TipRanks allows investors to keep track of the investment activities of financial experts, such as hedge fund managers. By compiling the data from Form 13-Fs released by 483 hedge funds, the TipRanks Hedge Fund Confidence Signal indicates how bullish these managers are about a stock. Today, using the TipRanks Stock Screener tool, we have focused on two financial stocks: Metlife (NYSE:MET) and Synovus (NYSE:SNV). Both stocks carry a “Strong Buy” rating and were bought by hedge funds in the last quarter.

Metlife

MetLife is a multinational insurance company providing life insurance, annuities, employee benefits, and asset management services. In 2024, the company seems well-poised to benefit from favorable macro conditions, a healthy balance sheet, and easing concerns about the commercial real estate market.

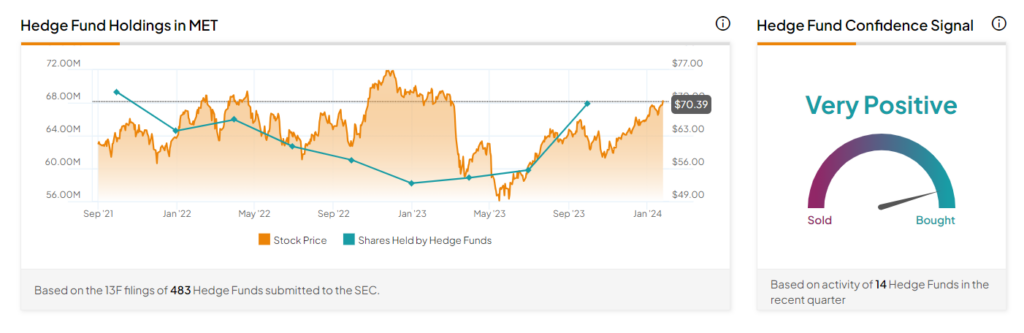

As per TipRanks’ database, hedge funds bought 8.1 million shares of Metlife last quarter. Several hedge fund managers increased their holdings in the stock, including Joel Greenblatt of Gotham Asset Management and Andreas Halvorsen of Viking Global Investors, among others. Also, the Hedge Fund Confidence Signal is currently Very Positive.

Is MET a Good Stock to Buy Now?

On January 23, Evercore ISI analyst Thomas Gallagher lowered the price target on MetLife stock to $84 (19.3% upside potential) from $86, while maintaining a Buy rating.

Wall Street is optimistic about MET stock. It has received 11 unanimous Buy, translating into a Strong Buy consensus rating. The analysts’ average price target of $81.27 implies 15.5% upside potential. Shares of the company gained 13.9% in the past six months.

On a positive note, the stock has a Smart Score of “Perfect 10” on TipRanks. Note that shares with this Smart Score have historically outperformed the S&P 500 Index (SPX) by a wide margin.

Synovus Financial

Synovus is a financial services company that provides banking, investment, and mortgage services. The company’s efforts to control costs and commitment to distribute shareholder returns remain encouraging.

Interestingly, the stock has a “Very Positive” signal from TipRanks’ Hedge Fund Trading Activity tool. The tool shows that hedge funds bought 794,800 shares of this company in the last quarter. Our data shows that Pzena Investment Management’s Richard Pzena and Echo Street Capital Management’s Greg Poole were among the hedge fund managers who increased their exposure to SNV stock.

Is SNV a Good Stock to Buy?

Following the company’s release of Q4 earnings last week, 10 analysts have rated the stock a Buy. The latest rating is from Jefferies analyst Ken Usdin, who raised the price target on SNV to $46 (18.1% upside potential) from $44.

The stock has received 11 Buy and three Hold recommendations for a Strong Buy consensus rating. The average Synovus stock price target of $43 implies 10.4% upside potential from the current level. Shares of the company have gained 17% in the past six months. Importantly, SNV stock carries an Outperform Smart Score of eight.

Ending Thoughts

Seeking advice from financial experts seems to be a prudent investment strategy during uncertain market conditions. For more ideas on Top Expert Picks, investors can visit the TipRanks Expert Center and make informed investment decisions.

Find out which stock the biggest hedge fund managers are buying right now.