Alibaba (NYSE:BABA) recently delivered better-than-expected September quarter earnings. Following the announcement, this Chinese internet giant’s ADS (American Depositary Share) closed 7.8% higher on November 17. However, challenges stemming from macro weakness in China, regulatory headwinds, and a slowdown in its growth continue to persist, which is why investors should be cautious before investing in BABA stock.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Let’s Get Into the Details

Alibaba’s top line inched up 3% in the September quarter. However, what catches the eye is the 7% decline in customer management revenue. A drop in customer management revenue reflects softer consumption trends and increased competitive headwinds. Also, its cloud segment’s revenue slowed to 4%, reflecting weak demand for its cloud offerings in the domestic and international markets.

During the conference call, Daniel Zhang, Alibaba’s CEO, said that the macro environment would determine the future of Alibaba and other companies operating in the consumption space. Given the uncertainty and ongoing weakness in domestic consumption trends, Alibaba’s top-line growth could remain pressured.

In addition to the slowing growth and macro weakness, increased regulations are a big concern for Chinese stocks, including Alibaba.

According to our data, legal and regulatory risks are one of the top risk categories for BABA. For context, our Risk Factors tool shows that BABA’s legal and regulatory risks accounted for 27.3% of its total risks. What’s alarming is that BABA’s legal and regulatory risks are significantly higher than the sector benchmark of 15.2%.

Is BABA Stock a Buy, Sell, or Hold?

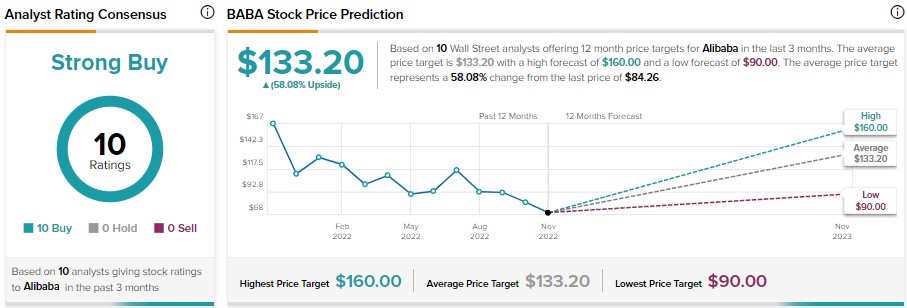

BABA stock has corrected about 50% in one year, and analysts are bullish on its prospects. It has received 10 unanimous Buy recommendations for a Strong Buy consensus rating. Meanwhile, analysts’ price target of $133.20 implies 58.1% upside potential.

Bottom Line

While Wall Street is bullish about BABA stock, several analysts, including Bo Pei of US Tiger Securities, Gary Yu of Morgan Stanley, and Youssef Squali of Truist Financial, have recently lowered their price targets.

Further, Alibaba stock is trading at a forward Enterprise Value/EBIT multiple of 13.6x, which is higher than the sector median of 12.8x, making it unattractive on the valuation front, especially as the growth has slowed.

Overall, investors should take caution and wait for domestic consumption trends to improve before investing in BABA stock.