There’s nothing like a criminal investigation to take the wind out of a stock’s sails. Many investors really don’t like to have money parked in a company where the law gets involved. And despite an impressive earnings report, chip stock Applied Materials (NASDAQ:AMAT) dove over 5% in Friday morning’s trading thanks to an unfortunate combination of a criminal investigation and a decent earnings report.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Analysts came out in droves to discuss the situation, starting off with Vivek Arya and the team from Bank of America. Arya noted that Applied Materials is still worth its Buy rating but that criminal investigation is likely to spark up “near-term uncertainty,” which is absolutely true. With no one knowing whether Applied Materials will face fines, how much those will be, or potentially worse, “near-term uncertainty” might be the best way to describe Applied Materials’ situation right now. Meanwhile, analysts also suggested that wafer fab equipment—what goes into making chips—should continue to be strong going into 2024.

Applied Materials Sent Equipment to China without Export License

Of course, the elephant in the room for Applied Materials remains that criminal investigation. Reports note that it’s connected to some sales the company made to China. The U.S. Department of Justice alleges that Applied Materials sent “…equipment worth hundreds of millions of dollars to Chinese chipmaker SMIC without export licenses.” And given that Chinese sales account for about 44% of Applied Materials’ overall sales, there’s certainly a reason to engage in such behavior.

Indeed, reports from Applied Materials revealed that Chinese sales could remain “elevated” for some time, thanks in large part to several shipments to a customer looking for computer memory. But, thanks in part to the new export rules, China may only account for about 30% of Applied Materials’ sales.

Is Applied Materials Stock a Good Buy?

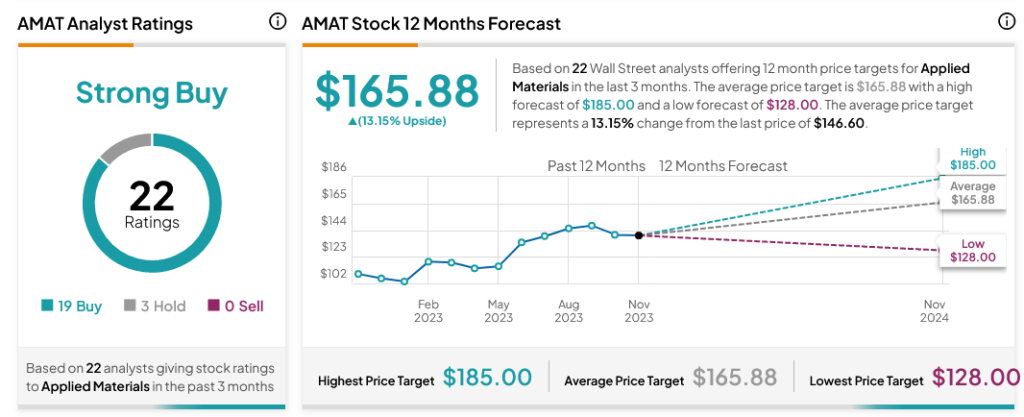

Turning to Wall Street, analysts have a Strong Buy consensus rating on AMAT stock based on 19 Buys and three Holds assigned in the past three months, as indicated by the graphic below. After a 41.78% rally in its share price over the past year, the average AMAT price target of $165.88 per share implies 13.15% upside potential.