Amid weak economic prospects, top executives of leading companies, including Jamie Dimon of JPMorgan (NYSE:JPM) and Elon Musk of Tesla (NASDAQ:TSLA), have warned that we are on the brink of a recession. With signs of an impending recession, investors should take caution and consider adding a few high-quality stocks like Walmart (NYSE:WMT) and Costco (NASDAQ:COST) to their portfolio with a “Perfect 10” Smart Score.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Note: Shares with a “Perfect 10” Smart Score have historically outperformed the benchmark index.

Walmart and Costco have defensive businesses that would add stability to your portfolio. Moreover, their maximum Smart Score implies that these stocks are more likely to outperform the broader markets. Let’s take a closer look.

Walmart (WMT)

Amid high inflation and fear of recession, Walmart is a solid option for shoppers and investors. Walmart attracts customers looking for value, which makes it attractive amid a slowdown. Further, its increasing penetration of private brands (especially in food categories) indicates that Walmart has managed to defend its pricing gap with peers, which bodes well for growth.

Highlighting its value offerings, Jefferies analyst Corey Tarlowe stated that “As the value leader in retail, we believe WMT is well-positioned in the present environment, particularly given the benefit we estimate WMT could realize as a result of higher-income customers trading down.”

Tarlowe added that the current economic environment has “some challenges,” but the scenario is best suited for Walmart to outperform.

What is the Prediction for Walmart Stock?

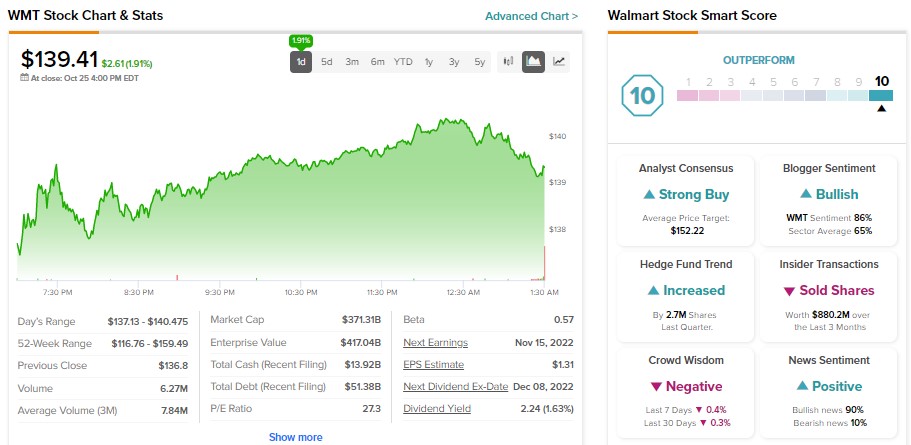

Given its strong competitive positioning, revenue diversification, and reduction of excess inventory, Walmart stock has a Strong Buy consensus rating on TipRanks. WMT stock has received 23 Buy and five Hold recommendations. Further, analysts’ average price target of $152.22 implies 9.2% upside potential.

Besides for analysts, hedge funds have maintained a positive outlook on WMT stock. TipRanks’ data shows that hedge funds bought 2.7M WMT stock last quarter. Meanwhile, WMT stock has a maximum Smart Score of 10 out of 10.

Costco (COST)

Costco has performed exceptionally well in Fiscal 2022 despite macro concerns. Its adjusted comparable sales increased by 10.6%, showing the resiliency of its business. Further, the momentum in its business has been sustained in Fiscal 2023, with September adjusted comparable sales increasing by 8.6%.

Costco’s solid growth is supported by its value pricing strategy that attracts customers and its high membership renewable rate and fee income.

In response to Costco’s solid start to Fiscal 2023, Tarlowe stated, “Strong start to 1Q sets a precedent for remainder of quarter.” Costco is Tarlowe’s top pick.

The analyst views “COST as a compounder of value, with incremental sales helping to drive profit outperformance. Our model does not include advancement of omni-channel capabilities, which offers additional upside.”

Is COST a Buy or Sell?

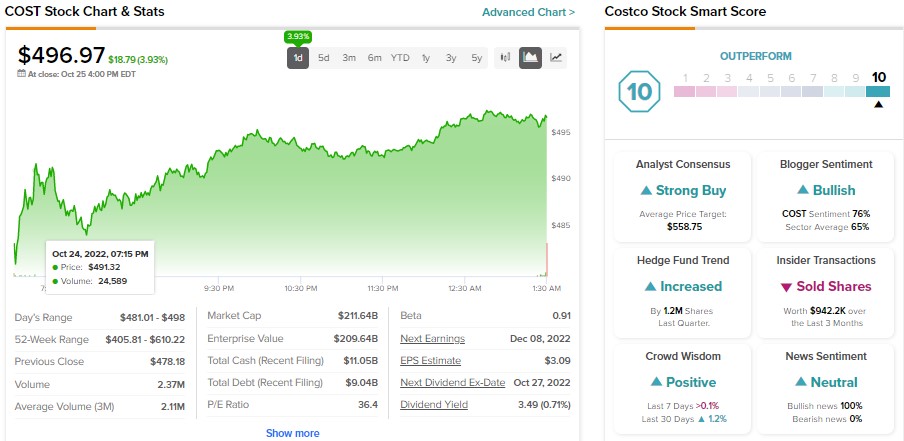

On TipRanks, Costco stock sports a Strong Buy consensus rating based on 17 Buy and four Hold recommendations. Further, the average price target of $558.75 implies 12.4% upside potential.

Our data shows that hedge funds bought 1.2M COST stock in three months. Meanwhile, 1.2% of investors holding portfolios on TipRanks have increased their exposure to COST stock in one month. Overall, Costco has a “Perfect 10” Smart Score on TipRanks.

Bottom Line

With their defensive business models and value offerings, Walmart and Costco are well-positioned to easily navigate the economic slowdown. Further, their maximum Smart Score indicates that these companies are more likely to outperform the broader market.