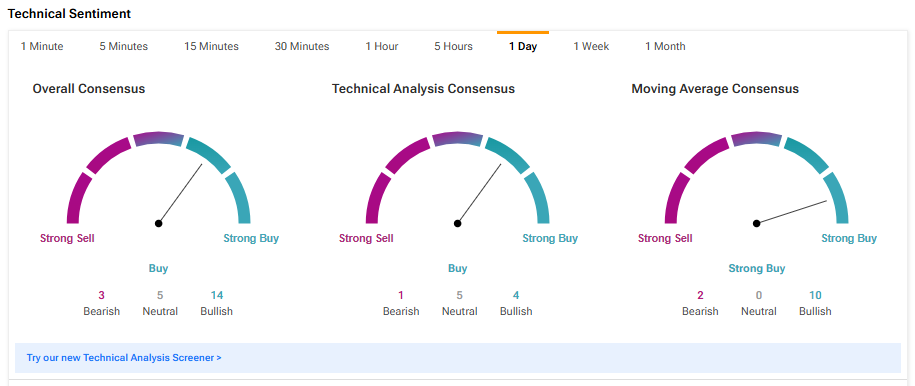

With a market cap of $2.80 trillion, tech giant Apple (AAPL) is the second largest company in the U.S. The company’s diverse technology products, strong focus on product innovation, and customer loyalty keep AAPL well-poised to maintain its position as a market leader. Importantly, AAPL stock has gained more than 23% over the past year. Despite its impressive gains, technical indicators suggest that Apple stock is a Buy, implying further upside from current levels.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Analyzing AAPL’s Technical Indicators

According to TipRanks’ easy-to-understand technical analysis tool, AAPL stock is currently on an upward trend. The Moving Averages Convergence Divergence (MACD) indicator, a crucial tool for understanding momentum and potential price direction shifts, is currently signaling a Buy.

AMZN’s 50-day EMA (exponential moving average) is 226.22, while its price is $226.96, implying a bullish signal.

Another technical indicator, Williams %R, helps traders determine if a stock is overbought or oversold. In the case of Apple, the Williams %R is currently indicating a buy signal, suggesting that the stock is not overbought and has more room to run.

What Is the Price Target for AAPL?

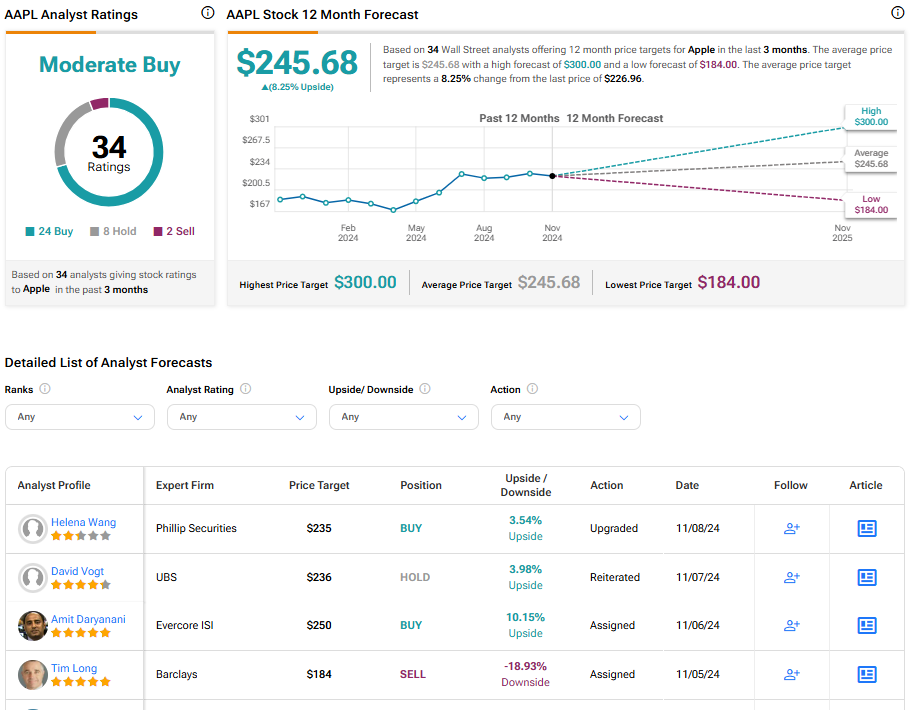

Turning to Wall Street, AAPL has a Moderate Buy consensus rating based on 24 Buys, eight Holds, and two Sells assigned in the last three months. At $245.68, the average Apple price target implies an 8.25% upside potential.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue