Alternative energy stocks face some of the strongest secular tailwinds out there. In 2020, when oil prices were on shaky ground, green energy stocks were red-hot, surging to new highs and eventually peaking in 2021 alongside many other momentum stocks that got a bit ahead of themselves. Fast-forward to today, and oil is a hot commodity again. Many renewable energy plays have now retreated from their highs. With investors looking to fossil fuels to shelter from high inflation, the tables have turned against alternative energy firms. Nonetheless, let’s check out three intriguing alternative energy stocks, BEP, NEE, and AQN, that Wall Street sees upside in.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Indeed, alternative energy stocks are forward-looking. Many investors likely overestimated the speed of the transition from fossil fuels (oil and gas) to renewable sources (wind and solar). Though long-term demand for renewable projects is likely to stay elevated as firms look to go carbon neutral, it will take many decades before fossil fuels are on their way out.

For investors seeking a long-term opportunity, the beaten-down renewable plays may finally be worth pursuing while the worst of the rate-hike fears are baked in. Higher borrowing costs are a negative for such capital-intensive firms as renewable power plays.

Brookfield Renewable Partners (NYSE:BEP)

Brookfield Renewable Partners is a renewable power play down more than 40% from its all-time high hit in January 2021. The company, which is majority owned by Canadian alternative asset manager Brookfield Asset Management (NYSE:BAM), is starting to look cheap after its two-year sell-off. At 3x sales and 13.3x cash flow, BEP stock stands out as one of the better values in the green energy industry.

The 4.3% dividend yield may not be the biggest of the batch, but it looks more sustainable than that of some of its peers – most notably, Algonquin Power (NYSE:AQN), which now boasts a yield near 10%.

Amid the tumble, Brookfield has been busy putting its cash to work. Recently, the firm teamed up with Cameco (NYSE: CCJ) to acquire nuclear service firm Westinghouse Electric Company. Such a deal gives Brookfield some unique exposure beyond just wind and solar.

Looking ahead, I expect Brookfield to continue making deals where it makes sense.

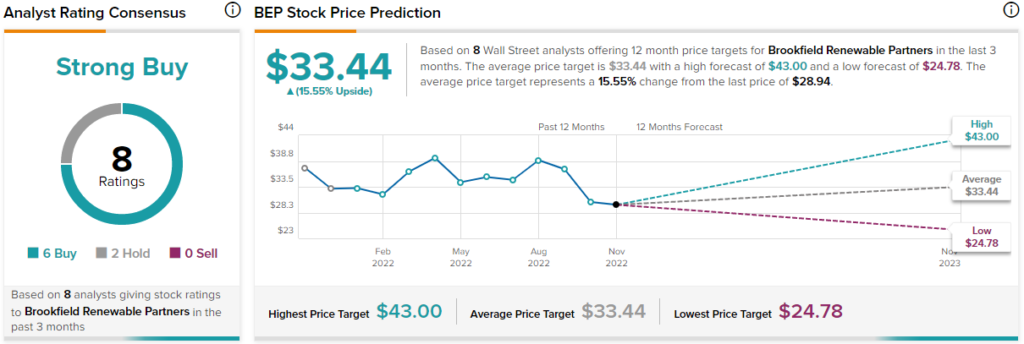

What is the Price Target for BEP Stock?

Wall Street has a “Strong Buy” rating on Brookfield Renewables based on six Buys and two Holds assigned in the past three months. The average BEP stock price target of $33.44 implies 15.55% upside potential.

NextEra Energy (NYSE:NEE)

NextEra Energy is a $167.6 billion energy behemoth that’s done a better job of holding its own amid this market sell-off than some of its smaller peers. The stock is off just 11% from its all-time high. With a modest 2% dividend yield and a stretched 43.5x trailing earnings multiple, NEE stock may seem like a less exciting way to play the next era of energy.

The electric power and infrastructure firm may not be a green energy pure-play, but its renewable business is proliferating. Arguably, NextEra’s renewable segment is the star of the show and the main reason why shares of the utility firm boast such a lofty price tag.

NextEra is a wind and solar giant that’s investing very prudently. With a healthy balance sheet, a steady cash flow stream, and disciplined managers, it’s not a mystery why many Wall Street analysts love the stock in the face of an economic downturn.

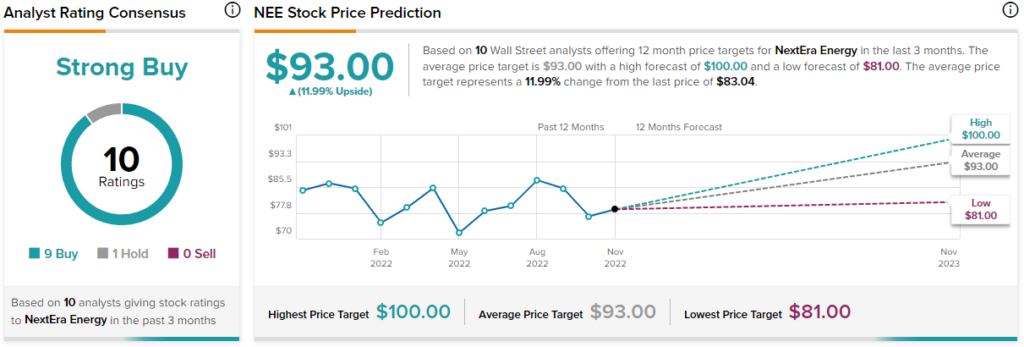

What is the Price Target for NEE Stock?

Wall Street is a big fan of NextEra Energy. They have the name at a “Strong Buy” based on nine Buys and one Hold. The average NEE stock price target of $93.00 implies 12% upside from current levels.

Algonquin Power & Utilities (NYSE:AQN)

Algonquin Power stock made new multi-year lows following a quarterly flop (EPS of $0.11 versus the $0.17 estimate) and a guidance downgrade. The stock is now down around 58% from its peak, and the massive 9.4%-yielding dividend looks at risk.

Indeed, the Canadian renewable power company was on the receiving end of price target downgrades this week. Credit Suisse (NYSE:CS) slashed its AQN stock price target to $12.00 from $13.00. TD Securities downgraded its rating to Hold from Buy, citing a lack of clarity regarding the firm’s growth prospects.

Indeed, Algonquin is feeling the weight of higher interest rates. It seems doubtful that the dividend will hold up as the firm sails into mounting macro headwinds.

After such a vicious post-earnings drop (around 35%), the stock trades at 2x sales and just 1x book value. That’s one of the best deals in the alternative energy space today. A lot of pain already seems to be baked into the stock. Even if a dividend reduction is in the cards, the company may not have that much more downside from these depths.

What is the Price Target for AQN Stock?

Wall Street has turned on Algonquin stock of late. Shares sport a “Hold” consensus rating. The average AQN stock price target of $11.88 implies 55.5% upside potential.

Conclusion: Wall Street Expects the Most Gains from AQN Stock

Alternative energy stocks have taken hits to the chin of varying magnitude. Despite sporting a “Hold” rating, Wall Street analysts expect the most year-ahead upside from Algonquin.