per share, suggesting an increase of 26% from the year-ago reported figure and a decline of 5.3% from the previous quarter’s earnings. The consensus estimate for revenues stands at $5.61 billion.

For the first quarter, the company expects carload volumes to be impacted by soft intermodal volumes (international) and a hike in COVID infections. Industrial and bulk businesses are likely to be strong. Effective pricing actions are expected to play a key role in dealing with the adverse impacts of inflation.

A few days ago, Walter Spracklin, an analyst at RBC Capital, downgraded Union Pacific to Hold from Buy. The analyst also lowered the price target to $258 (0.10% upside potential) from $271.

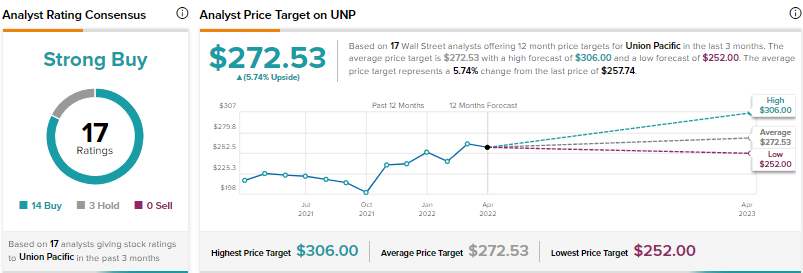

The company carries a Strong Buy consensus rating based on 14 Buys and three Holds. Union Pacific’s average price target is at $272.53, mirroring a 5.74% upside from current levels. It scores a ‘Perfect 10’ on Tipranks’ Smart Score rating system.

Honeywell International Inc. (NASDAQ: HON)

Based in Charlotte, NC, Honeywell is a manufacturing and technology company with expertise in safety and productivity, building, and performance material technologies. Its stock has declined 5.2% year to date.

The $134-billion company reported upbeat earnings in three quarters of 2021, while lagged estimates in one.

It is expected to release first-quarter results on May 5, 2022. The consensus estimate for earnings is at $1.86 per share, down 3.1% and 11% from the year-ago and sequential adjusted earnings, respectively. The estimate for revenues is $8.41 billion.

For the first quarter, the company anticipates sales to be in the range of $8.1-$8.4 billion. Organically, sales growth is expected to be within the (1%)-2% range. Further, Honeywell expects its pricing actions to boost revenues by 4% while forex woes to lower sales by 2%. A fall in COVID-induced mask sales is also expected to hurt its sales by 2%. Supply-chain woes are to hurt.

Adjusted earnings at $1.80-$1.90 per share in the quarter are expected to reflect a year-over-year change of (6%) to (1%).

Recently, Gautam Khanna, an analyst at Cowen, reiterated a Buy rating on Honeywell with a price target of $230 (17.31% upside potential). Khanna expects the company’s sales to lag the consensus estimate for revenues.

HON has a Moderate Buy consensus rating based on eight Buys and seven Holds. Honeywell’s average price target of $225.67 suggests 15.10% upside potential. It scores an 8 out of 10 on TipRanks.

Conclusion

With Strong or Moderate Buy consensus ratings and impressive scores on TipRanks, each of the aforementioned stocks are a worthy medium to long-term investment option. For the near term, a wait and watch approach is preferred until the companies release their Q1 results.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure