Apple (NASDAQ:AAPL) remained on an upward trajectory on Friday following its robust Fiscal Q2 results and a substantial stock buyback of $110 billion. This trend persisted despite a dip in the company’s iPhone sales during the second quarter. The tech giant’s earnings surpassed analysts’ consensus estimate of $1.50 per share, with earnings per share of $1.53. Although AAPL’s sales experienced a 4.3% year-over-year decline to $90.8 billion, it exceeded analysts’ expectations of $90.4 billion.

AAPL’s Declining iPhone Sales

Interestingly, in the second quarter, AAPL saw a 10% year-over-year decline in iPhone sales, amounting to $45.96 billion. It’s worth noting that sales of iPhones contribute approximately 50% of the company’s revenues.

However, investors didn’t seem to mind. They were focusing instead on the company’s gross margin, which expanded to 46.6% in Q2. Additionally, Apple’s revenue from its services business reached $23.87 billion, marking a 14.2% year-over-year increase. Apple’s services business includes its App Store, Apple Pay, and subscription services like Apple TV+ and Apple Music.

Wedbush Analyst Remains Bullish on AAPL

Following the company’s earnings, four-star-rated analyst Daniel Ives remained bullish and reiterated a Buy rating with a price target of $250 on the stock. The analyst stated that the iPhone maker delivered a better-than-expected second quarter, with its iPhone sales aligning with estimates.

Ives added that the June guidance highlighted revenue growth in the low single digits, defying Street expectations of a decline in revenues. Moreover, the analyst commented that this revenue growth seemed to be driven by improving iPhone demand in China and strong performance in Services—a key “bedrock of growth” for Apple.

Is Apple a Buy, Sell, or Hold?

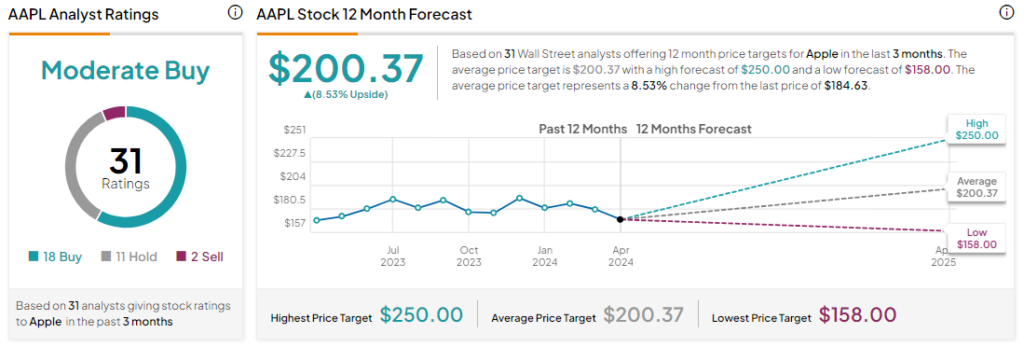

Analysts remain cautiously optimistic about AAPL stock, with a Moderate Buy consensus rating based on 18 Buys, 11 Holds, and two Sells. Over the past year, AAPL has increased by more than 10%, and the average AAPL price target of $200.37 implies an upside potential of 8.5% from current levels.