Taking full advantage of the stock market and investing with confidence are typical aspirations for both novice and experienced investors.

Turns out, it’s not that easy. Why is that?

The explanation is simple: the stock market is rife with unprecedented levels of risk. With the Q3 earnings season well underway, we can see that a select few equities are outperforming the market, while others struggle to gain traction. This is due to the fact that the stocks are susceptible to a wide range of factors, ranging from macroeconomic trends to political winds. As a result, even seasoned investors sometimes become perplexed.

TipRanks offers a variety of tools to assist investors in resolving this conundrum. Let’s see what some of those tools are.

Risk Factors, Insiders, Smart Score System, and Website traffic are examples of the tools TipRanks offers, all of which can help you become a better, more confident trader.

TipRanks’ Smart Score System is one such tool that is detailed in-depth here.

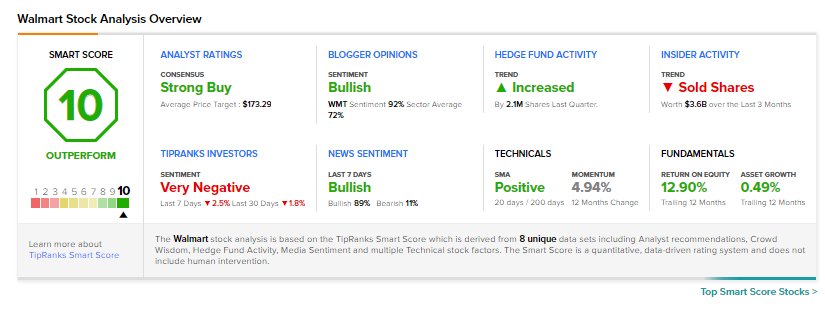

One of those tools, TipRanks’ Smart Score System, evaluates eight key indicators, including Fundamentals and Technicals; Analyst, Blogger, and News sentiment, and Hedge Fund and Corporate Insider activities. Following the study of each parameter, a single numerical score on a scale of 1 to 10 is computed, showing how the stock is expected to move in the short to medium term. On the Smart Score, a ‘Perfect 10’ implies expected outperformance.

We selected three mega-cap stocks that achieved a “Perfect 10” score using TipRanks’ Top Smart Score Stocks. In addition to a “Perfect 10” rating, these companies have a Strong Buy consensus rating and significant upside potential.

Let’s delve deeper:

SoFi Technologies

SoFi Technologies (SOFI), a digital financial services company, is the first stock we’ll look at that has received a “Perfect 10” over the past two days. The company began as a lender that helped consumers refinance student loans, but it has gradually grown into different verticals, ranging from mortgages to cryptocurrency and specialty goods like wedding loans and travel loans.

Further, its asset-light business strategy enables it to provide a wider range of services than many of its rival digital banks. As a consequence, it has a number of channels for attracting clients into its financial services ecosystem.

Markedly, SoFi acquired Galileo, a payments processor firm, for $1.2 billion earlier this year, marking its foray into the business-to-business segment (B2B). The deal will enable SoFi to further diversify its business and give it a foothold into the B2B market.

Furthermore, SoFi is seeking confirmation of its bank charter, which might be another major driver in the near future. It would gain access to the same low interest rates as traditional banks, allowing it to compete more effectively in the lending market.

The stock also receives a ‘Perfect 10’ rating since all of the variables are good: technical and fundamental aspects are all positive, and News and Investor sentiment are both positive. Insider Activity, on the other hand, remains negative.

On the analyst side, Betsy Graseck of Morgan Stanley initiated coverage on the stock with a Buy rating and price target of $25, implying 20.8% upside potential.

SoFi is expected to deliver “powerful revenue growth” as it gains a larger portion of customers’ financial services wallets, according to Graseck.

She further added, “Competition is rising among challenger FinTechs for Gen Y & Z, but SOFI has a leg up given its roots in the hardest part of consumer finance, lending, along with a robust digital offering.”

On TipRanks, SoFi Technologies stock commands a Strong Buy consensus rating based on 5 Buys and 1 Hold. The shares are priced at $20.69 and their $24.58 average SoFi price target suggests an upside of 18.8%.

Thermo Fisher Scientific

Thermo Fisher Scientific (TMO), a manufacturer of scientific instruments, has received a “Perfect 10” for the past four days.

Thermo Fisher has been utilizing its experience in the sector to help all of its clients in the fight against COVID-19. The pandemic, in fact, has worked as a catalyst in the company’s development during this period, substantially improving its financials, as seen by the company’s outstanding Q2 results.

Furthermore, Thermo Fisher’s strong momentum should be maintained going ahead, since it presented an enthusiastic forecast for 2022 at its Virtual Investor Day. Impressed with the company’s investor day presentation, BTIG’s Sung Ji Nam highlighted the company’s rising top-and bottom-line growth potential, as well as its $48 billion in incremental capital deployment possibilities for M&A through 2025.

She reiterated a Buy rating on the stock but increased the price target to $700.00 from $610.00, which implies about 15% upside potential to current levels.

According to the Smart Score, this stock is performing well. It scores a ‘Perfect 10’, rating since all of the variables are positive, with the exception of Insider data and TipRanks Investors, which remain negative.

With 15 recent reviews on file, including 14 recommendations to Buy and just 1 to Hold, Thermo Fisher gets a Strong Buy consensus rating from Wall Street’s analysts. Shares are trading for $607.75 and the average Thermo Fisher price target of $622.47 implies 9% upside from that level.

The company’s prospects remain bright and it should be able to keep its ‘Perfect 10’ score when it reports third-quarter earnings on October 27.

Walmart

Walmart (WMT), a massive retailer, is another stock that has received a “Perfect 10” over the past five days. The company has been growing for decades, but in recent years it has focused its efforts on increasing online sales by extending its logistics network and providing better prices.

As a result, the company’s e-commerce and omnichannel sales have increased significantly in the last year. Further, Walmart’s profit margins are expected to improve as the business reduces extra expenses associated with retail sales. This should result in improved profits in the future.

It doesn’t end there. The firm is popular among investors since it is a dividend-paying investment that also offers yearly dividend increases.

Overall, Walmart appears to be on the right road in its quest for the perfect blend of physical (store numbers) and digital.

By examining Walmart’s Smart Score page on TipRanks, we can see that six out of eight metrics are favorable, with Technical and Fundamental factors being green, and News and Bloggers’ opinion favorable. However, Investors and Insider activity metrics remained red.

On the analyst side, Edward Yruma of KeyBanc has weighed in with a Buy rating and a $180 price target indicating almost 20% upside for the next 12 months.

Yruma is optimistic about the company’s fundamentals. He believes that the company’s growth and profits may be fueled by innovation. In the long run, he believes that better and more tailored digital and in-store consumer experiences will help create bigger sales and profitability.

It’s clear from the consensus rating of a Strong Buy based on 18 Buys and 4 Holds that Wall Street generally agrees with the bullish views on this one. The shares are priced at $150.06 and their $173.29 average Walmart price target suggests an upside of 15.5%.

Disclosure: At the time of publication, Shalu Saraf did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.