Looking for some advice on which stocks to invest in? TipRanks gives investors a Hedge Fund Trading Activity tool that reveals which hedge fund managers are best to follow. We accumulate data from Form 13-Fs released by about 483 hedge funds, and show which stocks hedge funds are buying and selling. TipRanks then determines their investment success rates, and provides hedge fund signals, showing how well each hedge fund has performed.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Today, we will focus on the energy sector, which benefited from oil and natural gas prices touching new highs in 2022. Although volatile prices since mid-2022 hurt the bottom lines of these companies, expectations of higher demand in the coming months on the back of reopened China borders might support the performance of the energy sector.

NextEra Energy (NYSE:NEE), Cenovus Energy (NYSE:CVE), and Suncor Energy (NYSE:SU) are some of the stocks that hedge fund managers bought in the previous quarter.

Let’s take a closer look at these three stocks.

NextEra Energy

Hedge funds bought 1.1M shares of NEE last quarter. Overall, NextEra has a very positive Hedge Fund Confidence Signal at present. Buyers include Ken Fisher of Fisher Asset Management LLC and Ray Dalio of Bridgewater Associates, LP, among others.

Impressively, Fisher ranks #285 among all the hedge fund managers covered by TipRanks. He purchased NEE stock worth $791.9 million. Meanwhile, Dalio ranks #186 and has bought the company’s shares for $21.9 million.

NextEra is a leading electric utility holding company. Its recently reported fourth-quarter results reflect year-over-year growth. Further, the company recently disclosed plans to raise the dividend by 10% every year through at least 2024. Even more, NextEra’s outstanding payout ratio of 58.4% might continue to attract investors’ attention.

Should I Buy NextEra Energy Stock?

Wall Street is bullish about NEE stock. It has received 11 unanimous Buy recommendations, translating into a strong Buy consensus rating. Meanwhile, analysts’ average price target of $95.73 implies 25.84% upside potential. Shares of the company declined 8.6% in the past three months.

On a positive note, the stock has a maximum Smart Score of “Perfect 10” on TipRanks. Note that shares with a “Perfect 10” Smart Score have historically outperformed the S&P 500 Index (SPX) by a wide margin.

Suncor Energy

TipRanks data shows that hedge fund bought 1M shares of Suncor last quarter. Several hedge fund managers increased their holdings in the stock, including Joel Greenblatt of Gotham Asset Management and Maple Rock Capital Partners’ Xavier Majic. Also, the Hedge Fund Confidence Signal is currently positive.

Greenblatt is ranked #244 among all the hedge funds managers and he disclosed having bought SU stock worth $3.2 million. As for Majic, he ranks #49 on TipRanks and purchased $58.4 million shares of the company.

Suncor is a Canada-based integrated energy company, engaged in the exploration, acquisition, development, production, and marketing of crude oil. The company’s efforts to enhance core business and reduce debt levels is likely to support long-term growth. Also, Suncor has an impressive dividend history with a dividend yield of 4.4%, which compares favorably with the sector’s average of 3%.

Is Suncor Energy a Good Buy?

SU stock has received six Buys and four Holds for a Moderate Buy consensus rating. Further, analysts’ average price target of $40.44 implies 22.2% upside potential. The stock is down 4.8% over the past three months.

Moreover, SU stock sports a “Perfect 10” Smart Score on TipRanks.

Cenovus Energy

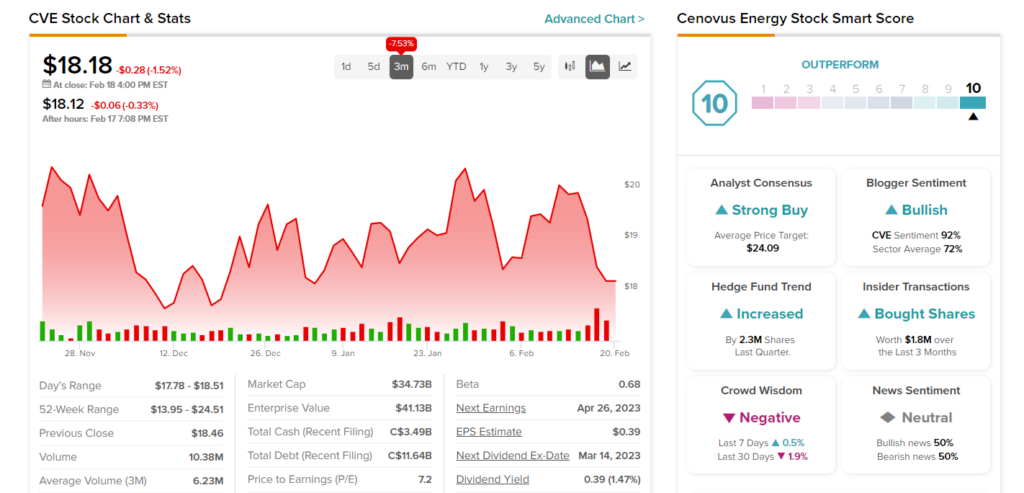

Cenovus stock has a very positive signal from hedge funds who bought 2.3M shares of the company in the last quarter. EdgePoint Investment Group’s Tye Bousada and David Gerald Greenspan of Slate Path Capital are among the managers who added CVE stock to their portfolios.

With a rank of #129, Bousada increased exposure to the stock by $9.7 million. Further, Greenspan holds a #143 rank and purchased $44.8 million worth of CVE stock.

Cenovus engages in gas and oil provisions. Its activities include development, production, and marketing of crude oil, natural gas liquids (NGLS), and natural gas in Canada. The company is well poised to benefit from the TransMountain Pipeline expansion project. Also, its efforts to reduce the debt load is expected to aid in bottom-line growth.

Is Cenovus Energy a Good Company?

Analysts are optimistic about CVE stock. It has received nine Buy and one Hold recommendations for a Strong Buy rating consensus. The average price target of $24.09 implies 32.5% upside potential. In the past three months, the stock has declined 7.5%.

Overall, CVE has a top-notch Smart Score of “Perfect 10.”

Concluding Thoughts

Investment decisions in such uncertain times, especially with recession fears looming, can be a difficult task. But one can rely on the experts, such as hedge fund managers, who are known for beating the average market returns.

NEE, CVE, and SU display potential to generate strong returns based on positive signals from hedge funds and analysts’ optimism.

Find out which stock the biggest hedge fund managers are buying right now.