The sentiments in the U.S. stock market are shaky as the country’s central bank is taking stringent measures to keep inflation under control. The Federal Reserve hiked its benchmark interest rate by 75 basis points (bps) earlier this month, preceded by an increase of 50 bps in May and 25 bps in March. Another rate hike of 50 to 75 bps is likely in July.

On June 22, Jerome Powell, the Federal Reserve Chairman, commented on the speculation that these inflation-control measures might trigger a recession.

He said, “It’s not our intended outcome at all, but it’s certainly a possibility, and frankly the events of the last few months around the world have made it more difficult for us to achieve what we want, which is 2% inflation and still a strong labor market.”

The geopolitical tension caused by the Ukraine-Russia war and its subsequent impact on the oil and gas industry, an ailing supply chain, and surging costs has also slowed the economic progress of the country over the past few months.

Under such uncertain market conditions, an investor’s ability to pick the right stock for his portfolio could get impacted. The TipRanks Smart Score Rating system might come in handy at this point, as it highlights which stocks could underperform or outperform the market.

Now, we bring to you two mega-companies (market capitalization of >$200 billion) that have a “Perfect 10” Smart Score on TipRanks and a beta of <1.

Johnson & Johnson (NYSE: JNJ)

The $455.3-billion healthcare company has solid footprints in the United States and globally. Its offerings include products related to baby, oral and skin care; treatment of arthritis, bowel problems and infectious diseases; and cardiovascular diseases.

The company’s solid product offerings, innovation and technological capabilities, operational excellence, and an experienced workforce raise its investment value.

In April 2022, the company’s CEO, Joaquin Duato, said, “Looking ahead, I remain confident in the future of Johnson & Johnson as we continue advancing our portfolio and innovative pipeline.”

For 2022, the company anticipates operational sales to grow 6.5%-7.5% year-over-year to $97.3-$98.3 billion and adjusted operational earnings to increase 8.2%-10.2% to $10.60-$10.80 per share.

The company’s ‘Perfect 10’ Smart Score underpins its solid growth prospects. Its beta stands at 0.43, suggesting low exposure to the current market volatility.

On TipRanks, the company has a Moderate Buy consensus rating based on seven Buys and three Holds. Also, JNJ’s average price forecast of $193.40 suggests upside potential of 10.05% from current levels. Over the past year, shares of JNJ have increased 8.1%.

The Coca-Cola Company (NYSE: KO)

With a market capitalization of $265.1-billion, the non-alcoholic beverage provider is recognized globally for its soft drink, Coca-Cola. Other product offerings include Fanta, Diet Coke, Sprite, Costa Coffee, Fuze Tea, and Aquarius.

Its popular brand, focus on providing new products, partnerships to expand revenue opportunities, efforts to boost operational excellence, and environmentally friendly initiatives are appealing. In April, the company’s Chairman and CEO, James Quincey, opined that the company is “well-equipped to win in all types of environments” with a focus on boosting “topline momentum” and value for stakeholders.

For 2022, the company anticipates non-GAAP earnings per share to increase 5%-6% year-over-year. Organic revenues in the year are forecast to grow within the 7%-8% range.

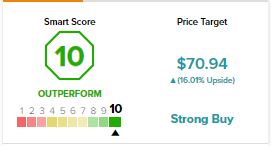

Considering its ‘Perfect 10’ Smart Score and the tailwinds highlighted above, the chances that the stock could outperform the market are high. Also, the company has a beta of 0.60.

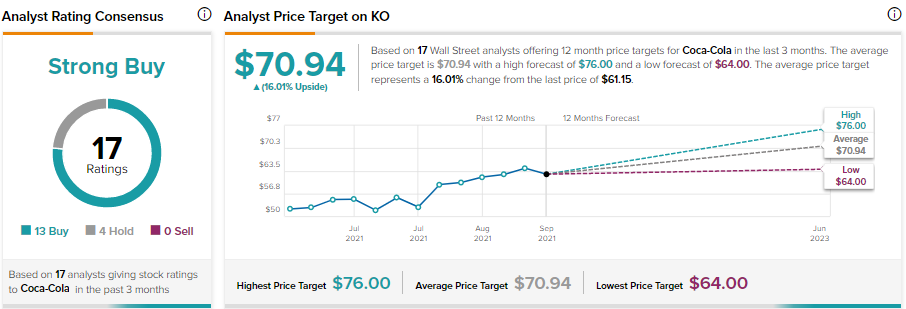

Further, the company has a Strong Buy consensus rating based on 13 Buys and four Holds. KO’s average price target is pegged at $70.94, implying 16.01% upside from current levels. Shares of the company have risen 13% in the past year.

Conclusion

Johnson & Johnson and Coca-Cola Company could be good investment options in these volatile market conditions. The companies have solid growth prospects and their top Smart Score rating on TipRanks implies that they have strong potential to outperform the market. Also, a low beta reassures of lower impact from market volatility.