We talk a lot about the ways to make money in the market, and there’s usually an unspoken assumption that most investing is undertaken as a positive move. It’s a move to buy into a stock, assessed as having upbeat prospects going forward, and holding on for as long as it takes to realize the gains. Warren Buffett, one of history’s great stock traders, is the exemplar of this strategy; he has said, “If you aren’t thinking about owning a stock for ten years, don’t even think about owning it for ten minutes.”

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

He’s not wrong. But Buffett’s way is hardly the only path toward market profits. An investor can make money on a stock that drops, if he takes a short position. And if a short position fails, and the stock gains in price, short sellers will scramble to cover their leverage, new buyers can jump in, sending the price higher – and the ‘early birds’ will rake in the profits, while latecomers get the scraps, and the original short investors get squeezed. So let’s talk a bit about the short squeeze.

To start with, there will always be some traders shorting a stock. It’s the nature of the game. One clue that a short squeeze may be in the offing, however, is when a stock has an unusually high percentage of short positions. Generally, if a given stock’s trades are more than 15% short positions, the stock may be vulnerable to the short squeeze phenomenon.

There are two other factors to look for. Investors should seek out a stock whose price is beaten down – but whose fundamentals remain generally sound. These are the equities that are more likely to see a turnaround from a share price collapse, and that’s the precipitating event in a short squeeze. The signal to buy, of course, is when a positive catalyst hits and there’s rush into the stock.

We’ve dug into the TipRanks data to find two stocks that fit this profile of the short squeeze candidate. Both have 20% or more short positions on their outstanding stock, both have a Strong Buy rating from the Street’s analysts, with plenty of upside potential for the year ahead.

Vuzix Corporation (VUZI)

We’ll start with Vuzix, a tech company in the area of ‘wearable displays.’ Vuzix started out in the optical field, and has since combined that with high-end AR tech, designing smart glasses and accessories. The company holds well over 200 patents in the field, and is positioning itself to lead the market as wearable tech matures.

But let’s talk about its vulnerability to a short squeeze. First off, over 21.5% of the outstanding VUZI shares are shorted – that is, more than one in five shares are held by investors who have bet that the stock will decline in value.

That may be a good bet. After all, VUZI is down 70% from the peak value it reached in April of last year. The fall in share value has come as the company continues to record net operating losses and middling revenues.

But – let’s take a dive into the most recent quarterly report, for 3Q21. The company showed just over $3 million at the top line, missing the analyst forecast by a 20% margin. Earnings came in at negative 13 cents per share, in line with the forecast. This was hardly a blockbuster report – except that management provided bullish guidance for the just-ended Q4, and even more upbeat going forward in 2022. Vuzix is seeing its product deliveries increase, and has four new smart glasses lined up for release this year.

Hitting those goals will create exactly the catalyst that sparks a short squeeze. They are precisely the type of achievements that will send a stock’s price up – and that will force the short sellers to buy to cover their positions, driving the price up more in the classic short squeeze pattern.

Craig-Hallum’s 5-star analyst Christian Schwab gives us a good idea of Vuzix’s current status, and its potential for gains, writing: “OEM product development engagements continue to proceed with negotiations currently underway for volume production in 2022 and beyond. As a reminder, the company is currently engaged with multiple defense and aerospace contractors, a U.S. medical partner, and a custom microLED display manufacturer. Management has outlined in the past that these large opportunities could ultimately lead to production volumes ranging from a few-thousand units to tens-of-thousands of units, each with ASPs of multiple thousands of dollars.

“We continue to believe Vuzix is in the early innings of a potentially significant opportunity with multiple irons in the fire and an expanding pipeline,” the 5-star analyst summed up.

Schwab’s comments back up his Buy rating on the stock, and his $30 price target implies the shares have room to run an impressive 220% in the next 12 months. (To watch Schwab’s track record, click here)

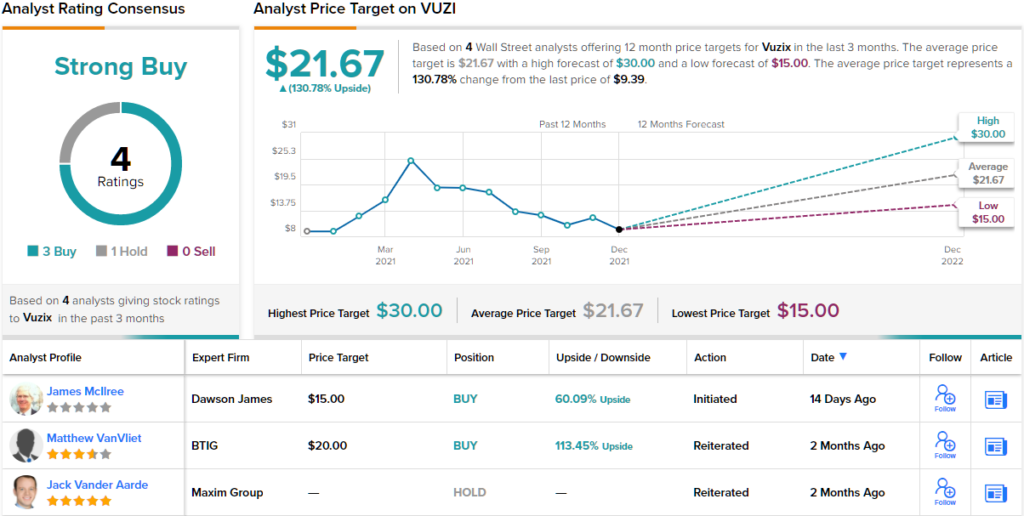

The aggregated analyst reviews show us that Wall Street generally agrees with the bullish thesis here. Of the 4 most recent reviews, 3 are to Buy while only 1 says to Hold, for a Strong Buy consensus rating. VUZI is selling for $9.39 and its $21.67 average price target indicates a high 130% upside potential. (See VUZI stock analysis on TipRanks)

Camping World Holdings (CWH)

The second stock we’ll look is Camping World Holdings, an interesting company in the RV niche. RVs, or recreational vehicles, saw resurgence in popularity in the past two years as the COVID pandemic put a premium on leisure activities that can be enjoyed in small groups or private locales. CWH, a leader in RV retail along with outdoor and camping gear, was well-positioned to take advantage of that trend.

That shows in the company’s revenues and earnings over the past couple of years. While both metrics have been somewhat ‘choppy,’ there is an upward trend. CWH typically sees its highest top line in the second and third quarters of the year, and last year’s Q3 report showed $1.92 billion in total sales, the second highest in the past several years (2Q21 came in at $2.06 billion.) The Q3 sales were up 14% yoy. Earnings typically show the same pattern, the 3Q21 bottom line, of $1.98 per share, was up 25% from 3Q20.

The share price has also gained. CWH is up 49% in the last 12 months, outpacing the S&P’s 29% gain. Meanwhile, nearly 21% of the outstanding shares are held by short sellers.

There are some points to note that tend to indicate a sound future for Camping World Holdings. First, the company has the largest network in its niche, with 185 locations in 40 states. Second, it sells everything – new and used RVs, trailers, campers, accessories, camping gear – and no competitor can match the breadth of the product line. And finally, CWH also offers RV service – and is expanding that to send RV mechanics on call to RV parks. These are the advantages that will cement customer loyalty.

For investors, CWH offers a reliable dividend that yields ~5%. Even when the Fed starts hiking rates later this year, they won’t get anywhere near 5%. And, in its Q3 report, the company raised its full-year 2021 guidance. Management bumped the adjusted EBITDA from the $840 million – $860 million range to a new range of $915 million – $930 million. This is an increase of 8.5% at the midpoint.

Covering the company for BMO, analyst Gerrick Johnson sees several reasons to expect a solid year ahead for CWH: “We think 2022 should benefit from continued interest from new buyers, trade-ups from recent new buyers, and the release of pent-up demand from existing RVers crowded out of the market during the pandemic owing to the influx of new buyers.”

Johnson gives CWH shares an Outperform (i.e. Buy) rating, and his $65 price target suggests it has an upside of 64% waiting for it this year. (To watch Johnson’s track record, click here)

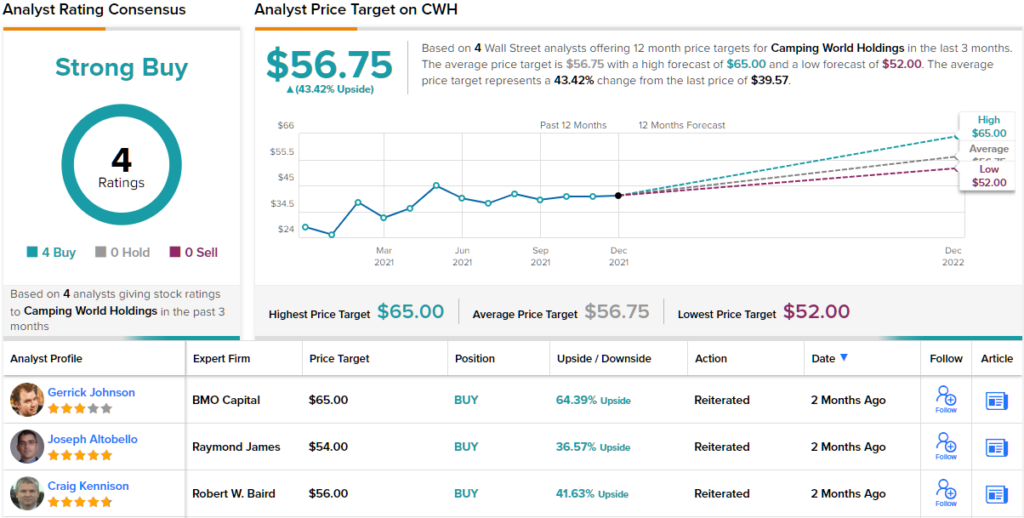

All in all, Wall Street very clearly likes what it sees in Camping World Holdings, because the stock has a unanimous Strong Buy consensus rating based on 4 positive reviews. The average price target, at $56.75, implies a one-year upside of 39% from the current $39.6 share price. (See CWH stock analysis at TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.