Looks like there won’t be an Apple (NASDAQ:AAPL) Car after all. The undertaking, titled Project Titan, has been in development for about a decade, with the tech giant aiming to get a piece of the emerging EV market, but now Apple has decided to stop investing in the endeavor.

Wedbush’s Dan Ives, a 5-star analyst rated in the top 5% of the Street’s stock pros, thinks it’s a bit of a shame an Apple Car won’t be a reality after all. Yet, the change of heart allows it to really go after an altogether different opportunity.

“On one hand this is a modest disappointment as the view within Cupertino was that with roughly 2k employees on this initiative, an Apple Car was still on the medium term horizon,” Ives said. “On the other hand, the laser focus within Apple is ramping up and executing a broad AI strategy within the Apple ecosystem as it appears the vast majority of these engineers and developers will now focus their efforts on AI.”

The employees in Apple’s Special Products Group (SPG) working on Project Titan, will now move over to the artificial intelligence division, to turn their full attention to generative AI projects, a shift Ives says is “clearly the right move for Cook & Co. moving forward.” Ives also anticipates some layoffs as part of the project’s demise.

Ives thinks the project’s closure represents a “black eye” for the highly competitive and evolving EV space, one that has struggled with weakening demand recently. It also amounts to a bit of an “indirect nod” to Tesla, with Apple probably realizing how difficult it would be to compete with the EV leader’s “stronghold grip” on the EV market with more competition also coming out of China.

The AI opportunity, however, remains a big one. The recently released Vision Pro, Apple’s mixed-reality headset, represents Apple’s first serious foray into the AI game, and Ives anticipates generative AI will be introduced to the upcoming iPhone 16, in what will amount to the start of a “new frontier of growth” for the company. “We believe taking these Project Titan engineers and developers with all efforts on AI could further accelerate Apple’s AI initiatives over the next 12 to 18 months,” the top analyst summed up.

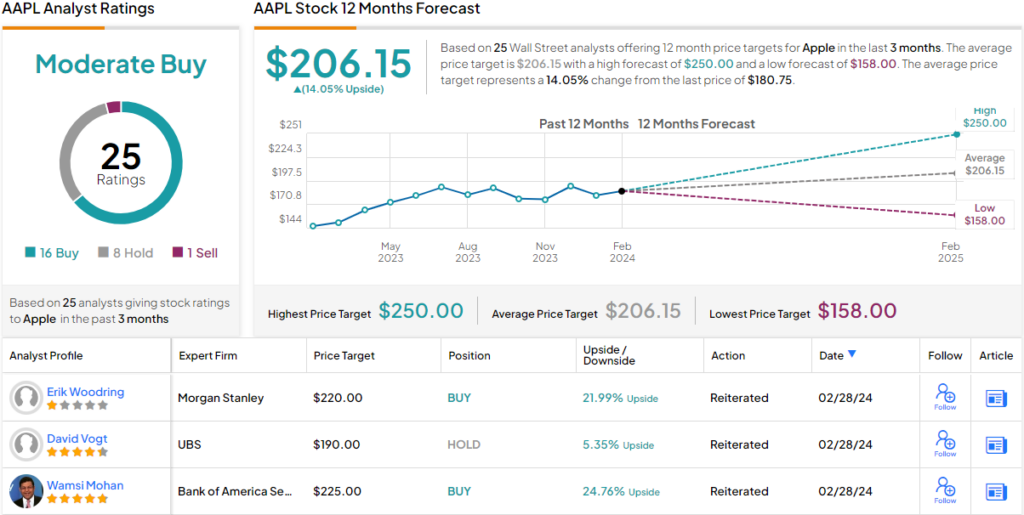

All told, Ives maintained an Outperform (i.e., Buy) rating on Apple shares to go along with a Street-high $250 price target, implying the stock will climb 38% higher in the year ahead. (To watch Ives’ track record, click here)

Ives is the Street’s biggest AAPL bull amongst 16 positive reviews and with the addition of 8 Holds and 1 Sell, Apple stock claims a Moderate Buy consensus rating. The forecast calls for one-year returns of 13%, considering the average target clocks in at $206.15. (See Apple stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.