With news that major oil-producing countries agreed to cut production in a bid to bolster sagging hydrocarbon energy prices, the oil sector naturally jumped higher. Therefore, investors may do well by pivoting their portfolio to incorporate the industry majors. However, for the funds earmarked for speculation, certain high-risk, high-reward tickers – particularly PBR and KOS – may generate incredible profitability.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

On Wednesday, the Organization of the Petroleum Exporting Countries and its non-member allies – also known as OPEC+ — agreed to cut crude oil production by two million barrels per day. Since OPEC+ nations control more than half of the world’s oil output, the narrative is invariably positive for oil stocks to buy, all other things being equal.

In addition, Russia cut critical energy outflows to Europe in retaliation for the region’s support of Ukraine. Fundamentally, this dynamic set off a massive crisis, effectively reducing hydrocarbon supplies to western nations and their allies. Combined with escalating inflation stemming from prior monetary excesses, these circumstances cynically bolstered oil stocks.

Logically, then, investors should dive into hydrocarbon-related investments without hesitation. While oil stocks have increased significantly, some pensiveness still exists. Mainly, the Federal Reserve’s insistence on a hawkish monetary policy stands poised to increase the purchasing power of the dollar. By deduction, such a trajectory would reduce commodity prices, including energy products.

At the same time, oil stocks generally benefit from inelastic demand at the baseline of consumption. In other words, people must consume a bare minimum of fuel to get from point A to point B. With society increasingly normalizing to pre-pandemic standards, energy costs might rise irrespective of the Fed.

Therefore, investors really should focus on oil stocks to buy. However, daring gamblers may benefit handsomely from the speculative subsegment.

Petrobras (NYSE:PBR)

Officially titled Petroleo Brasileiro, the petroleum firm is better known as Petrobras. A state-owned Brazilian multinational corporation, Petrobras received a jolt of relevancy from the unique dynamics of 2022. Since the start of this year, PBR stock has gained 30%, with more upside performance possible.

To be fair, Petrobras operates in an ambiguous political juncture. Earlier this year, the company attracted high-level criticism for posting consensus-beating profitability. Specifically, Brazilian President Jair Bolsonaro railed against Petrobras, characterizing the firm as pocketing a financial windfall as it squeezed regular people at the gasoline pump.

Add in Petrobras’ historical scandals and an extremely contentious election cycle in Brazil, and it’s easy to see why some folks backed away from PBR in favor of other oil stocks to buy. However, if circumstances end up favorably for Petrobras, it can really swing higher.

Financially, the company features a modestly-undervalued profile. For instance, Petrobras features a three-year revenue growth rate of 13%. In comparison, the industry median is actually in negative territory or 1.1% below parity, to be specific. On the bottom line, Petrobras’ net margin pings 28.4%, ranked higher than 81% of its peers. Yet, the company has a forward price-earnings ratio of 4.1x, below the industry median of 6.5x.

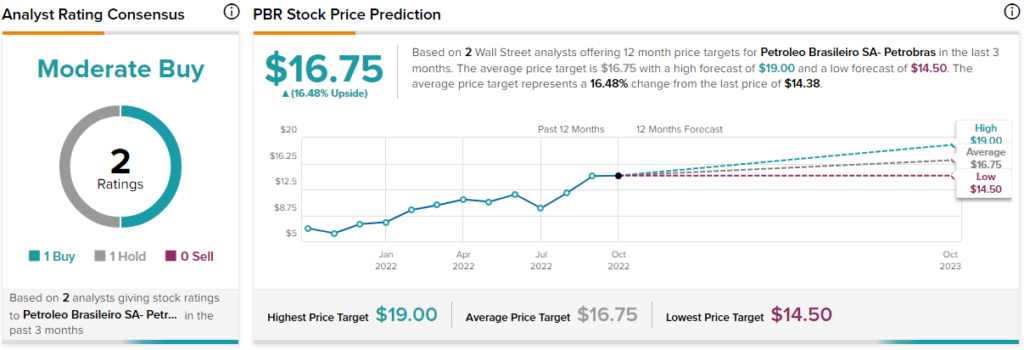

Is PBR a Good Stock to Buy?

Turning to Wall Street, PBR stock has a Moderate Buy consensus rating based on one Buy, one Hold, and zero Sell ratings. The average PBR price target is $16.75, implying 16.5% upside potential.

Kosmos Energy (NYSE:KOS)

An upstream hydrocarbon specialist, Kosmos Energy is a leading deepwater exploration and production company. While it primarily focuses on natural gas exploration and production, Kosmos also features several projects in Ghana. There, it oversees several oil fields, making KOS an organic beneficiary of the energy paradigm shift.

Since the start of this year, KOS stock has skyrocketed to the tune of 65%. However, there could be more upside along the way. First off, in the trailing six months, Kosmos’ equity value declined about 17.5% as the Fed pushed its hawkish monetary policy aggressively. However, with OPEC+ cutting production, KOS should enjoy a bullish trajectory, moving forward.

Financially, the company’s business profile is overall fairly valued, according to GuruFocus calculations, although brewing relevance could theoretically make KOS one of the undervalued oil stocks to buy. For instance, the company features a three-year revenue growth rate of 13.4%, whereas again, the industry median sits 1.1% below parity. Kosmos also features a staggering operating margin of 42.5%, beating out more than 83% of its competitors.

Nevertheless, Kosmos’ forward P/E ratio sits at a subterranean 2.6x. That seems unusually low, making KOS an intriguing idea for speculative oil stocks to buy.

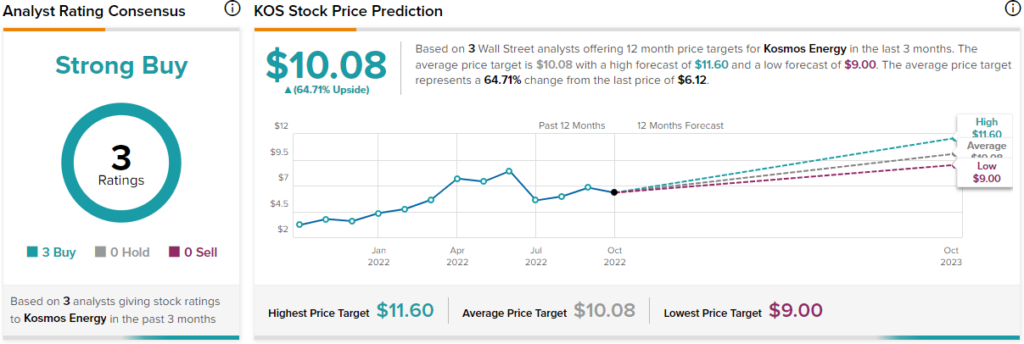

Is KOS a Good Stock to Buy?

Turning to Wall Street, KOS stock has a Strong Buy consensus rating based on three unanimous Buy ratings. The average KOS price target is $10.08, implying 64.7% upside potential.

Conclusion: Running with the Wind

Ordinarily, most investors should avoid speculative market ideas like the plague. Generally, this category features high return potential but extremely low probabilities of success. However, with the above oil stocks to buy, the underlying narrative is also very bullish. Therefore, the odds swing a bit more in the gambler’s favor.