Don’t write off Apple (NASDAQ:AAPL) stock just because it’s lagging the pack so far this year. Though shares are struggling to recover after recently correcting to around $170 per share (a drawdown of nearly 15%) due to a wide range of perceived negatives (analyst downgrades, a lack of AI news, EU regulatory woes, soft iPhone sales in China, and the list goes on), there may be a compelling catalyst from WWDC 2024—this year’s edition of Apple’s annual developer conference—that can come to the rescue.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The developer events tend to hit in June, and this year’s is likely to include a glimpse of iOS 18, an update that could be chock-full of new AI features, updates, and maybe even a few surprises.

Big-name analyst Mark Gurman boldly stated that iOS 18 could be the “biggest” in iPhone history, something I remarked on briefly in my prior AAPL piece. I agree with Gurman and am inclined to stay bullish on the stock, even as recent negative momentum in shares of AAPL builds on themselves over the coming weeks.

Not only could the next major iOS update represent the most significant leap in the device’s history, but we could be entering an era where software features become a bigger deal than hardware ones as Apple looks to find the right time to flex its very strong AI muscles at the big crowds in Cupertino.

Why WWDC 2024 Could Keep Fans on the “Edge” of Their Seats

Back in January, Erik Woodring of Morgan Stanley (NYSE:MS) noted that Apple was equipped to capitalize on the “Edge AI” opportunity that “increased the likelihood of an ‘AI Phone’ launch as soon as Fall 2024.” Indeed, Woodring’s upbeat comments seem to have been forgotten by investors who’ve been hitting the sell button on the stock lately.

Few firms can make their hardware and software play together so gracefully. To have better control over the user experience, a firm must innovate on both fronts to ensure maximum efficiency and the most seamless experience possible. With a tight grip on hardware and software, the company looks best equipped of any company to deliver the absolute best on-device (or “edge”) AI experience in the market, at least in my opinion.

The latest iPhone (the 15 Pro) appears to look quite similar to last year’s model, and the 16 is likely not to look drastically different from this year’s. However, it’s what’s on the inside that counts.

Many of us will begin to realize this once AI plays a more prominent role in powering our devices. With that, it’s my belief that the inner workings of the Neural Engine (Apple’s neural processing unit) and how it helps power on-device models are sure to receive more attention at future iPhone keynotes.

As you’re probably now aware, running language models on a device requires some pretty powerful hardware (think AI-grade GPUs). Power consumption is also a potential concern for running advanced AI models on one’s device rather than in the cloud in a remote data center. Indeed, a model needs to play well with the hardware and be optimized enough not to be so power-hungry that it drains one’s battery after just a few tasks.

Given that Apple Silicon (the M- and A-series chips) has made some profound advancements in power efficiency in recent years, I would certainly not be surprised if Mr. Woodring is right and Apple is close to running a powerful AI model natively on the device without being a power sink.

In this regard, Apple may be very difficult to top if it is, in fact, creating an advanced language model optimized to run on its custom-designed mobile hardware. Either way, WWDC 2024, or perhaps an iPhone keynote later this year (Fall 2024, when Woodring sees iPhone 16 launching), stands to keep investors and iPhone fanatics on the edge of their seats.

Why Apple’s Lack of LLM Is a Good Thing

Undoubtedly, investors hope that the coming WWDC unveils generative artificial intelligence (AI) innovations, perhaps enough to get even more analysts to view the name as more of an AI stock than one sitting out the early innings of this AI boom. Even if the event is light on AI, I’m not in the least bit concerned. Why? Apple isn’t a firm that’s forced into decisions just because something is “hot” in the tech community.

Remember, it “thinks differently” than most other firms. Even if it can’t release innovations faster, it can release them better. In my opinion, being better trumps being faster in most circumstances.

CEO Tim Cook is running Apple for the long term. Given the setbacks we’ve witnessed other companies make over the past year, I’d argue it’s better to be watching from the sidelines than to have a product contributing to the pile of shortcomings.

Google, a subsidiary of Alphabet (NASDAQ:GOOGL)(NASDAQ:GOOG), has seemed to make more than its fair share of AI mishaps with Gemini. Though I still view Google as one of the best AI players and a firm that intends to learn from its mistakes, Apple stands out as a company that learns from the mistakes of others, including Google.

Personally, I’d much rather own shares of a company in the latter camp, even if it means pushing much of the AI upside into the future. If you’re a long-term investor, it’s better to have AI upside pushed out and have a firm ensure its offering is perfect (or close to it) before releasing it to the public — a public that’s sure to put an AI’s guardrails to the test.

As Apple observes the AI scene and slowly, steadily, and carefully makes its move (or lack thereof) behind the scenes, I believe the company will be able to make the most of the opportunity at hand.

Apple is seldom the first or even second to any new product category. It’s not in the business of being a first-mover. In fact, it never has been. It’s in the business of doing things better, far better than the rest. For that reason, it’s a mistake to view Apple’s relative AI silence as a disadvantage. Silence in a noisy environment is actually a powerful advantage. But it’s one that only long-term AAPL shareholders stand to benefit from, in my opinion.

Is AAPL Stock a Buy, According to Analysts?

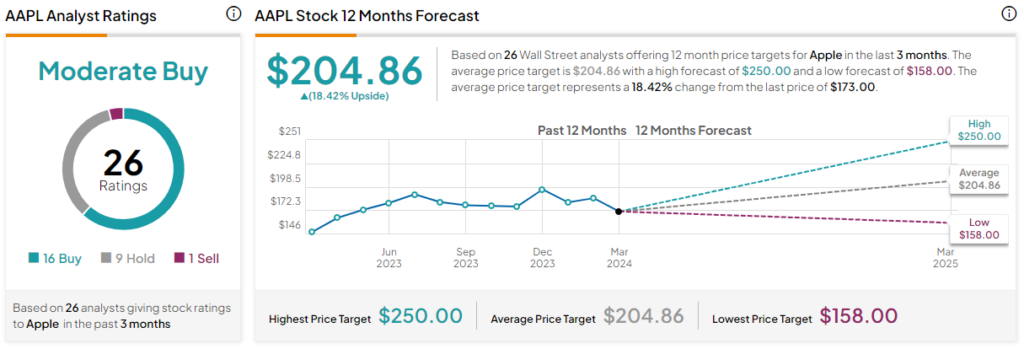

On TipRanks, AAPL stock comes in as a Moderate Buy. Out of 26 analyst ratings, there are 16 Buys, nine Holds, and one Sell recommendation. The average AAPL stock price target is $204.86, implying upside potential of 18.4%. Analyst price targets range from a low of $158.00 per share to a high of $250.00 per share.

The Bottom Line on Apple Stock

Given the magnitude of what could be ahead, I find it a mystery as to why Apple stock is stuck in a correction right now. Perhaps investors lack patience when there are so many intriguing AI stocks on the market that aren’t in correction territory.

At this pace, I’ll be unsurprised if Apple stock barely budges higher, even on big up days for the Nasdaq 100 (NDX) and the broader market.

Only time will tell whether WWDC 2024 or the next iPhone reveal raises the needle. In any case, I’d much rather hold onto shares for the long haul and put my trust in Tim Cook and his team. When the time is right, they will move. Otherwise, they will simply wait until the real opportunity comes knocking.