Investors can leverage TipRanks’ Top Smart Score Stocks tool to identify stocks with a higher likelihood of outperforming the market. The tool evaluates stocks based on eight key factors, including analyst ratings, technical analysis, and insider activity. Notably, stocks with a “Perfect 10” Smart Score have historically surpassed the returns of the S&P 500 Index (SPX) by a wide margin. This tool can be a valuable resource for investors seeking to make informed investment decisions.

Using this tool, we’ve chosen two stocks that are currently sporting “Perfect 10” scores — Chesapeake Energy (NASDAQ:CHK) and Accolade (NASDAQ:ACCD). Let’s take a closer look at these two companies.

Let’s take a closer look at these stocks.

Chesapeake Energy Corp

CHK stock was added to the Perfect 10 list yesterday. The stock has a Positive signal from hedge funds. Our data shows that hedge funds bought about 79,400 shares of the company in the last quarter. The stock also enjoys bullish blogger sentiment and very positive news sentiment on TipRanks. The efficiency of Chesapeake is further demonstrated by its return on equity of 90.5%.

Chesapeake is an independent exploration and production company. An anticipated increase in natural gas prices due to higher exports forecasted in 2024 is expected to have a positive impact on CHK’s performance in the future. Additionally, the company’s strategy to distribute special dividends is supported by its solid free cash flow position.

Is CHK Stock to Buy, According to Analysts?

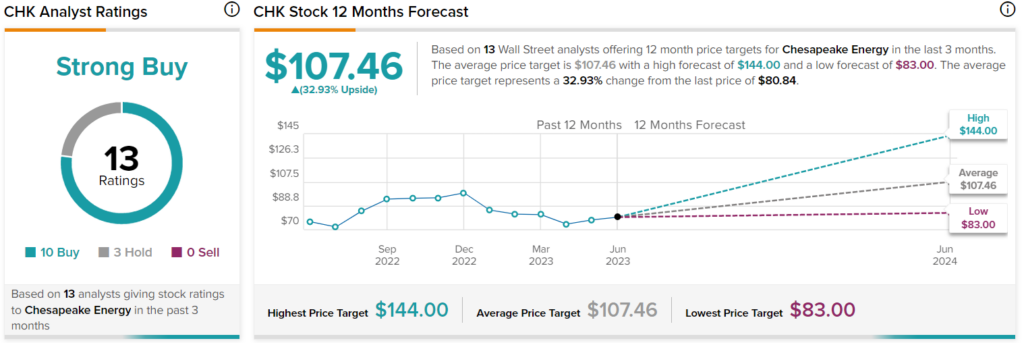

CHK stock has a Strong Buy consensus rating on TipRanks. This is based on 10 Buys and three Hold recommendations assigned in the past three months. The average CHK stock price target of $107.46 implies 32.9% upside potential from current levels. The stock gained about 6% in the past three months.

Accolade Inc.

ACCD made it to the Perfect 10 list yesterday. The stock also has a positive signal from hedge funds and insiders. Our data shows that insiders bought $1.6 million worth of ACCD shares in the last quarter. The stock also enjoys bullish blogger sentiment and very positive news sentiment on TipRanks.

Accolade is a personalized healthcare company. It’s witnessing robust demand, evident from the increasing number of commercial account memberships. The company’s wide range of products and efficient business operations supports expansion in commercial, government, and consumer channels.

Following the release of mixed first-quarter results on June 29, six analysts rated ACCD stock a Buy, while two maintained a Hold. Among the bullish analysts, Needham analyst Ryan MacDonald is optimistic about the company’s strong pipeline and healthy level of demand for multi-product adoption. Moreover, MacDonald raised his price target on Accolade to $17 from $15.

Is ACCD Stock a Buy, According to Analysts?

ACCD stock has a Moderate Buy consensus rating on TipRanks. This is based on nine Buys and five Hold recommendations assigned in the past three months. The average ACCD stock price target of $16.50 implies 48.8% upside potential. The stock is up 51.5% year-to-date.

Ending Thoughts

Perfect 10 Smart Scores suggest that these stocks could outperform the broader market. Moreover, Wall Street analysts see considerable upside potential in the stocks. Additionally, for investors seeking more in-depth analysis and expert opinions, TipRanks’ Experts Center tool can provide valuable insights and recommendations on top stocks.