Archer Aviation (ACHR) makes electric air taxis that can take off and land vertically, also known as eVTOL. The company now stands at a pivotal juncture, caught between being a speculative bet for investors and becoming a global player in transportation. At this moment, Archer is in a two-way race with Joby Aviation (JOBY) to gain approval from the Federal Aviation Administration for the first commercial launch. While Joby is ahead in the process, Archer is working to close the gap with strong partners, new production capacity, and global launch plans.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Investor Acknowledges Archer’s Long-Term Expansion

Now, according to one top investor, Juxtaposed Ideas, Archer Aviation is well-positioned for growth but remains a Hold. His view is shaped by the gap in certification progress compared to Joby, the company’s heavy cash burn, and the ongoing risk of shareholder dilution. Although Archer is building key partnerships and preparing for commercialization, Juxtaposed Ideas sees the future returns as speculative at this stage.

At present, Archer trails Joby in FAA certification. Joby has cleared about half of Stage 4, while Archer is closer to 15%. Still, Archer has gained attention through deals such as its exclusive role as the official air taxi provider for the 2028 Olympics. The company is also preparing new landing sites in major cities. Additionally, Archer has completed a high-volume plant in the U.S., with Stellantis (STLA) serving as its contract manufacturer. This partnership is expected to raise annual production from 24 aircraft in 2025 to 650 aircraft by 2030. Therefore, while certification progress is slower than Joby’s, Juxtaposed notes that Archer is laying the groundwork for long-term expansion.

Cash, Burn, and Dilution

Juxtaposed Ideas highlights the company’s financial trade-off. Archer holds $1.72 billion in net cash, giving it flexibility to fund research and production. However, cash burn reached $704.4 million in the second quarter of 2025, up 45% from last year. Stock-based pay also grew, and the share count expanded by more than 70% year over year. These trends show why dilution is a key concern for investors.

Even so, the analyst notes that revenue is beginning to take shape. Archer has signed agreements in the United Arab Emirates that are expected to generate tens of millions of dollars over the next two years. Launch programs in Ethiopia and Indonesia could follow once certification is achieved. With that in mind, analyst consensus points to revenue of $416.04 million by 2027, which would ease concerns about today’s stretched valuation.

Cost and Profit Outlook

The investor also underlines the limits of Archer’s current business model. Each aircraft can carry four passengers and a pilot, but operating costs per trip may reach $1,400. That equals about $350 per passenger, compared to helicopter services at $195 and Joby’s expected target of $200 per passenger through Uber Technologies (UBER). This makes near-term profitability unlikely unless demand from premium users or defense clients expands.

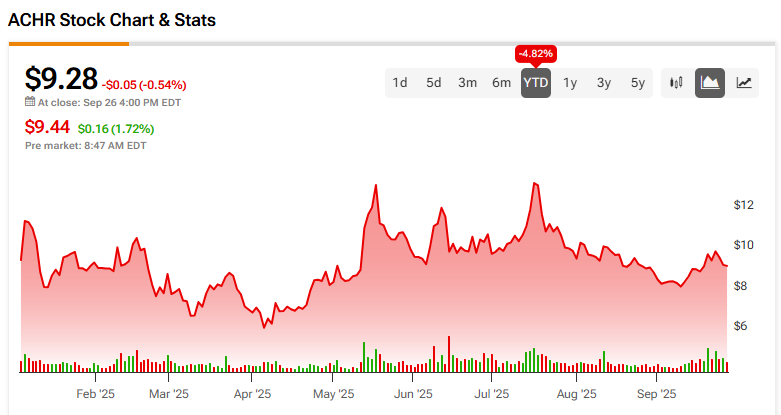

For now, Archer’s stock has surged more than 200% in the last year, boosted by investor optimism and policy support. Yet the analyst believes the key questions remain around when Archer can turn a profit and how much dilution will occur along the way.

In his view, Archer has cash strength, strong partners, and promising projects in motion. Even so, Juxtaposed Ideas concludes that the long-term return outlook is still speculative. Therefore, the stock is best viewed as a Hold.

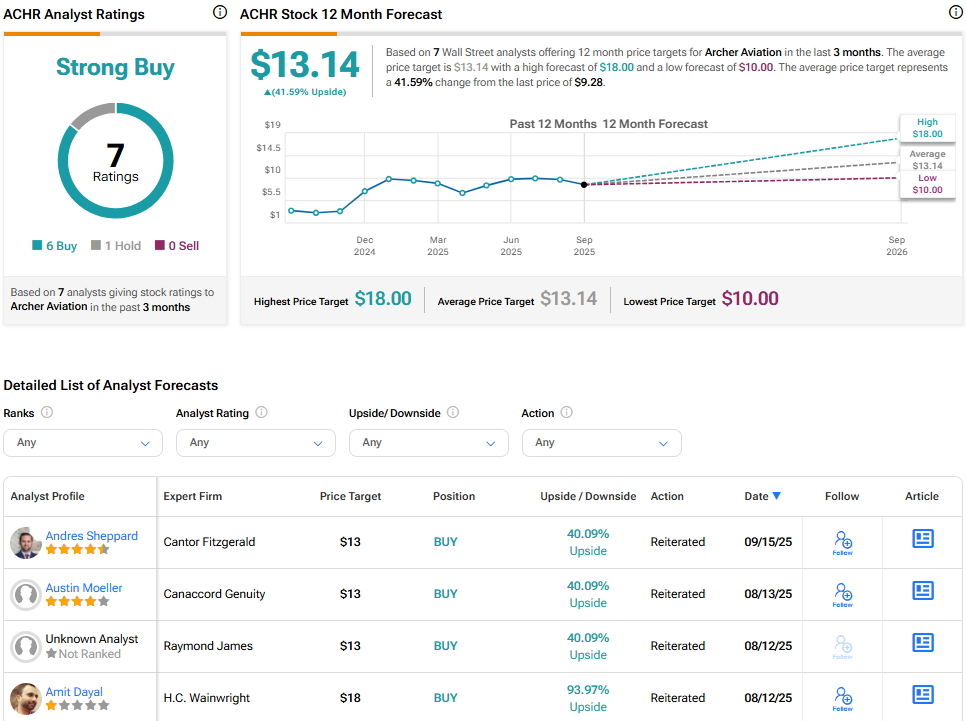

Is Archer Aviation Stock a Good Buy?

Despite the speculative nature of the eVTOL industry, Wall Street analysts remain optimistic about the company. Based on seven recent ratings, Archer Aviation boasts a “Strong Buy” consensus with an average 12-month price target of $13.14. This implies a 41.59% upside from the current price.