Investors looking for regular income can consider investing in dividend stocks. Using TipRanks’ Stock Screener tool, we zeroed in on companies offering a dividend yield higher than 5% and have received Buy recommendations from Wall Street analysts. Let’s take a closer look at two such high-yielding dividend stocks – Citizens Financial (NYSE:CFG) and Ares Capital (NASDAQ:ARCC).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Citizens Financial Group, Inc.

Citizens Financial offers retail and commercial banking products and services. It has an attractive dividend yield of 5.7%. Further, the company increased its share repurchase program by an additional $1.5 billion in February. Also, last year, it raised the common stock dividend by 8%. These moves are supported by Citizens’ strong capital position and solid top-line growth momentum.

Recently, Morgan Stanley analyst Betsy Graseck maintained a Buy rating on the stock but lowered the price target to $38 from $53. Despite the uncertainty in the banking sector, Graseck approves of banks that boast flexible funding.

Is CFG a Good Stock to Buy?

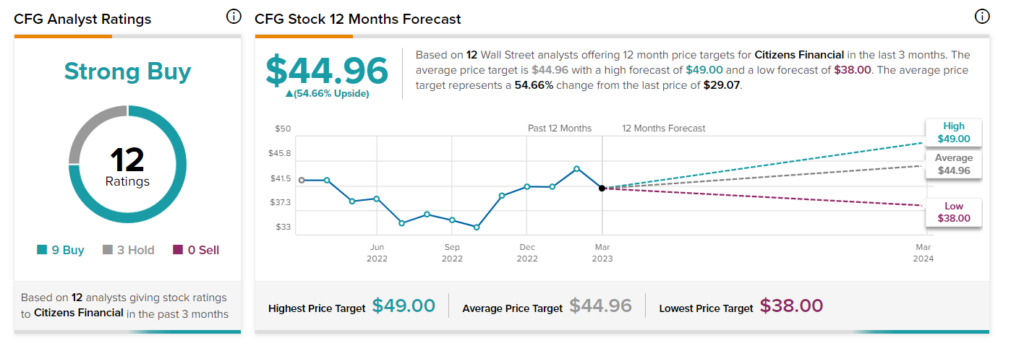

Citizens Financial has received nine Buy and three Hold recommendations for a Strong Buy consensus rating. Further, CFG’s price target of $44.96 implies 54.7% upside potential. The stock has lost 25.8% so far in 2023.

Ares Capital Corporation

Ares Capital is a specialty finance company that primarily invests in U.S. middle-market companies. The stock has a rock-solid dividend yield of 10.5%. The company’s top line is thriving in the current high-interest rate environment as Ares Capital issues floating-rate loans. Further, its investment-grade credit rating and strong market presence help instill confidence in the stock.

JMP Securities analyst Devin Ryan reiterated a Buy rating on ARCC stock with a price target of $23. Given the competitive advantages of the Ares platform, Ryan thinks that despite the current macroeconomic headwinds, the company is well-positioned to outperform in 2023.

Will ARCC Stock Go Up?

ARCC stock has a Strong Buy consensus rating on TipRanks. This is based on six unanimous Buy recommendations. The average stock price target of $21.25 implies 17.8% upside potential. Shares have tanked 0.2% so far in 2023.

Concluding Thoughts

As per analysts, both CFG and ARCC have the potential to generate strong returns based on solid fundamentals. Investors might want to consider adding these stocks to their portfolios to generate steady passive income.