It’s been a pretty mixed start to the year for markets, with sizeable moves in both directions for the broader basket of video game stocks. With a hawkish Fed that expects more rate hikes in 2023, anything tech may still appear to be the “danger zone” for prudent investors looking to steer clear of choppy moves.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Nonetheless, in this piece, we’ll take a look at two attractive gaming stocks that Wall Street rates as Strong Buys.

Take-Two Interactive (NASDAQ:TTWO)

Take-Two is a video game firm behind extremely-popular open-world games like Red Dead Redemption and Grand Theft Auto (GTA). Both blockbuster brands are the bread and butter for Take-Two. They do a lot of the heavy lifting for the firm and, unlike a lot of other games quick to lose appeal in the months following their releases, its big two titles have staying power.

The only knock against Take-Two is it takes many years to develop big games, and the waits can be pretty painful for shareholders. In that regard, Take-Two is firm that calls for patience. As a long-term thinker, I am bullish.

The company has done a decent job of further diversifying beyond its big two blockbuster titles to maintain a “smoother” pipeline of releases. As you can imagine, GTA or Red Dead launches can make for a rather lumpy multi-year release schedule.

Take-Two’s entry into mobile gaming could solve this. The Zynga acquisition could do wonders in helping Take-Two become a more diversified and higher-growth play, given that mobile’s one of the hottest areas of gaming. In any case, Take-Two has been slow to get off the mobile-gaming runway of late.

Management recently lowered its revenue guidance for Fiscal 2023 following some weak fiscal second-quarter numbers. Net bookings are slated to come in at $5.4 billion – $5.5 billion, below initial expectations of $5.77 billion. Sure, macro headwinds were partially to blame, but it was lower mobile expectations that had many downbeat on the name.

In due time, I expect Take-Two will get off the ground with its mobile division, giving investors more to look forward to than the next GTA release.

For now, Take-Two is playing it on the side of caution, and it seems far too few investors are willing to be patient enough with the name to benefit from its longer-term catalysts (GTA VI release and its mobile-gaming push).

The stock’s down around 50% from its high, thanks partly to two consecutive quarterly earnings misses. Despite the magnitude of the decline, shares trade at 4.1 times sales, which remains a hefty premium to the leisure products industry average of 1.8 times.

Still, with strong brands and catalysts likely to kick in within the next five years, I view the premium to the peer group as justifiable. Further, Take-Two stands out as a prime acquisition candidate. As the industry consolidates, the firm seems worthy of a scarcity premium.

What is the Price Target for TTWO Stock?

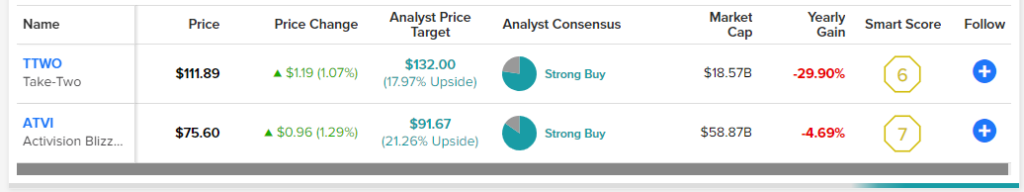

Take-Two sports a “Strong Buy” consensus, with the average TTWO stock price target of $133.00 implying 18% upside potential from here.

Activision Blizzard (NASDAQ:ATVI)

The odds of a successful Microsoft (NASDAQ:MSFT) takeover seem to be fading by the day. Regulatory hurdles are prominent right now. The FTC is eager to block the deal, while the EU issued a warning. Undoubtedly, such chatter is a significant reason why shares (currently at $75.60) are a country mile away from their proposed takeover price of $95 per share.

For those who still have faith a deal will happen, there’s a juicy 25.7% gain to be had from here. Personally, I’d pin the odds of a successful deal as well below 50/50.

If a deal does get blocked, Activision Blizzard stock is bound to face further pressure. In any case, I remain a fan of the firm as its stock hovers around in the $72 – $82 range.

Assuming no deal, Activision Blizzard has some of the most enviable brands in the industry. I expect Microsoft to do its best to show that it won’t hurt the competition due to its added dominance from an approved deal. Microsoft is already a powerful force in gaming, but it had noted it plans to allow the hit game Call of Duty to be released on other platforms for the next 10 years.

Deal or no deal, Activision is a prized asset that Microsoft sees value in at much higher prices. That alone makes me bullish from a longer-term perspective.

What is the Price Target for ATVI Stock?

Activision Blizzard has a “Strong Buy” consensus rating based on 11 Buys amd two Holds assigned in the past three months. The average ATVI stock price target of $91.67 implies 21.3% upside potential.

The Takeaway

Nobody wants to be late to the party. Whether we’re talking about getting greedy in December of 2021 or rotating into “value” stocks after a full year of a bear market, investors shouldn’t seek to shift gears in such a drastic way after markets have already made their move. Oftentimes, it’s best to stay the course than respond to recent action in markets, and the two stocks highlighted above present solid long-term opportunities.