The great tech wreck of 2022 will go down in the history books as one of the worst tech-focused sell-offs since the 2000 dot-com bust. High-tech innovations like Twilio (NYSE: TWLO) and Atlassian (NASDAQ: TEAM) have seen their shares obliterated (down 82% and 70% year-to-date, respectively). Despite the downfall, most Wall Street analysts haven’t changed their stances. Each stock sports a “Moderate Buy” rating, even after a drastic reversal in sentiment amid rising interest rates.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Indeed, many investors who lived through the 2000 market crash may have seen the wreckage coming from a mile away. Warren Buffett’s right-hand man, Charlie Munger, knew that there was quite a bit of “wretched excess” in markets.

Unfortunately, many market participants who rode hot stocks like TWLO and TEAM to their 2021 peak levels likely weren’t old enough to be invested in the run-up leading to the 2000 dot-com bust. Though it may be too early to be aggressive with the imploded mid-cap tech stocks, I do think they’re worth a second look as the Federal Reserve could slow its pace of rate hikes drastically.

Indeed, a “Fed pause” would be a bull-case scenario for speculative tech stocks. Regardless, I still think TWLO and TEAM have products that are strong enough to make it through this rough patch.

Let’s use TipRanks’ Comparison Tool to determine which cloud-harnessing innovation stock faces more upside over the year ahead.

Twilio (TWLO)

Many speculative tech stocks deserved to shed more than 80% of their value from peak to trough. There were too many hot IPOs of companies that had commoditized products or couldn’t grow beyond pandemic lockdowns. Twilio is one of the companies that seem to have been unfairly dragged down alongside such companies.

Though many investors may misunderstand CPaaS (Communications Platform as a Service), Twilio offers a vital service that helps save its users (programmers) time and money. In essence, Twilio is a SaaS company that pretty much pays for itself.

The usage-based model offers flexibility but introduces considerable volatility to underlying growth numbers. In due time, such lumpy numbers should smoothen out as demand looks to reach normalized conditions.

In the meantime, management is downbeat as recession headwinds approach. Twilio clocked in a narrower loss in its third quarter (-$0.27 EPS loss versus expectations of -$0.39) on $983 million in revenue. Still, management guided cautiously for the fourth quarter. This cautious guide has weighed the stock down toward multi-year lows.

As we move into a recession year, growth could continue to sink, and the losses could linger. Indeed, Twilio’s lack of profits or profitability prospects is a huge concern, with rates rising so quickly.

Twilio isn’t the same hot growth stock it used to be. At 2.4 times sales, shares don’t seem to be priced with growth in mind.

Recently, the firm launched a customer data platform aimed at the health and life sciences industries. Even as the firm enters tougher conditions, it continues to bring forth new offerings. It’s these offerings that should help Twilio regain its growth edge once the worst of recession headwinds come and go.

What is the Price Target for TWLO Stock?

Wall Street has been lowering the Twilio stock price target steadily throughout the year. Despite lowered estimates, analysts remain bullish, with 15 Buys, nine Holds, and one Sell assigned in the past three months. The average TWLO stock price target of $84.04 still implies a solid gain of around 81%.

Atlassian (TEAM)

Atlassian is a leader in software for software development. Programmers and software project managers are fully aware of the company’s market dominance. In recent quarters, free user conversions have slowed drastically. The latest quarter saw sales growth of 32%. Not a bad number, but the company’s customer count growth has really slowed down in recent years to just 15% year-over-year.

With massive layoffs concentrated in the tech sector, demand for Atlassian products could continue to take a hit. As tech companies axe unprofitable projects, Atlassian will likely feel the full force of the impact. Industry headwinds are hard to steer clear of for the $36 billion software company.

Even after a 72% drop, Atlassian stock is anything but cheap at 12.9 times sales. Undoubtedly, Atlassian remains a risk-on play, as the tech sector continues to act as one of the sorest industries going into a potential recession year that could see even higher interest rates.

As valuations contract across the industry, Atlassian could make use of its $1.52 billion in cash. There are a lot of small productivity tools that would make for fine additions to the Atlassian suite. Besides M&A, things seem pretty bleak for the high-multiple software stock as it looks to brace for further weakness in the tech scene.

What is the Price Target for TEAM Stock?

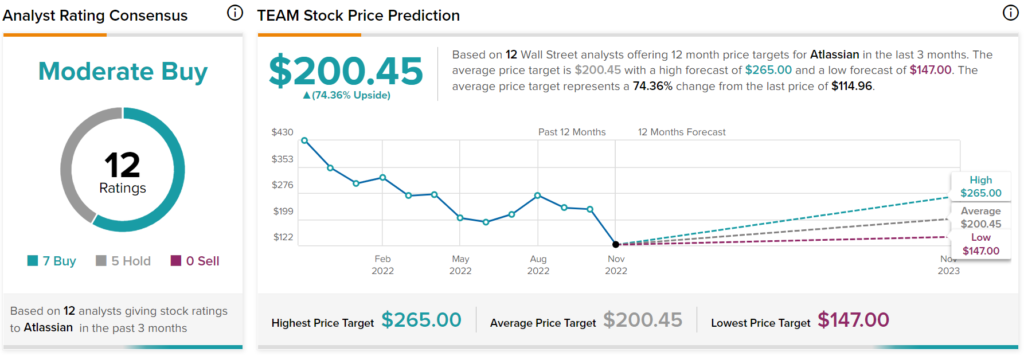

Wall Street is staying bullish on Atlassian, with seven Buys and five Holds assigned in the past three months. The average TEAM stock price target is $200.45, which implies a 74.36% gain from current levels.

Conclusion: Wall Street Expects More Upside from TWLO Stock

Twilio and Atlassian stocks could continue to sink as rates rise and pressure mounts on the tech industry. Nevertheless, Wall Street expects upside potential from both fallen tech plays, though it favors TWLO slightly more at the moment.