There are some positions that every investor needs to include in their portfolio for success, such as stocks with a proven track record of long-term performance and solid returns. These are the blue-chip stocks, of course, a combination of old names and headline-grabbing growth shares that are sometimes seen as a bit dull – but also reliable.

The blue-chips bring reputations for dependability, for weathering any set of market conditions, and for generating steady gains. So it’s fair to say that every portfolio should hold these positions at its core.

The stock analysts at Bank of America would agree – and they’ve been looking under the hood at two big-name blue-chips – Apple (NASDAQ:AAPL) and Microsoft (NASDAQ:MSFT) – to discern which one presents greater potential in the current landscape. While bullish on both, the bank’s analysts have taken a clear stance on which one has more room to run. Let’s take a closer look.

Apple

First up on today’s list of Bank of America picks is Apple, the iconic tech company whose logo has become one of the world’s most recognizable brands. The company’s winning combination of solid product offers and smart marketing made it Wall Street’s first trillion-dollar company, and then Wall Street’s first two-trillion-dollar company, and it even touched above a $3 trillion market cap before slipping back to its current valuation of $2.93 trillion and its place as the second-largest publicly traded firm on Wall Street.

In recent years, Apple’s obvious strengths have faced a set of growing headwinds. There was a perception that the company had grown too dependent on its iPhone lines as a revenue driver, and that the company was leaning too heavily on the Chinese market for sales. These perceptions were at least partially offset by the underlying advantage of Apple’s business model: its products and software are self-contained, and are not compatible with other operating systems. This has the effect of ‘locking in’ Apple’s customer base, which earlier this year was estimated at 2 billion, or approximately one-quarter of the global population.

Sheer size is not the only advantage to be gained here; as new technologies and products hit the market – such as AI, online services, wearable devices – Apple’s customers will need to upgrade, and they will upgrade to newer Apple products. The overall model bodes well for Apple’s continued strong performance.

More than that, however, Apple is delivering results. The company’s most recent financial report, which covered fiscal 2Q24, showed this clearly.

Start with the headline numbers – the company brought in $90.8 billion in revenue during fiscal Q2. While this was down 4.3% year-over-year, it beat the forecast by $190 million. At the same time, the bottom line earnings, reported as an EPS of $1.53, came in 3 cents per share above the forecast.

Those numbers were considered solid, but what really interested investors came in some of the drill downs. iPhone revenue was reported at $45.9 billion, or just over half the total, compared to 54% in the prior-year quarter. At the same time, Apple China revenues fell y/y from $17.8 billion to $16.3 billion. The company reported a strong gain in Services revenue, from $20.9 billion to a record-level $23.9 billion, making the Services segment responsible for just over 26% of Apple’s total revenue. Apple finished fiscal Q2 with $32.7 billion in cash and cash equivalents, plus another $34.4 billion in marketable securities, giving the company a solid set of liquid assets as a potential cushion.

Of note to return-minded investors, in the 2Q24 report Apple’s Board authorized an increase to its share repurchase program of $110 billion, along with an expected annual increase in the common share dividend to 25 cents. These announcements mark Apple’s continued commitment to supporting its share value and returning capital to stockholders.

All of this, and more, forms a core to Bank of America’s view of Apple, ably set forth by 5-star analyst Wamsi Mohan in his recent note on the stock.

“The thesis for our upgrade to Buy earlier this year is playing out with: (1) strong multi-year iPhone upgrade cycle coming driven by GenAI (mgmt. commentary on earnings call very bullish), (2) Services growth reaccelerating (11% in Dec to 14% in March), (3) emphasis on Apple silicon across iPhone, Mac, Servers (CEO Cook mentioned R&D $100bn over last 5 years), (4) continued strong capital returns ($110bn buyback announced), (5) upside to GMs (Services was 74.6%) and (6) incentive for institutional clients to increase positions in anticipation of AI features,” Mohan noted.

Mohan gives AAPL shares a Buy rating, along with a price target of $230, implying a one-year upside potential of ~20%. (To watch Mohan’s track record, click here)

The Bank of America view is decidedly more bullish than the overall Street take on AAPL. The stock has a Moderate Buy consensus rating, based on 33 recent reviews that include 21 to Buy, 11 to Hold, and 1 to Sell. The shares are trading for $190.90 currently, and the average price target of $203.93 suggests an increase of ~7% in the next 12 months. (See Apple stock forecast)

Microsoft

The second stock we’ll look at is one of Apple’s peers at the top of the tech pyramid. Microsoft is another venerable name in the tech world; it was founded back in 1975 and today, like Apple, its success in tech has made Microsoft one of the world’s best-known brands. Microsoft has grown in its five decades of business to become Wall Street’s largest public firm, with a market cap value of $3.2 trillion.

Also like Apple, Microsoft has fueled its own success through its prowess as a technology innovator. AI is the shiny new thing in tech these days, and Microsoft was an early backer and adopter. The company has made several investments, totaling $10 billion, in OpenAI – the firm that brought us ChatGPT and generative AI tech. Microsoft has benefited directly from that investment, through access to new AI developments.

Microsoft’s customers will likely have noticed this already. The company’s recent upgrades to Windows and Office included the new Copilot feature, an AI-powered online assistant, and the company’s Bing search engine is also incorporating AI technology in an effort to improve its interface and search results to better compete with Google.

Finally, of greatest note, Microsoft has been incorporating AI into its subscription-based cloud computing platform, Azure. Azure is a direct competitor with both Amazon and Google, who offer their own cloud platforms, and AI promises to make Azure stronger, adding a new portfolio to its existing array of more than 200 apps and tools.

Azure’s strength is clear from its contribution to Microsoft’s last earnings report. The release, for fiscal 3Q24, showed that the company’s Intelligent Cloud – the segment which includes Azure – generated $26.7 billion in revenue. This was 43% of the Q3 total, and was up 21% year-over-year. Microsoft’s overall quarterly revenue was up 17% from the prior year and beat the forecast by $1 billion to come in at just under $62 billion total. The computing giant saw bottom line earnings of $2.94 per share, 11 cents better than the estimates and up 20% year-over-year.

So Microsoft is posting solid growth numbers, firmly rooted in AI and cloud computing. Bradley Sills, covering the stock for Bank of America, notes this, and runs with the thesis, saying, “Microsoft’s native AI offerings (such as Azure AI or OpenAI services) continued to drive incremental growth in Q3. Coupled with OpenAI consumption strength, Azure is the only software business that is benefitting from AI at this point in the cycle. This validates our view that Microsoft remains ahead of the curve in this massive new cycle. Guidance for Q4 Azure growth of 30% to 31% suggests continued acceleration is likely into FY25.”

Sills goes on to explain just how far the cloud will drive Microsoft, writing of the company’s prospects, “We believe Azure strength is enough to drive total revenue growth higher for now (we raise our FY25E total revenue estimate by $1.4 billion). The preliminary outlook for FY25E margin to decline 100 basis points is a surprise, prompted by the recently elevated capex. However, cloud investments backing this are justified, given the massive AI opportunity ahead (IDC estimates the AI industry to reach $151 billion by 2027).”

The analyst quantifies his stance on MSFT with a Buy rating and a $480 price target that points toward a 12-month gain of 11.5% for the stock. (To watch Sills’ track record, click here)

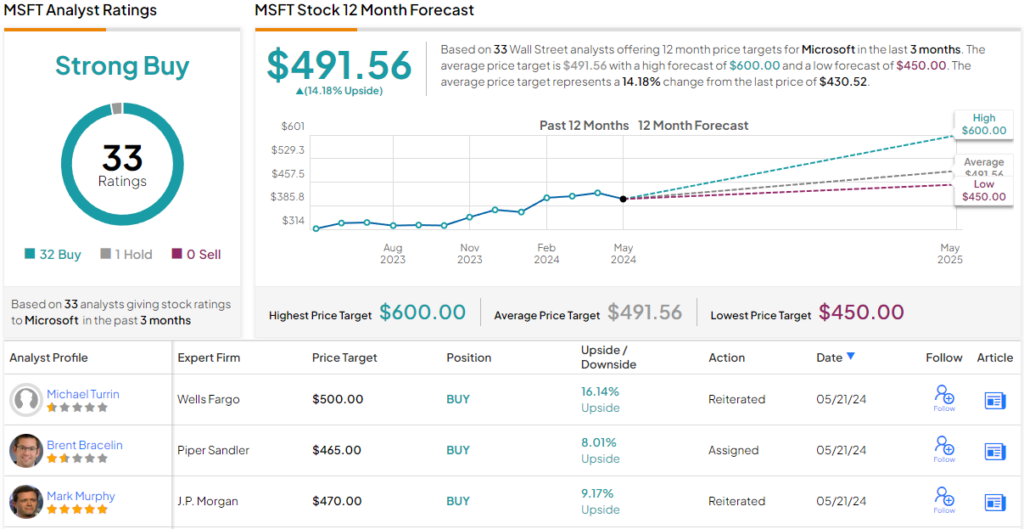

Sills’ stance is more or less in line with the bigger picture from the Street. Microsoft has 33 recent recommendations, including 32 Buys to just 1 Hold, for a Strong Buy consensus rating, while the stock’s $491.56 average price target suggests a ~14% gain from the current share price of $430.52. (See MSFT stock forecast)

Taking a look at the data and the stock reviews makes it clear: Bank of America likes both Apple and Microsoft. But when it comes to potential upside, Apple’s got the edge.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.