With millions of workers engaged in the broad remote operations experiment, several people ordinarily unaccustomed to the equities sector had plenty of time on their hands to learn. Soon enough, the concept of short-squeeze stocks dominated headlines. However, successfully navigating this niche discipline involves more than just wagering on garbage companies. Instead, participants must exercise some strategies, which may benefit the tickers PETS and MNDY.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

To get everyone on the same page, let’s quickly discuss the basics of short-squeeze stocks. Typically, retail investors participate on the long side of the trade, that is, buying securities in anticipation that they will move up. However, traders can also profit on the downside.

Rather than purchasing stocks, these folks borrow shares and sell them immediately in the hopes of picking them up at a discount later. If all goes to plan, traders can return the borrowed shares back to the lender and pocket the difference.

Of course, the main risk with bearish bets is that the underlying security can rise in value. Not only that, because no upside limit theoretically exists for equity valuations, short traders risk unlimited liability. Therefore, participants of short-squeeze stocks take advantage of this dynamic by betting on heavily shorted securities in the hopes of sparking a panic.

After all, to close out a short position, short traders must buy back the underlying securities, which is bullish for the price. That’s the undeniable allure of short-squeeze stocks. Nevertheless, bullish participants must be smart with their decision-making processes.

For instance, just because certain companies feature high bearish interest does not mean they will automatically rise. People who acquired short-squeeze stocks early this year found that out the hard way when countless headwinds collapsed the market. To be successful requires picking the right ideas.

PetMed Express (NASDAQ:PETS)

An online pet pharmacy, PetMed Express sells prescription and non-prescription pet medication. Since the start of this year, PETS stock has lost nearly 16% of its equity value. The negativity likely centers on consumer economy weaknesses. Not surprisingly, then, PETS ranks among Fintel’s Short Squeeze Leaderboard.

Specifically, PETS stands at #137 out of 250 entries of potential short-squeeze stocks. At writing, PetMed features a short percentage of float of 24.86%. Also, the short-interest ratio (or the number of days it takes short traders on average to cover their positions) stands at a lofty 19.43x.

Fundamentally, though, the bears appear to be discounting the extraordinary relevance of the pet industry in the U.S. According to the American Pet Products Association, in 2021, the industry generated total revenue of $123.6 billion, a fresh high since records were kept. As well, sales have continued to increase every year since at least 2018.

Financially too, bears might be making a mistake. PETS features a very robust balance sheet augmented by zero debt. Therefore, PetMed can win a war of attrition, making its security one of the short-squeeze stocks to consider.

Is PETS Stock a Buy, According to Analysts?

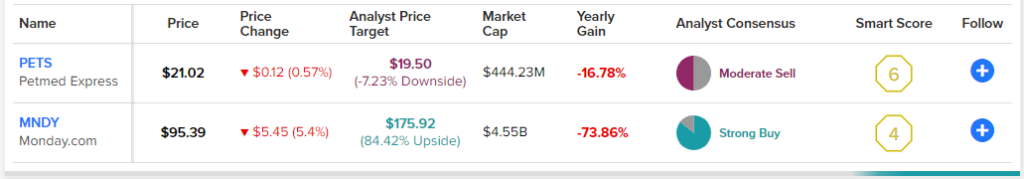

Turning to Wall Street, PETS stock has a Moderate Sell consensus rating based on zero Buys, one Hold, and one Sell rating. The average PETS price target is $19.50, implying 7.2% downside potential.

Monday.com (NASDAQ:MNDY)

At first glance, it’s easy to see why Monday.com attracted so much bearish attention. Since the start of this year, MNDY has hemorrhaged nearly 70% of its market value. Part of it could be its business profile. Monday.com is a cloud-based platform that allows users to create their own applications and project management software.

Of course, the main problem with this narrative centers on recession risks. With many high-profile corporations actively engaged in layoffs – or about to engage in them – business software solutions don’t seem relevant. After all, businesses must exist in the first place for enterprises to provide solutions for improvement.

However, it may be too pessimistic to not assume that, at some point, the economy will recover. When it does, companies will need an edge to beat out their competitors, bolstering MNDY. While Monday.com’s financials aren’t as stout as PetMed’s, the former company still commands resilient metrics. For example, it carries a cash-to-debt ratio of 14x, ranking better than nearly 68% of the industry.

Therefore, MNDY ranking as number 172 on Fintel’s Short Squeeze Leaderboard – with a short float of 16.64% and 4.17 days to cover – seems ungenerous. If you feel the same, MDNY could make an interesting idea for a short-squeeze stock to buy.

Is MNDY Stock a Buy, According to Analysts?

Turning to Wall Street, MNDY stock has a Strong Buy consensus rating based on 12 Buys, two Holds, and zero Sell ratings. The average MNDY price target is $175.92, implying 83.5% upside potential.

Conclusion: Take Smarter Risks with Short-Squeeze Stocks

One of the reasons why many retail traders found themselves in trouble with short-squeeze stocks is that they merely paid attention to the headline metrics of short float and days to cover. However, if bears are betting against truly garbage companies, chances are, those securities will fail. Instead, if you want to go with the contrarian approach, consider heavily-shorted stocks that also feature strong fundamentals.