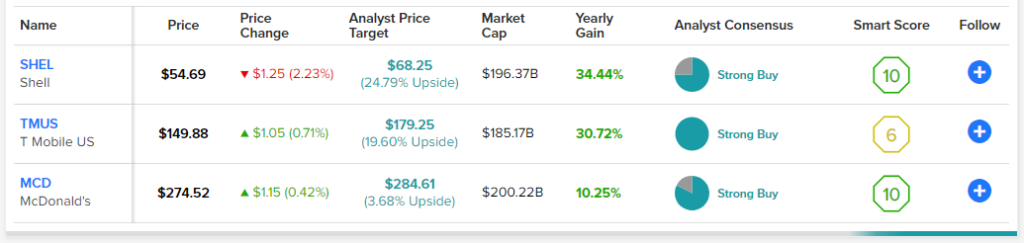

Some stocks didn’t get the memo that they’re supposed to be down significantly this year. Only time will tell if this market’s resilient winners will be left standing once the bear passes the torch to the bull. Regardless, there’s no discounting the resilience of firms that continue to charge higher under their own power. British big-oil firm Shell (NYSE:SHEL), red-hot telecom titan T-Mobile (NASDAQ:TMUS), and legendary fast-food behemoth McDonald’s (NYSE:MCD) are three “Strong Buy” stocks that analysts think can keep raising the bar going into 2023.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Given the durability and strengths of each firm heading into a potential recession, I think Wall Street is right to stand by each firm.

Shell (SHEL)

Shell is an oil and gas supermajor that moved its headquarters to London nearly a year ago. Over the past year, shares have surged more than 26% on the back of oil’s run. Though Shell stock has been outperformed by various American producers, I do view Shell as an intriguing catch-up option for investors who’d missed the energy rally. The stock sits down around 11% from its 52-week high.

Oil showed a bit of fragility recently, with prices plunging to about $75 per barrel. Still, SHEL has been holding up better than oil has. The biggest draw to the British oil giant is its depressed valuation.

At writing, shares trade at 4.8x trailing earnings, making SHEL one of the cheapest mega-cap oil plays out there. With a 3.6% dividend yield, Shell is also one of the more bountiful of the energy behemoths.

Despite the strength in oil, Shell is sticking with a long-term game plan that entails marketing retail growth and production decreases. Such a plan will work out over many decades.

The company seeks to hit net-zero emissions by 2050. Aided by renewable power projects and other initiatives, Shell makes for a very intriguing energy company ready to make the sustainability shift when the time comes.

Though Shell’s committed to decreasing its dependence on oil production, I wouldn’t rule out nearer-term ramp-ups if energy demand causes prices to stay elevated for longer. For now, Shell is sticking with the long-term game rather than keeping an ear to the energy futures markets. This may be why Shell stock trades at a lofty discount to the peer group.

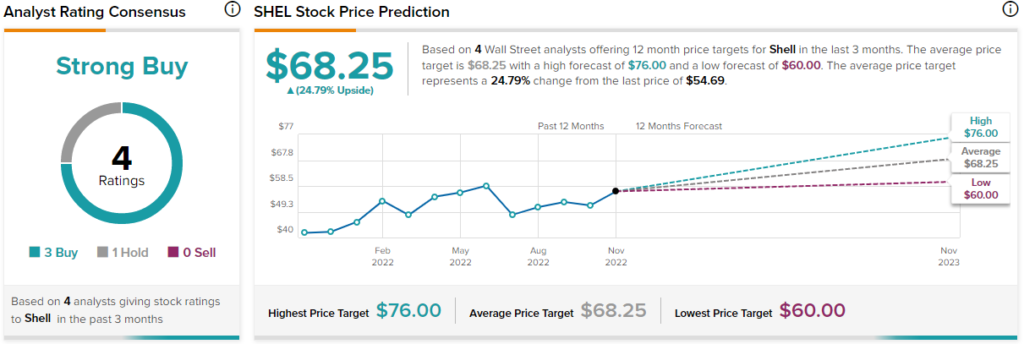

What is the Price Target for SHEL Stock?

Wall Street loves Shell. Based on three Buys and one Hold rating, the average SHEL stock price target of $68.25 implies 24.8% gains from today’s close.

T-Mobile (TMUS)

T-Mobile stock is less than 3% off its recent all-time high. Undoubtedly, T-Mobile feels the same macro headwinds as most of its peers. The big difference is that T-Mobile has been keeping its foot on the gas to take market share away from rivals that are now feeling the pinch.

Not even a mild recession seems like it could halt T-Mobile’s momentum at this juncture. The company isn’t just seeing customer additions accelerate; its operating margins have also held up nicely (at around 6.1%).

Indeed, TMUS seems to be getting the best of its rivals. The lack of a dividend allows the firm to go all out on infrastructure investments while offering more attractive pricing options to consumers. With a strong management team that knows how to navigate the telecom waters, I’d not bet against the firm, as it continues making new highs while the rest of the market remains stuck in limbo.

At writing, shares trade at 2.3x sales, with a 0.54 beta, meaning shares are less likely to follow in the footsteps of the broader market.

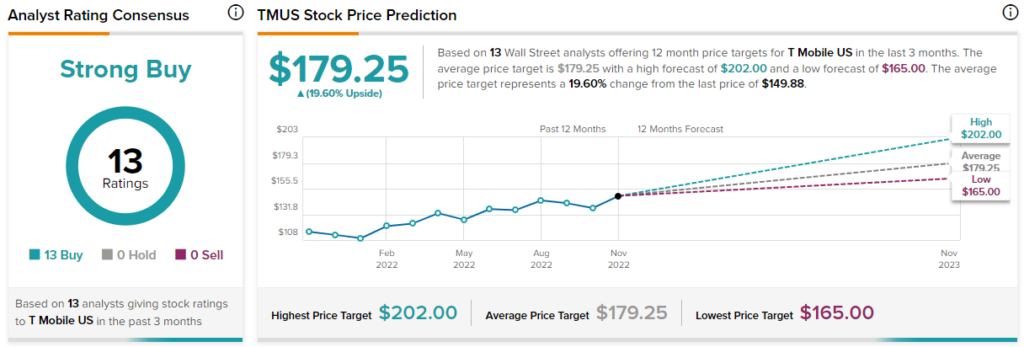

What is the Price Target for TMUS Stock?

Wall Street praises T-Mobile amid its remarkable run relative to rivals. It has 13 unanimous Buy ratings from analysts. The average TMUS stock price target of $178.85 suggests 23.5% upside potential.

McDonald’s (MCD)

McDonald’s is the iconic burger chain that’s continued to find a spot with consumers. Loyalty programs and creative initiatives (BTS and adult Happy Meals) have brought traffic into stores across the nation.

Menu innovation and store remodels have also helped beckon customers away from competitors. Inflation and a weakening economy have also tilted the odds in McDonald’s favor, with consumers pursuing superior value options.

As the economy tilts into a recession, McDonald’s could continue to surge higher. The stock is off 2.5% away from its all-time high. At 34.4x trailing earnings, MCD stock is the priciest it’s been in quite a while. Its dividend yield stands at 2.22%, while the beta is a soothing 0.65.

Still, you’ve got to pay up for such recession-resilient exposure. With one of the best managers in the industry, I think McDonald’s is well worth the premium. Wall Street agrees.

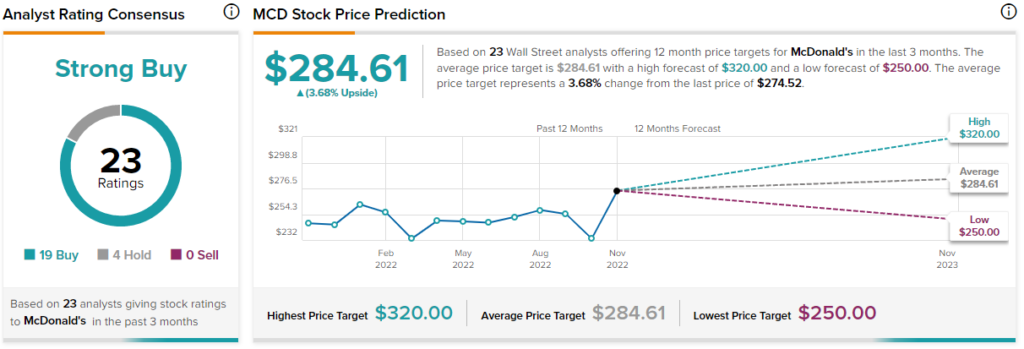

What is the Price Target for MCD Stock?

Wall Street can’t get enough of the golden arches, with 19 Buys and four Holds assigned in the past three months. The average MCD stock price target of $284.61 implies 3.7% upside potential.

Conclusion: Analysts Expect the Most Gains from SHEL

Shell, T-Mobile, and McDonald’s are very different companies that have demonstrated their resilience amid one of the roughest markets in recent memory. They’re still “Strong Buys” through the eyes of Wall Street. Over the next year, analysts expect the biggest gains from SHEL stock.