With the explosion of Artificial Intelligence, cryptocurrencies, and Electric Vehicles, there is increasing demand for energy generation. Companies engaged in the building of energy facilities, such as Argan (NYSE:AGX), could be well-positioned to take advantage of the growing need. Indeed, the stock is up over 55% for the past year, and could be a solid option for investors looking for value.

Construction Partner for the Power Industry

Argan is an engineering, procurement, and construction (EPC) company in the power generation sector. Its services include designing, building, and commissioning facilities for natural gas, renewable energy, and other power sources.

The EPC market is estimated at $730 billion in 2024, and is expected to reach $927 billion by 2029.

Analysis of Recent Financial Results

Argan recently posted financial results for the quarter ending January 31, 2024. Revenues came in at $164.6 million, reflecting a substantial 38.6% rise from the $118.8 million achieved in the same period the previous year. Net income for this quarter reached $12 million, or $0.89 per diluted share, beating the consensus estimate of $0.75 per share.

For FY2024, consolidated revenues rose 26.0% to $573.3 million. Net income was $32.4 million, or $2.39 per diluted share, slightly below the previous year’s $33.1 million, or $2.33 per diluted share. Fourth-quarter project backlog rose to $757.0 million, roughly in line with levels observed since Fiscal 2022, suggesting ongoing strength in future revenue growth.

The company also increased its quarterly cash dividend by 20% to $0.30 per share and paid a total of $1.10 per common stock share for the year. Furthermore, repurchases during FY2024 accounted for 303,160 shares of common stock at a total cost of $12.5 million.

Argan reported robust financial health and a pristine balance sheet, including no debt on its books.

What is the Price Target for AGX Stock?

Shares of the company have jumped up over 20% since the company announced its earnings, and the stock is currently trading at the high end of the 52-week price range of $36.87-$61.79, while demonstrating ongoing positive price momentum trading above the 20-Day (50.74) and 50-Day (48.95) exponential moving averages. However, it appears to be fair to slightly undervalued on a relative basis, with a EV/EBITDA of 9.75, comparing favorably to the Engineering & Construction industry average of 11.92.

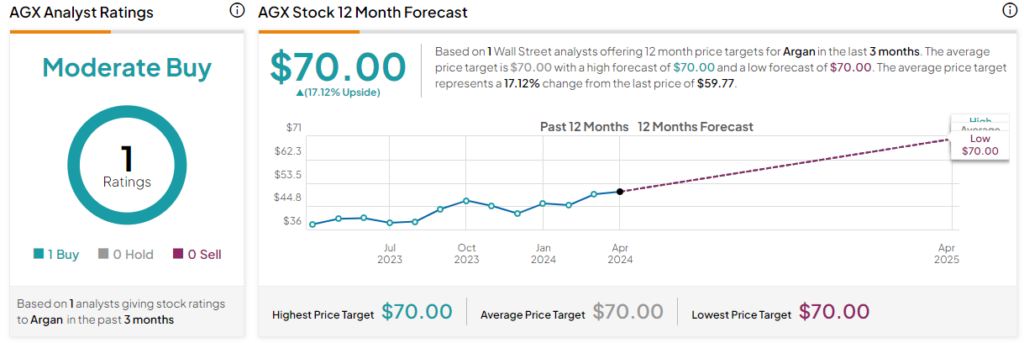

The company is thinly followed by Wall Street, though Lake Street analyst Robert Brown has been bullish on the stock. He recently raised the price target on Argan to $70 from $61, while placing a Buy rating on the shares. He cited the strength of Q4 results and an accelerating new project pipeline.

The stock is rated a Moderate Buy, and the price target for AGX stock of $70.00 represents a 17.12% upside from current levels.

Final Analysis on AGX

The increasing demand for energy production has placed Argan in an advantageous position. The company’s recent financial results and robust balance sheet demonstrate its financial health, while the upcoming project pipeline points to the potential for future growth. The stock could represent an opportunity for investors looking for positive price momentum and relative value.