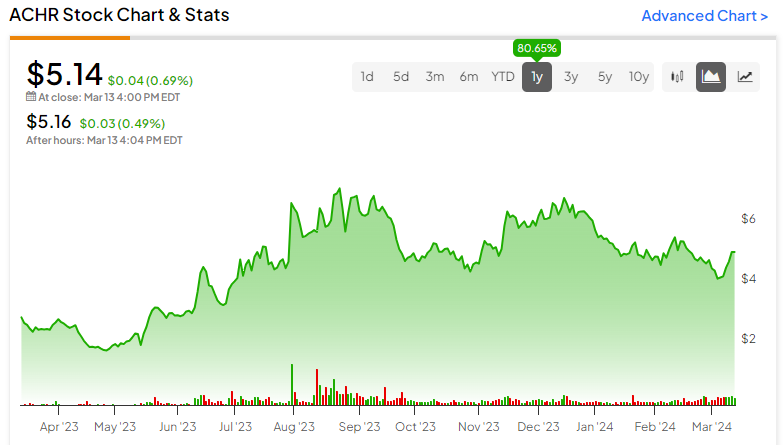

As the aerospace sector embarks on an exciting new chapter, testing and developing electric vertical takeoff and landing (eVTOL) aircraft for potential commercial use, Archer Aviation (NYSE:ACHR) has firmly planted itself at the forefront of the “flying car” revolution. The share price has been somewhat volatile, though it has enjoyed the attention of notable investors such as Cathie Wood’s Ark Invest, which has helped to power it up about 81% in the past year. With the company’s new technology on the precipice of launch and testing, the stock is a “lotto ticket” type of investment – no sure thing, but potentially substantial upside if it hits.

Up, Up, and Away

Archer Aviation is an aerospace company currently developing and testing eVTOL aircraft with the end goal of commercializing air taxi services. The first three of Archer’s highly anticipated Midnight aircraft line are in advanced stages of production.

Impressively, the company’s eVTOL aircraft recently concluded Phase 1 flight testing ahead of schedule, readying it for the next crucial stage of testing, which includes takeoff, landing, and active wingborne flight. After a successful Phase 3 testing, the goal is to map commercial routes. The company expects to complete 400 test flights this year.

In a significant move, Archer has joined forces with NASA to collaborate on advanced eVTOL technologies, particularly in battery cell performance and safety. Archer’s reach also extends to the international market, with Falcon Aviation from the UAE announced as Archer’s vertiport infrastructure partner for Dubai and Abu Dhabi. The company is also on track to complete the build-out of a volume manufacturing facility, alongside car-maker Stellantis (NYSE:STLA), in Georgia later this year.

Financial Outlook

Archer’s recent Q4 results delivered a mixed bag to stakeholders. The company continued to generate no revenue and reported a loss of $0.33 per share, which was beyond the analysts’ expectations of a loss of $0.31 per share.

However, the company maintains robust liquidity, with cash and cash equivalents amounting to around $625 million as Q4 ended. This cash position should be sufficient to see the company through next year’s testing and launch cycle.

Where the Stock Stands Now

ACHR shares have been on quite a ride since raising capital in a SPAC merger in 2021 when they were valued at $10 each. Since then, shares have ranged from a high of over $17 to trading just under $2.

Lately, ACHR stock has rebounded to over $5 per share, largely on the strength of sizeable investments by Stellantis (NYSE:STLA), which now holds more than 10% ownership in Archer, and Cathie Wood’s Ark Invest, which has been snapping up shares for several ARK ETFs (ARKK, ARKQ, and ARKX), and is now the top shareholder overall.

Valuation metrics for this kind of stock are ephemeral, as it trades based on investor sentiment or an analyst’s DCF model with revenues plugged in at some unknown point in the future (for which each has their estimates). However, on a Price-to-book basis, at 4.43x, the shares are relatively richly valued when compared to the Industrials sector (2.79x) and the Aerospace & Defense industry (3.88x) averages.

What is the Forecast for ACHR in 2024?

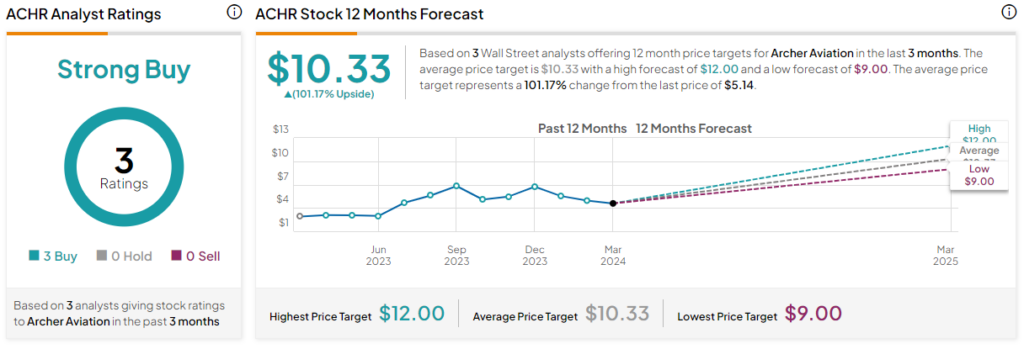

Analysts covering ACHR stock have been bullish, seeing significant upside potential for the shares.

ACHR is currently listed as a Strong Buy based on three unanimous Buys assigned in the past three months. The average ACHR price target of $10.33 represents an upside potential of 101.2% from current levels.

The Big Picture

Archer Aviation displays promise as a disruptive eVTOL player in the aerospace and defense industry. The company’s strong cash position and strategic partnerships with NASA and Falcon Aviation illustrate its potential for long-term growth. Furthermore, investments from high-profile stakeholders such as Cathie Wood’s Ark Invest and Stellantis demonstrate continued faith in the company’s vision and roadmap.

While there is a lot of hype and excitement around the idea of “flying cars,” investors are best served by keeping perspective and viewing the stock as a highly speculative “lotto-ticket” investment.