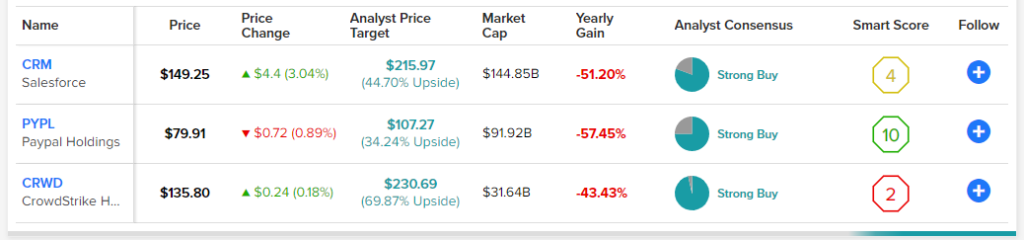

Most of the damage this year has been concentrated in the tech sector. With rising interest rates and a recession likely in the new year, speculative innovation firms have been hit the hardest. The shockwaves have spread to large-cap tech stocks as well. Hard-hit companies like Salesforce (NYSE:CRM), PayPal (NASDAQ:PYPL), and CrowdStrike (NASDAQ:CRWD) have been feeling the pressure. Still, each firm can still recover from this downturn. The same can’t be said for many of their smaller rivals in the tech scene. Let’s compare these three innovative tech companies that have what it takes to persevere through another year of headwinds.

Salesforce (CRM)

Salesforce stock is one of the bluest blue chips in the cloud. Still, the cloud software king couldn’t steer clear of a more than 53% sell-off. The negative momentum behind Salesforce is quite jarring. Still, Marc Benioff‘s $149 billion empire will live to see better days.

Amid worsening macro conditions, Salesforce has made cuts to its workforce. Such cuts have become the norm in the tech scene. Although layoffs could damage a firm’s reputation as a great place to work, I view Salesforce as a firm that can conduct layoffs with empathy and understanding. Indeed, Salesforce isn’t going about job cuts in the same way Twitter has.

As Salesforce makes moves to cut costs and enhance productivity en route to higher margins, I do view the company as one that can climb higher, even in a recession year. The stock trades at 5.1x sales and 271x trailing earnings.

With sights set on 25% non-GAAP operating margins for its Fiscal Year 2026, I view CRM stock as cheaper than it looks. Further, Salesforce has been known to top estimates in an astounding fashion. If anything, Salesforce may be one of the market’s most undervalued “pricy” stocks.

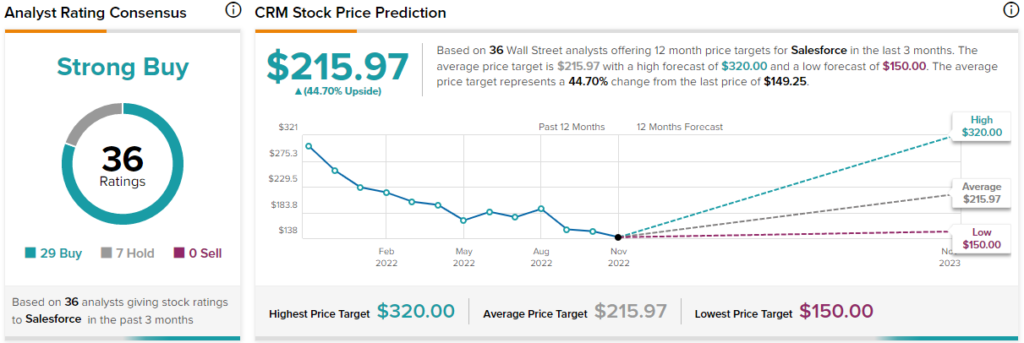

What is the Price Target for CRM Stock?

Wall Street is pounding the table on Salesforce at these depths, with a “Strong Buy” consensus rating. The average CRM stock price target of $215.97 implies 44.7% upside potential.

PayPal (PYPL)

PayPal is a fintech pioneer that crashed by around 77% at its worst. Now off around 73% from its high, the stock’s initial wave of negative momentum seems to have subsided. Despite the implosion, PayPal stock doesn’t look cheap at 43.2x trailing earnings. With recession-induced pressure up ahead and a growing number of big-tech rivals jumping into the digital wallet space, it’s unclear where the market will draw a line in the sand with PayPal stock.

Macro conditions are one thing. But a loss of competitive edge is another knock against PayPal. There’s only so much innovation that can go into payments. As the company targets digital commerce, there’s still a lot of room for upside as it looks to enhance its ecosystem to retain users.

In the latest quarter, PayPal impressed the Street, with earnings coming in better than expected ($1.08 EPS vs. $0.98 estimates). Such a better-than-feared quarter may not represent a turning point. Management is staying cautious ahead of a recession-driven consumer spending slowdown. With so little clarity on where PayPal heads from here, the stock will surely be a wild ride.

What is the Price Target for PYPL Stock?

Despite the fear of the unknown, Wall Street still loves PayPal stock. It’s just so profoundly cheap relative to its historical averages. The average PYPL stock price target of $107.27 implies 34.2% upside potential.

CrowdStrike (CRWD)

CrowdStrike is a top cybersecurity player that may be more recession resilient than expected. From good times to bad, cyber threats are still everywhere. Skimping on cybersecurity could prove detrimental. Despite the defensive traits of the cyber kingpin relative to other software companies, CRWD stock has been unable to dodge a 55% haircut.

The downgrades have been flowing in for the formerly-hot SaaS play. Though CrowdStrike is still a firm capable of posting strong numbers amid macro headwinds, the valuation remains incredibly frothy.

At writing, shares of CRWD trade at 17.3x sales. Annual recurring revenue (ARR) soared 59% year-over-year in the latest quarter. Also, while there are still many big growth quarters to be had, we’re in a market that no longer wants to pay up hand over fist for top-line growth.

Recently, CrowdStrike won the 2022 CRN Tech Innovator Award for best cloud security offering. The company is still one of the best innovators out there. It’s just the valuation that could work against the stock, even as the firm continues clocking in bottom-line beats.

What is the Price Target for CRWD Stock?

Despite the hot multiple, analysts still can’t get enough of CrowdStrike. The average CRWD stock price target of $230.69 implies a whopping 69.87% upside potential from current levels.

Conclusion: Wall Street is Most Bullish on CRWD Stock

Salesforce, PayPal, and CrowdStrike are fallen tech titans that have shed more than 50% of their value. With the confidence of Wall Street and many levers to turn the ship around, each name makes for an intriguing turnaround candidate. At this juncture, Wall Street expects the most significant year-ahead gains from CrowdStrike.