Australia’s AMP disclosed on Monday that the conditional takeover offer by US alternative investment manager Ares Management has an implied value of A$1.85 per AMP share.

AMP shares are popping almost 10% to A$1.68 following the deal value news. Ares’ price offer translates into a 21% premium to AMP’s closing price on Oct. 30 and reflects an implied deal value of about A$6.36 billion ($4.5 billion). The wealth manager announced last week that it received an indicative, non-binding, conditional proposal from Ares Management (ARES) to acquire 100% of its shares by way of a scheme of arrangement.

AMP though noted that discussions on the buyout proposal were at a very preliminary stage and that there was no certainty that the transaction will be closed.

The offer comes after AMP stated in September that the group is reviewing its assets and businesses, assessing all opportunities, and “evaluating the relative merits as well as potential separation costs and dis-synergies, with a focus on maximising shareholder value”.

“AMP has received significant interest in its assets and businesses and is assessing a range of options in a considered and holistic manner, including continuing to pursue its three-year transformation strategy, with a focus on maximising shareholder value,” AMP said.

Earlier this month, Ares and Pretium announced a deal to snap up US rental homes owner Front Yard Residential for about $767 million.

Shares of the US private equity firm have lost almost 6% over the past 5 days but are still up more than 18% since the start of the year. (See ARES stock analysis on TipRanks)

Following Ares’ solid 3Q earnings released last week, Oppenheimer analyst Chris Kotowski still held on to a Hold rating on the stock.

“While in our view it is “all systems go” at ARES, the shares seem a little ahead of themselves based on our near-term valuation model,” Kotowski wrote in a note to investors. “For longer-term-oriented investors who are not so sensitive to near-term valuation metrics, we do view this as a high quality long-term growth company.”

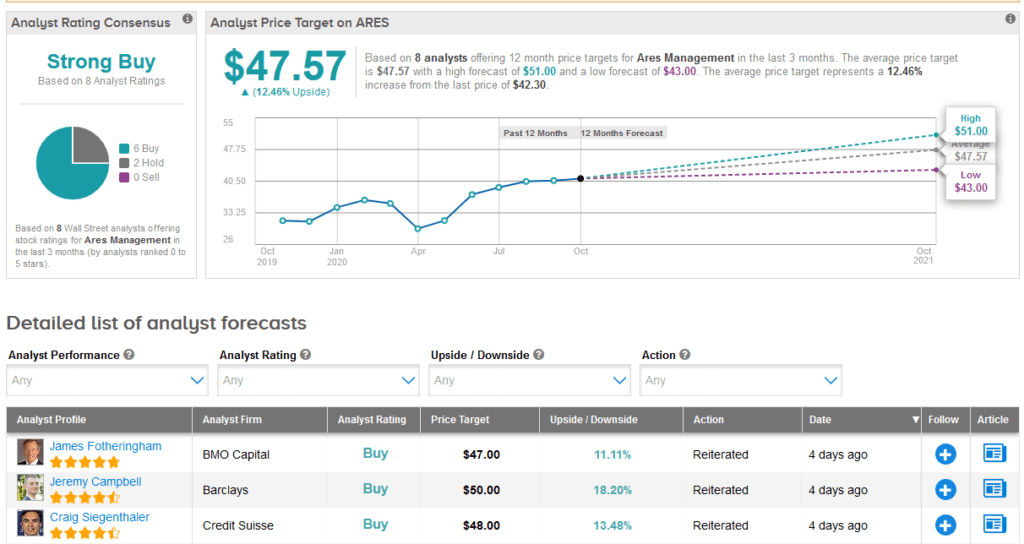

The rest of the Street has a bullish stance on the stock. The Strong Buy analyst consensus shows 6 Buys versus 2 Holds. That’s with a $47.57 average price target, indicating that 12% upside potential lies ahead.

Related News:

Carlyle To Buy Flender From Siemens In $2.4B Deal; Analyst Sees 65% Upside

Facebook Drops 6% on ‘Uncertain’ 2021 Warning; J.P. Morgan Raises PT

Under Armour’s 3Q EPS Top Estimates On Footwear Demand; Street Says Hold