American investor, hedge fund manager, and physician, Michael Burry, has deleted his Twitter (TWTR) account once again after gloating about his own success stories on the social media platform. Undoubtedly, Burry has earned loads of money for both himself and his clients by perfectly timing his predictions for the market.

The investor accurately predicted the 2008 financial catastrophe and is portending a similar fate for the economy today. After stating the worst in a couple of tweets since May this year, Burry has been consistently hinting at a major recessionary period ahead by charting market trends akin to the subprime mortgage crisis.

Burry has drawn all the conclusions from a fast-approaching ugly recession based on U.S. personal savings and Gross Domestic Product (GDP) trends, Consumer Price Index (CPI) figures, and U.S. labor force participation trends, as well as calling the mightiness of the “strong dollar” baseless. Year to date, the S&P 500 (SPX) is down around 23.3%, the Dow Jones (DJIA) is down 18.3%, and the NASDAQ 100 (NDX) is down 31.7%.

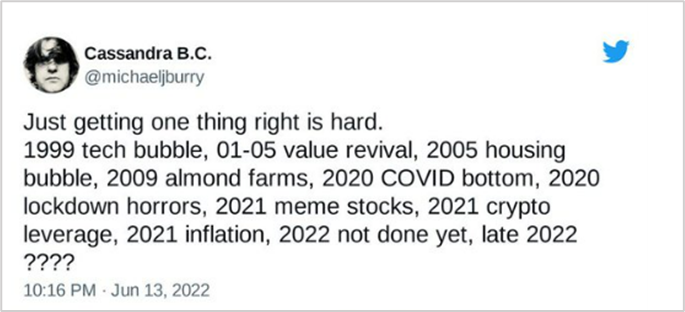

Shockingly, this time around, the short-seller does not have the faintest idea about what can be expected in late 2022, as he tweeted in his last post. It is typical for Burry to keep deleting his Twitter account and signing back in.

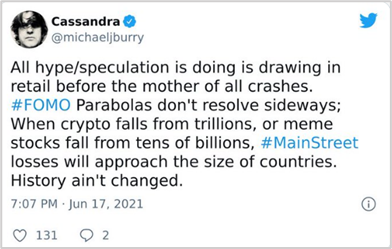

Burry believes that crypto/meme bots and pumpers inflate the stock prices of assets by replying to famous tweets. Hence, he deletes tweets to discourage them. “But it’s breathtaking, this religion of real and fake people. The speculation probably tops anything in history,” he quoted.

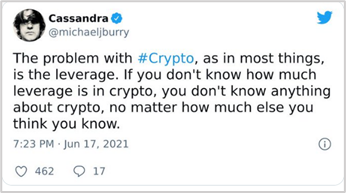

Notably, Burry had predicted the current record-high inflation back in April 2020 itself, when he had also projected the COVID-19 bottom. Moreover, the meme stock frenzy, which skyrocketed the prices of a few stocks and the crypto leverage, was also perfectly prophesied by the investor. “If you don’t know how much leverage is in crypto, you don’t know anything about crypto, no matter how much else you think you know,” he tweeted.

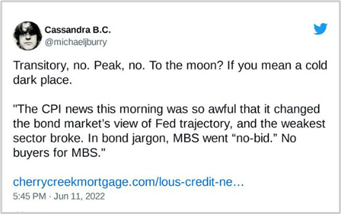

After last May’s CPI numbers, Burry tweeted, “Transitory, no. Peak, no. To the moon? If you mean a cold dark place.” As per Burry, inflation broke the weakest sector with “no buyers for MBS.” His hunch that the inflation of May is not yet at its peak has created profound fear among the masses, as they are already dealing with the reduced disposable income coupled with increasing gasoline prices and other everyday use items.

Regarding the crypto debacle, Burry predicted in June 2021, “When crypto falls from trillions, or meme stocks fall from tens of billions, #MainStreet losses will approach the size of countries. History ain’t changed.” Unsurprisingly, today, investors are bleeding due to both the crypto crash and the meme stock frenzy, as well as the disappointing performances from companies across all sectors.

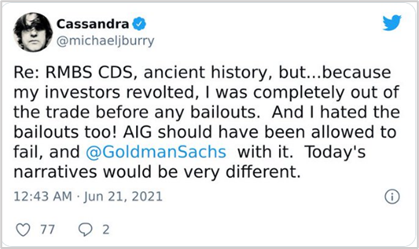

Burry has been particularly uncomfortable about the massive bailouts of insurance behemoth American International Group (AIG) during the 2008 crash. Although he had exited mortgage-backed securities (MBS) and other securities before the bailouts took place on the reluctance of investors, he believes AIG and other survivors should have been allowed to fail at the time. “Today’s narratives would have been very different,” he claimed back in June 2021.

Unarguably, Burry’s latest exit from Twitter has a tale to tell. His warnings for the rest of 2022 indicate an unfathomable pain that people are going to face. While he has deleted his account to prevent speculators from spreading hearsay and creating chaos, his premonitions should not be taken lightly.