U.S. tech giant Apple (AAPL) has taken the fight to the European Union, blaming “Brussels bureaucrats” for denying customers its innovative technology.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Ecosystem Challenge

Apple said EU regulators were unfairly challenging its closed ecosystem and preventing Europeans from fully enjoying the “magical, innovative experience” which makes the company unique.

“We have a serious threat to that in Europe,” executive Greg Joswiak said, as reported by the BBC.

The Apple ecosystem has been referred to as a walled garden which combines both the company’s products and software and, it claims, ensures a safe and high-quality experience for users.

However, EU regulators are keen to get their hands on the keys of that walled garden because they believe it unfairly shuts out rivals.

The EU slapped a $586 million fine on Apple in April accusing it of anti-competitive behavior on its App Store.

Apple was fined under the EU’s Digital Markets Act, a 2022 law designed to help smaller businesses compete with big tech companies and boost competition in the digital market. Breaking this law can lead to fines of up to 10% of a company’s yearly global income.

U.S. Threat

In Apple’s case, the DMA requires it in part to ensure that devices, such as headphones, made by other brands will work with iPhones.

The DMA also requires that Apple allow notifications to show up on third-party smartwatches and not just the Apple Watch – and to let other platforms send and accept content to and from an Apple device via AirDrop.

The European Commission, the EU’s executive body, last week published a decision rejecting Apple’s bid to scrap most of the order requiring Apple to make its iPhone work with other devices.

Other U.S. tech firms in the crosshairs of the EU include Alphabet (GOOGL)-owned Google which was handed a $3.5 billion fine early this month. The EU said Google had unfairly favored its own adtech services, particularly its ad exchange platform AdX.

Last week Google was defiant declaring that it would not break up its advertising business despite requests from the EU and its rivals.

These actions have also irked President Trump who has threatened to impose tariffs and export restrictions on any country whose taxes, legislation and regulations target U.S. big tech.

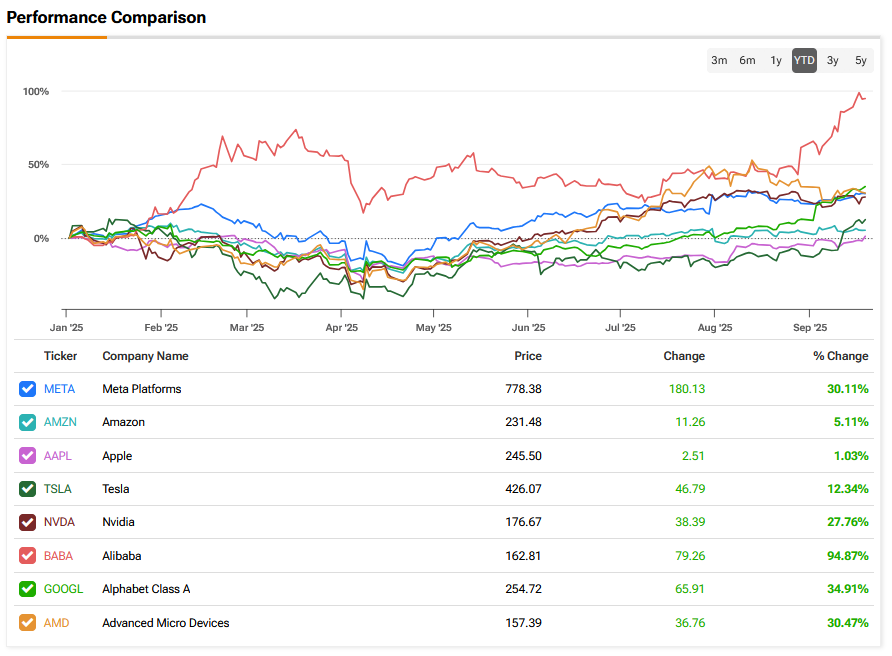

Despite this, big tech share prices have continued to have a strong year – see above – showing the underlying demand for their products and services remains strong.

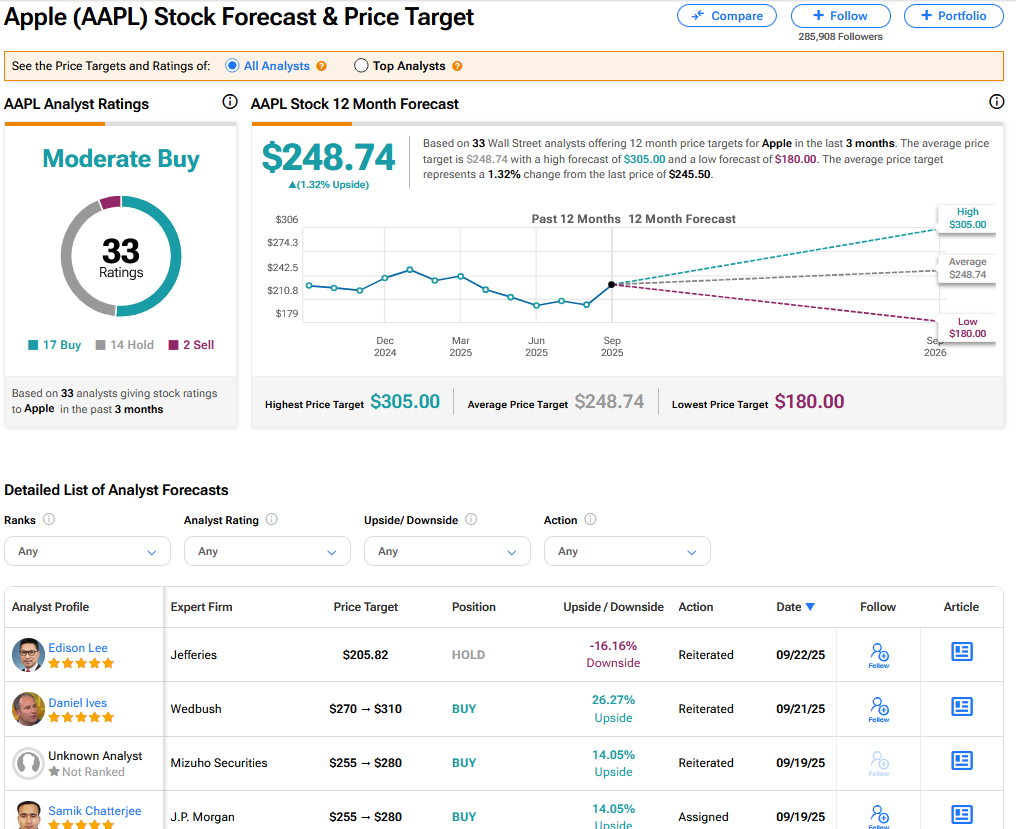

Is AAPL a Good Stock to Buy Now?

On TipRanks, AAPL has a Moderate Buy consensus based on 17 Buy, 14 Hold and 2 Sell ratings. Its highest price target is $305. AAPL stock’s consensus price target is $248.74, implying a 1.32% upside.