The tech landscape is rapidly evolving with the expansion of AI, presenting promising opportunities for semiconductor companies. Adopting a cyclical perspective, Evercore analyst Mark Lipacis, ranked #2 overall by TipRanks among Wall Street’s analysts, anticipates sustained growth in the sector, despite cautioning against the likelihood of a mid-cycle correction.

“Cyclically, we believe that this upcycle lasts into 1Q/2Q-2025… In the meantime, we do believe the group could see a mid-cycle correction in 3Q/4Q-2024, which we would use as a particular buying opportunity before the end of the cycle…. The good news is that as the supply chain continues to work down their inventories, visibility for semis will improve, and we believe will translate to a ‘V’ recovery, and upwards revisions to NTM consensus estimates for the group,” Lipacis opined.

Against this backdrop, Lipacis goes on to select the better semiconductor stock for investors to buy right now. He’s looked into the details of two major players, ARM Holdings (NASDAQ:ARM) and Intel (NASDAQ:INTC), and his choices and comments will bear some scrutiny.

ARM Holdings

While not a household name, ARM Holdings is one of the semiconductor world’s biggest players, the company behind the Arm architecture, known for its combination of high quality and low electric power consumption. These attributes make ARM particularly well-suited to provide CPU chips for portable computing devices; the company is also well-known as a supplier of chips for the data center and supercomputer niches.

Some numbers will show the extent of the company’s influence on the tech world. While ARM hasn’t got the scale of a giant like Nvidia, its technology lies at the heart of the chip industry. According to the company’s numbers, approximately 50% of all processor chips are based on Arm tech and 70% of the global population uses products based on Arm. To date, there have been over 280 billion Arm-based chips shipped, and these products are found in 99% of smartphones.

In recent years, ARM’s quality attracted both a takeover attempt from Nvidia and backing for an IPO. The takeover attempt fell apart in 2022, but the IPO took place in late summer of last year.

In February of this year, ARM saw a massive jump in price following the release of its earnings report amidst soaring tech enthusiasm for AI. The earnings report, for fiscal 3Q24, showed a 14% year-over-year increase in revenue, to a total of $824 million – a figure that also beat the forecast by $61 million. At the bottom line, ARM showed a non-GAAP EPS of 29 cents, 4 cents per share better than had been expected.

Analyst Mark Lipacis puts together a compelling picture of ARM, saying of the company, “We see Arm as a primary beneficiary of 3 Tectonic Shifts over the next 10 years: 1) Edge AI Play. As LLMs proliferate, we expect more inferencing to occur in the handset, which would translate to higher demand for both Arm CPU/GPU see a path to $30+ handset ASP and 4%+ royalty over time 2) Data Center Play. We expect Arm to continue to outperform vs. x86 amid power efficiency needs in parallel computing era, and see market share tracking towards from single digits to 30%+ over next 10 years 3) IoT Play. We believe AI could drive more Arm processing power into IoT devices, which could drive ASPs/royalty rates higher.”

“Near-term,” Lipacis added, “we forecast ARM revenues to increase by +26% 2yr CAGR to $4.65B in CY25, driven largely by an increase in royalty rates that comes with adoption of its ‘V9’ architecture due to an increase in royalty rates by at least 2x vs. V8.”

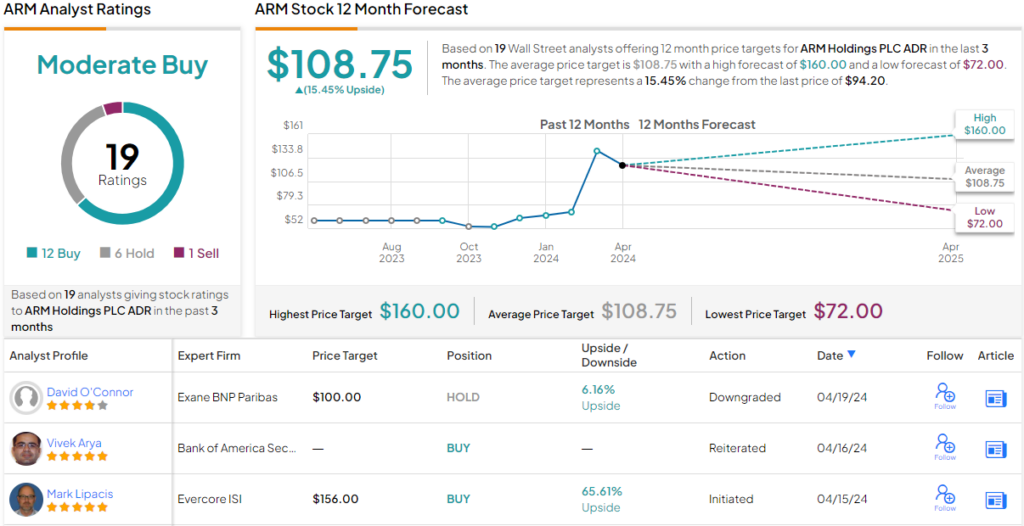

To this end, the top-rated analyst puts an Outperform (i.e. Buy) rating on ARM shares, and his $156 price target implies the stock will gain 65% over the coming year. (To watch Lipacis’ track record, click here)

Overall, ARM stock gets a Moderate Buy consensus rating from the Street’s analysts, based on 19 recent reviews that break down to 12 Buys, 6 Holds, and 1 Sell. The shares are currently trading for $94.20, and their $108.75 average price target suggests a one-year gain of ~15%. (See ARM stock forecast)

Intel

The second chip stock we’re looking at is Intel, a name that requires little introduction. With an annual revenue of $54.22 billion last year, Intel ranks fourth among the world’s largest chipmakers. Despite facing challenges compared to its peers in recent times, Intel maintains its dominance with a substantial 63% share of the PC CPU market.

Intel is working to improve its standing in the chip industry and has a solid base to support its efforts. The company is one of the few chipmakers globally able to produce top-end semiconductor products on an industrial scale, and it is leveraging that capability to establish itself as the leading chip foundry company in the US market. Intel has published plans to develop a new chip manufacturing facility in New Mexico and to optimize that facility for the production of AI-capable processor chips. Backing up these plans, Intel is in line to benefit from the disbursement of funds under the Federal CHIPS Act, as much as $8.5 billion, along with access to $11 billion worth of Federal tech loans.

These plans for the new foundry are proceeding apace, and Intel has announced an agreement with Microsoft, under which Intel’s new foundry will produce AI-capable semiconductors for the software company. The design process will be a collaboration between the two companies, and Intel will use its 18A process on the chip foundry’s manufacturing line. Looking forward, Intel intends to make its US foundry operations the world’s second-largest by 2030.

In addition to working on its foundry plans, Intel is also developing new chips for the AI market. These new products include its new Gaudi3 processors, as well as the fifth-generation Xeon server chips. While Intel is promoting its new AI-capable products, the company has also not abandoned its traditional competency and is also releasing new PC processors in its Core line.

We won’t see Intel’s first-quarter 2024 results until next Thursday, April 25, but a look back at 4Q23 will give an idea of where the company stands for now. Intel’s quarterly revenue came to $15.4 billion, missing the forecast by $230 million but growing 10% year-over-year. Earnings, reported as a non-GAAP EPS of 54 cents, were 9 cents better than had been anticipated. Shares in INTC are falling, however, and the stock has lost 31% so far this year.

Checking in again with top analyst Lipacis, we find him outlining both strengths and weaknesses for Intel, writing, “We view the risks for INTC as balanced. On the negative side, in a Tectonic Shift to an IoT/Parallel Processing Computing Era, the center of gravity of computing is drifting away from INTC’s x86 standard, and INTC is seeing competition not just from traditional processor companies like AMD and NVDA, but also its own customers. However, on the positive side, INTC is one of only 3 companies in the world that can make leading edge transistors at scale, and the only one in the US that can. INTC management is focused on driving its foundry business to benchmarks in customer service and cost, and has started to sign up customers. We think it will take time to execute on all three, but we could get constructive with visibility into improving fundamentals in its foundry business.”

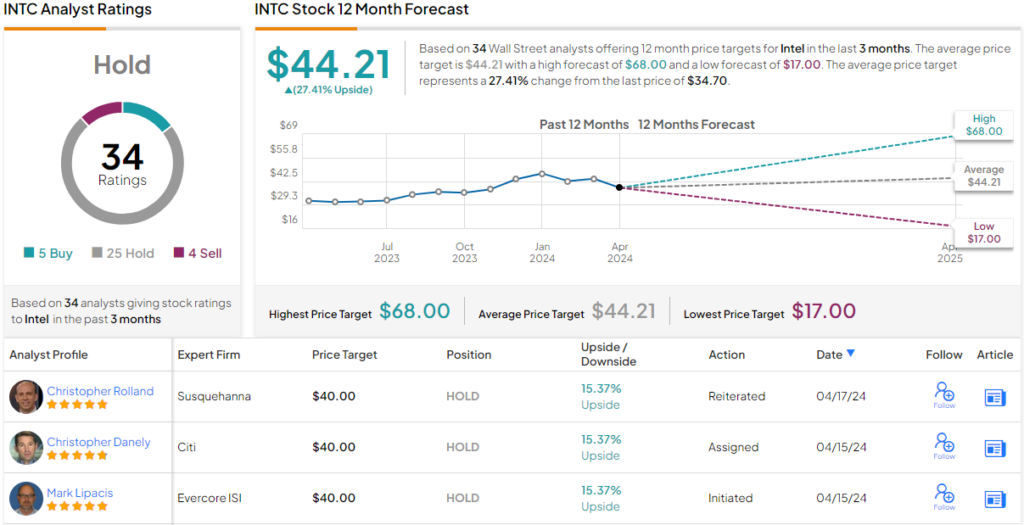

Going forward, the analyst puts an In-Line (i.e. Neutral) rating on the shares, with a $40 price target to point toward a 15% one-year upside potential.

This view is congruent with the Hold consensus rating on Intel shares, which is based on 34 analyst reviews that break down to 5 Buys, 25 Holds, and 4 Sells. INTC stock is priced at $34.70 and the average price target of $44.21 is somewhat more bullish than Lipacis would allow, predicting ~27% upside for the next 12 months. (See INTC stock forecast)

After reviewing both stocks, the verdict is clear: according to top analyst Mark Lipacis, ARM Holdings is clearly the better semiconductor stock to buy.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.