Dividend-paying stocks are a great way to generate passive income and can be considered a safe bet in the current uncertain market situation. Using TipRanks’ Stock Screener tool, we shortlisted two Dividend Aristocrats that have received Buy recommendations from the analysts. Let’s take a closer look at two such dividend stocks – Coca-Cola (NYSE:KO) and Procter & Gamble (NYSE:PG).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Coca-Cola Co.

Beverage giant Coca-Cola has raised its dividends for 61 consecutive years. Further, KO’s dividend yield stands at 3%, above the consumer goods sector’s average yield of 2.1%. Coca-Cola’s cash position remained strong with an operating cash flow of $11.02 billion and a free cash flow of $9.53 billion as of December 31, 2022. The company’s payouts are supported by its defensive business model, ability to grow organic sales, and consistent EPS growth.

Last week, J.P. Morgan analyst Andrea Faria Teixeira reiterated a Buy rating on the stock. Teixeria believes that the company’s tax litigation risk is appropriately discounted. Additionally, the analyst thinks that while consumption is still high, Europe will continue to be Coca-Cola’s most challenging market.

What is the Price for KO Stock?

Coca-Cola stock has received 10 Buy and two Hold recommendations for a Strong Buy consensus rating. Further, KO’s price target of $68.18 implies 13.8% upside potential. The stock has lost 4.1% so far in 2023.

Procter & Gamble Co.

The consumer products manufacturer has raised dividends for 66 years in a row. Also, its dividend yield of 2.54% compares favorably with the sector’s average of 2.1%. The company’s diverse offerings, big sales footprint, and strong brand name support these payouts.

Earlier this week, Deutsche Bank analyst Stephen Powers maintained a Buy rating on PG stock and lowered the price target to $156 from $162. The analyst is of opinion that the risk of economic headwinds is growing for the consumer staples sector.

Is PG stock a Good Buy?

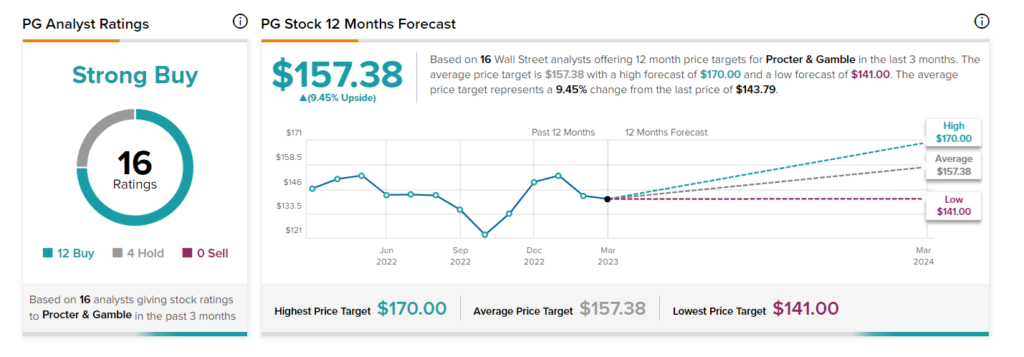

PG stock has a Strong Buy consensus rating on TipRanks. This is based on 12 Buy and four Hold recommendations. The average stock price target of $157.38 implies 9.5% upside potential. Shares have tanked 4.5% so far in 2023.

Concluding Thoughts

Long dividend histories, robust cash flows, and strong businesses make KO and PG good choices for investors to consider. Further, analysts expect these stocks to rise over the next 12 months.