The stock market has had quite a run year-to-date. With momentum slowing in the past two weeks, the bearish pundits could re-emerge again, but don’t count on analysts to turn against the two “Strong Buy” stocks outlined in this piece.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

After a wave of analyst downgrades swept through markets in the second half of 2022, the bar is quite low. Count me as surprised if select analysts need to raise the bar on the back of earnings that are more resilient than expected.

Regarding companies with resilient earnings, the following two stocks seem destined for continued outperformance and perhaps price target upgrades throughout the year.

Therefore, let’s check in on two Strong Buy stocks that could experience as much as 19.9% in gains from current levels, according to consensus estimates.

Meta Platforms (NASDAQ:META)

Meta Platforms has stormed out of the gate this year, now up a whopping 44% year-to-date on the back of an impressive fourth-quarter earnings report. Despite the run, shares are still down around 53% from their all-time high hit in 2021. It’s been a hot start to the year, but there’s still room to run. I am bullish.

Revenue was down 4% (or up 2% on a constant-currency basis), while daily and monthly users for the Family of Apps grew by the low-single digits. This wasn’t jaw-dropping growth, but it was certainly better than feared.

The same headwinds that dragged Meta stock into the gutter are still very much on the table. The macro still weighs on the digital advertising market, while rivals like TikTok threaten to take share. Still, investors seem comfortable that Meta can move on and overcome such pressure points.

Meta’s beginning to rein in its aggressive spending. The new guide will see the firm cut about $5 billion from overall expenses. I think there’s still more room to cut and reallocate, and the announcement of further cuts could act as a driver for the share price over the year ahead.

A more prudent shift of capital from metaverse moonshots to more-easily monetizable projects looked to be enough to regain the confidence of Wall Street. In essence, a commitment to be more deliberate about spending in a high-rate world could be all Meta needs to climb out of its funk.

For now, expenditures remain pretty hefty, with metaverse efforts expected to continue to cost a great deal. If Meta announces a drastic reduction to its metaverse budget (as billionaire investor Brad Gerstner called for), META stock could easily add to its recent rally.

Over the year ahead, look for Meta to get in on the artificial intelligence (AI) action. Such technologies could improve users’ overall experience and increase the value of its ads. Indeed, there’s a lot of incentive to join the likes of its big-tech peers currently engaged in an AI battle. Meta has the data and talent needed to create an AI that may surprise us all.

At writing, Meta stock trades at 20.9 times trailing earnings. It’s considerably more expensive than just a few months ago. Regardless, I think Meta’s multiple is still too low, given the potential for further cost cuts, a post-recession ad recovery, and the firm’s underestimated AI capabilities. In that regard, I think a multiple in the mid 20’s would make more sense.

What is the Price Target for META Stock?

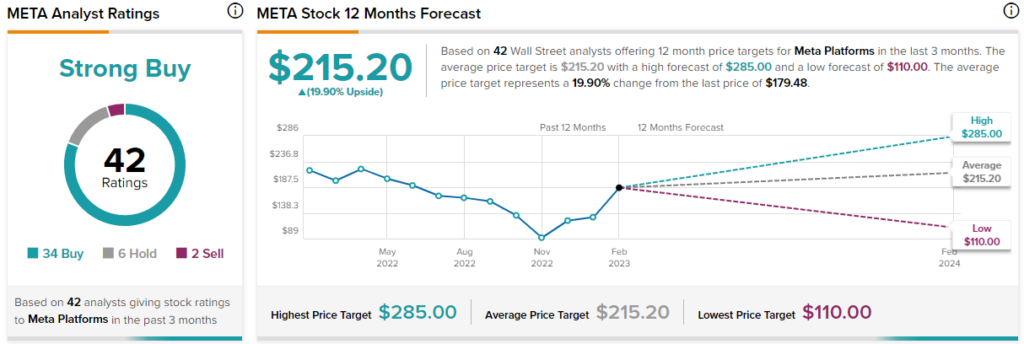

Analysts remain upbeat on Meta stock, with a “Strong Buy” consensus rating based on 34 Buys, six Holds, and two Sells. The average META stock price target of $215.20 implies 19.9% upside potential.

Visa (NYSE:V)

Visa stock has been relatively resilient through 2022, ultimately going nowhere over the past year. More recently, Visa stock has begun to feel relief, with nearly 11% gains year-to-date, just a hair higher than the S&P 500 (SPY). I am bullish on the stock.

The company recently clocked in better-than-expected first-quarter results ($2.18 EPS vs. $2.01 consensus), thanks partly to the continued travel spending recovery. However, as the economy worsens, the boost from the ongoing travel recovery could come to a standstill. Regardless, Visa continues to be an enticing play for a post-recession pick-up in consumer spending.

As rates continue increasing, Visa looks poised to use its size to its advantage. Undoubtedly, the ambition of unprofitable fintech startups has been curbed now that lenders are being more selective of how to navigate the high-rate climate.

As Visa’s smaller rivals begin to slash costs, their abilities to create truly disruptive innovations could be dampened. Meanwhile, Visa will continue improving its technological capabilities, security, and perks for cardholders.

Finally, I’d be unsurprised if Visa takes advantage of more opportunities in the M&A space now that fintech valuations have fallen back to Earth. Visa’s navigating this challenging environment far better than its smaller brothers in the fintech scene.

At 32.4 times trailing earnings, Visa stock is trading at a slight discount to its five-year historical average of 36.1 times.

What is the Price Target for V Stock?

Analysts have Visa stock at a “Strong Buy,” with 20 Buys, one Hold, and two Sells. The average V stock price target of $260.81 implies 13.7% upside potential.

Conclusion

Meta and Visa are reasonably-priced companies, and they have what it takes to climb higher in the face of macro headwinds. Currently, Wall Street expects more gains from Meta stock.