U.S. stocks have been on a roll. The S&P 500 closed Monday at a new record high and was up for the eight consecutive positive day — its longest streak of records since 1997.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Among the recent supporting factors are Q3 earnings, which are up 40% year-over-year and have been beating expectations; and passage of the bipartisan infrastructure bill last week, offering hope that Congress may be able to get its act together and put consequential legislation on the President’s desk. In addition, weekly payroll data showed a jump in wages. All in all, it was a welcome change from the downbeat jobs and inflation data we’ve been seeing, and the Congressional gridlock.

For investors, the question now is, how best to take advantage of this market moment? They’ve got plenty of signals to choose from, but one that’s frequently reliable is to take a cue from the Street’s major investment firms. And to that end, investment banking giant Goldman Sachs has been picking out the stocks it sees poised for gains in the current environment.

We’ve used the TipRanks platform to pull up the details on three of these Goldman picks, stocks which the firm sees with 60% upside in the coming year – or better. The rest of the Street also backs these tickers, with each sporting a “Strong Buy” consensus rating. Here are the details.

Cue Health, Inc. (HLTH)

We’ll start with San Diego-based Cue Health, a health tech company involved in the information and diagnostic segment of the healthcare industry. Cue offers access to lab-quality diagnostic testing, at the user’s location, be it home, work, or point-of-care, through a hand-held sampling and reading device. Cue’s testing devices are made in the USA, at the company’s 5 facilities in San Diego, and Cue boasts over 100 patents protecting its intellectual property.

In an important move, the company has introduced a mobile COVID-19 test. In just 20 minutes, Cue’s molecular test can deliver results comparable to the standard PCR test, delivered to the patient’s mobile phone. A Mayo Clinic study showed that Cue’s test gives 97.8% accuracy.

Furthermore, the company announced in October that is has made an agreement to serve as the NBA’s COVID testing provider for the 2021-2022 basketball season. And, on November 1, Cue and Major League baseball announced jointly that the health tech company provided COVID testing for MLB games through the postseason and World Series.

Cue Health is one of many companies that have jumped on the IPO bandwagon this year. As the stock markets have risen, Cue has used the opportunity to go public and raise new capital. Cue’s IPO, held in September, saw the company make 12.5 million shares available on the NASDAQ at $16 each, to raise ~$200 million in gross proceeds.

While Cue is well positioned as a portable medical test provider, the company does have one weakness – it is heavily reliant on its COVID test kit. Goldman Sachs analyst Matthew Sykes acknowledges that weakness, but sees Cue as a solid investment regardless.

“While we acknowledge near term risks of having a single test tied to Covid testing, we see this balanced with the potential long term opportunity of providing an at-home, molecular diagnostic solution for the growing TeleHealth market. However, we expect further evidence of a diversification in customer concentration with additional corporate customers coming on line plus more details on the company’s direct to consumer strategy which could provide positive catalysts,” Sykes opined.

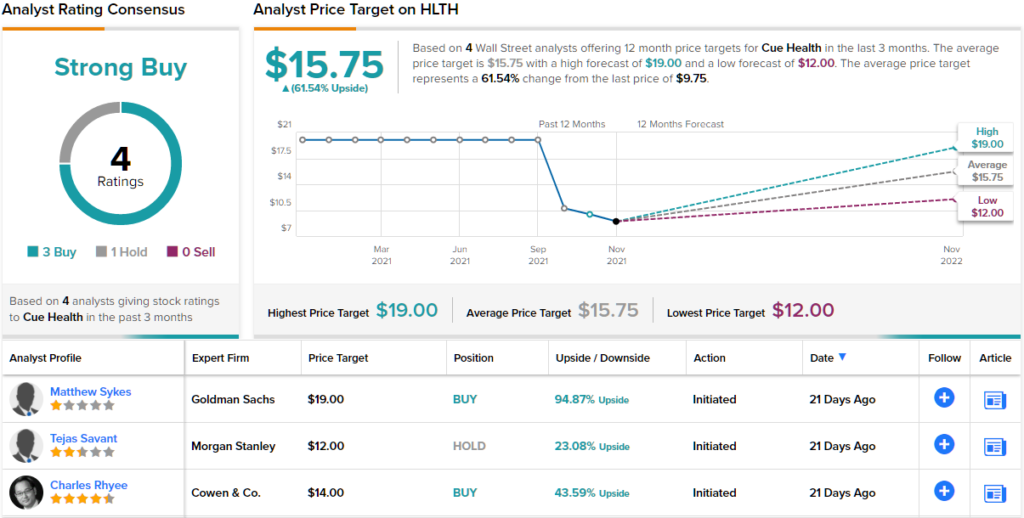

In line with his bullish stance, Sykes rates HLTH a Buy, and his $19 price target implies room for ~95% upside potential in the next 12 months. (To watch Sykes’ track record, click here)

Overall, Cue Health has 4 recent analyst reviews, and they break down 3 to 1 in favor of Buy over Hold – for a Strong Buy analyst consensus rating. The shares are trading for $9.8 and the $15.75 average price target suggests room for ~62% growth in the year ahead. (See HLTH stock analysis on TipRanks)

AvidXChange Holdings (AVDX)

The second Goldman pick we’ll look at is AvidXChange, an accounts payable service offering an automated AP technology. Customers find enhanced flexibility, security, and efficiency, to issue and approve invoiced, and make and receive payments, anytime, anywhere. AvidXChange’s products include invoice, bill payment, and purchase automation, along with utility bill payment. The system is scalable to grow with the customer, and includes remote access and fraud protections.

AvidXChange is actively working to expand its services and its customer base. Early this month, the company announced expanded availability of its AvidSuite for Financial Services – which is now available to credit unions.

AvidXChange, like Cue above, is another company that has recently gone public. The ADVX ticker debuted on the NASDAQ on October 13. The company put 26.5 million shares on sale to the public, with initial pricing of $25 per share. This was above the $21 to $23 price range originally expected, and well over the 22 million shares the company was expected to offer. The upsized IPO raised $660 million, and the company now boasts a market cap of $4.9 billion.

Analyst Will Nance initiated coverage of this stock for Goldman Sachs, and took a bullish stance, writing: “We believe AVDX is well positioned to take share in the largely unpenetrated $26bn total addressable market (TAM) for middle market AP automation, driving a very long duration growth profile with longer-term optionality for an inflection in automation adoption in its target market. In addition, we believe Avid should see strong growth in payments revenue over time… Lastly, we see intermediate- and longer-term opportunities to increase monetization through supplier-oriented products such as its Invoice accelerator product, as well through as rolling out support for cross-border payments.”

Nance’s comments back up his Buy rating, and his $40 price target indicates potential for 60% share appreciation in the next 12 months. (To watch Nance’s track record, click here)

Overall, with 8 positive analyst reviews on record since going public, AVDX stock has a unanimous Strong Buy consensus rating. The shares are currently trading for $25 and the $30.50 average price target implies a 22% one-year upside. (See AVDX stock analysis on TipRanks)

IHS Holding (IHS)

We’ll wrap up the list of Goldman picks with IHS Holding, a telecom infrastructure company specializing in emerging markets. IHS owns and operates wireless transmission towers in nine countries in Latin America, Sub-Saharan Africa, and the Middle East – with a total of more than 30,200 towers. This makes IHS one of the world’s largest independent owner/operator, and developer of such tower properties. The company’s tower network facilitates mobile communication for over 600 million people globally.

IHS offers a variety of solutions for tower placement, with infrastructure that can scaled to the customer’s needs, meet the needs of urban areas, or provide connectivity in remote locations. The company boasts that it’s infrastructures can be designed and built to fit the customer’s specifications, eschewing a one-size-fits all design.

The company held its IPO just a month ago, and the IHS ticker started trading on the New York Exchange on October 14. The IPO saw 18 million shares go on the market, at $21 each. Overall, the IPO raised $378 million in new capital.

Goldman Sachs analyst Brett Feldman is upbeat on IHS’ future, writing: “We believe that IHS is well positioned to benefit from secular tailwinds in emerging markets, such as rapid population and GDP growth, as well as increasing 4G and smartphone penetration, which should drive demand for telecom services and tower capacity. Furthermore, IHS’ business model has a high degree of operating leverage, as the company incurs very little incremental cost when it adds a tenant on to an existing tower…”

To this end, Feldman gives IHS shares a Buy rating, with a $29 price target for the coming year, suggesting an upside potential of ~78%. (To watch Feldman’s track record, click here)

Once again, we’re looking with a stock with a Strong Buy consensus rating. IHS’ rating is supported by a 5-to-1 breakdown of Buys versus Hold, and the $24.17 average price target implies a 12-month upside of 48% from the $16.30 trading price. (See IHS stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.