Shares of Array Technology (ARRY) declined 3.7% in Wednesday’s extended trading as the company reported mixed results for the second quarter ended June 30, 2021. The company engages in manufacturing ground-mounting systems used in solar energy projects.

Array Technology reported adjusted earnings of $0.07 per share, which surpassed analysts’ estimates of $0.03 per share and increased from $0.06 per share in the year-ago quarter.

Its revenues of $202.8 million grew 76% year-over-year but lagged the consensus estimates of $233.2 million. The upside can be attributed to strong demand for the company’s products during the quarter.

Adjusted EBITDA increased 23% to $16.2 million, compared to $13.1 million in the prior-year period. Its gross margin decreased from 19.3% to 13.2% due to higher input and freight costs. (See Array Technologies stock charts on TipRanks)

The CEO of Array Technologies, Jim Fusaro, said, “I remain bullish on the long-term prospects for utility-scale solar and for Array. The transition to renewable energy is only accelerating, …and we have taken the steps that were necessary to adapt our business to the current inflationary environment.”

The company expects revenues between $850 million and $940 million for full-year 2021. Also, it seeks to report adjusted net income per share in the range of $0.15 to $0.25.

On August 10, Roth Capital analyst Philip Shen upgraded the stock rating to a Buy with a $25 price target, implying 63.2% upside potential.

The analyst is of the opinion that Array Technologies may now be in a better financial position and could even gain share through the challenges posed by steel pricing.

The rest of the Street is cautiously optimistic about the stock with a Moderate Buy consensus based on 5 Buys and 3 Holds. The average Array Technologies price target of $26 implies 69.7% upside potential.

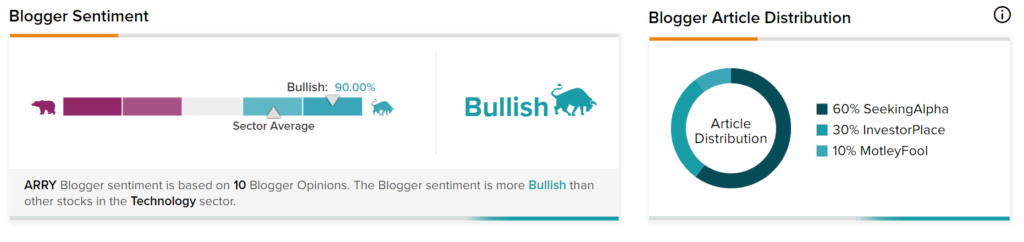

TipRanks data shows that financial blogger opinions are 90% Bullish on ARRY, compared to the sector average of 70%.

Related News:

Coinbase Reports Solid Q2 Results on Higher Trading Volume

FireEye Bolsters Mandiant Advantage Platform with Intrigue

Berkeley Lights Reports Wider-Than-Expected Loss in Q2