U.S. tech giant Apple (AAPL) is facing a ‘mountain of worry’ as demand for its iconic iPhone dials down.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Sales Dip

In a note from analyst Brian White of MCH Internet & Software, ahead of Apple’s Q3 earnings next week, he forecasts a downshift in iPhone and Services. He believes that iPhone revenue growth will marginally dip back into negative territory in the quarter with a 0.4% year-over-year decline to $39.16 billion.

Its shares slipped in early trading.

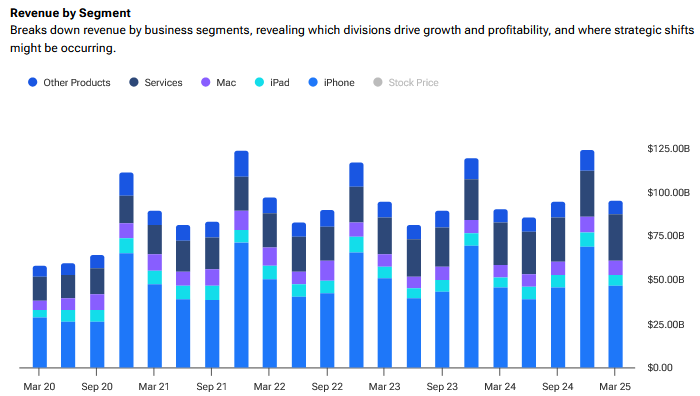

For iPad, he is expecting third quarter sales of $7.31 billion, marking 2% year-over-year growth. However, this would be a deceleration from the 15% increase recorded in the second quarter this year. He is also projecting third quarter Wearables, Home & Accessories revenue of $7.20 billion, down 11% year-over-year.

As can be seen below, the iPhone remains a key revenue builder for Apple.

“Apple is facing a mountain of worry ahead of a new iPhone cycle,” said White, who has a Buy rating and $245 target price on the stock.

“We expect Apple to host its traditional September event with the iPhone 17 family in the spotlight. In our view, Apple is innovating with industry-leading products supported by a powerful digital grid and embarking on a gen AI journey with Apple Intelligence,” he said. “However, regulatory headwinds persist, the implications of this trade war are unclear, geopolitical risks continue, and the macro is treacherous.”

Apple Resilience

Despite this uncertainty, however, overall White expects Apple to meet its third quarter revenue estimates of $88.55 billion and its EPS forecast of $1.44.

Indeed, Apple has faced a number of headwinds already this year from President Trump’s tariffs hitting supply and prices, market share challenges in China where it is facing competition from domestic rivals such as Huawei, and heightened regulatory scrutiny around its App Store and other areas of its business both in the U.S. and Europe.

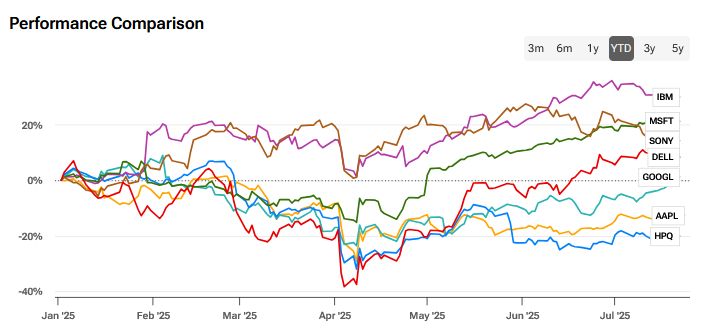

As a result, its share price has compared unfavorably with many of its U.S. rivals.

Is AAPL a Good Stock to Buy Now?

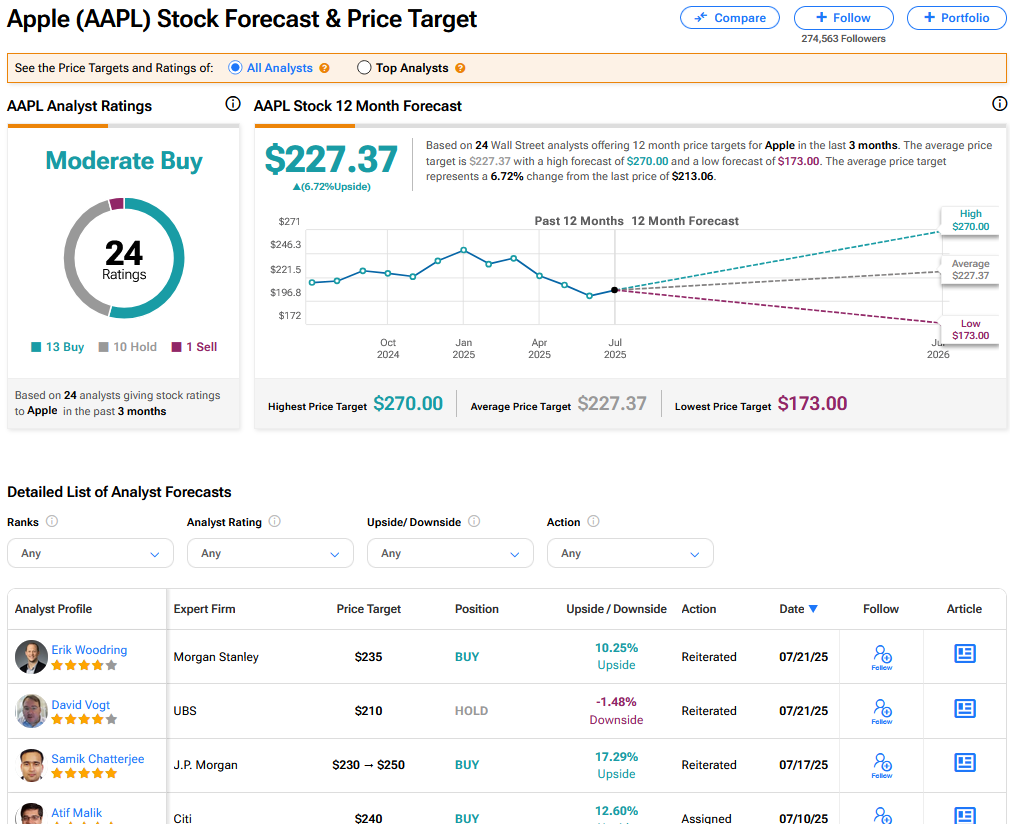

On TipRanks, AAPL has a Moderate Buy consensus based on 13 Buy, 10 Hold and 1 Sell ratings. Its highest price target is $270. AAPL stock’s consensus price target is $227.37, implying a 6.71% upside.