Apple (NASDAQ:AAPL) stock has been really struggling to break through to a new all-time high. Undoubtedly, Apple seems to have been outshined by its peers in the Magnificent Seven, but there exist catalysts that could help power a much-awaited rally, perhaps to the Street-high price target of $250 per share.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Indeed, Apple stock seems to be quite the battleground between the bulls and the bears, especially lately. The bears would point to weak growth and stagnation in iPhone demand in the Chinese market. Meanwhile, the bulls have a strong argument that the high-margin Services segment continues to swell and that looming products could easily drive growth rates much higher.

Personally, I’m siding with the bull camp. Though bearish arguments are quite sound, I do believe they’re too backward-looking. Sure, the iPhone 15 Pro Max could have had much better sales had the Chinese economy not been in a massive slump. And the recent drama revolving around Apple Watches being pulled from shelves has taken a subtle jab to the wearables segment.

Apple Vision Pro Will be a Bigger Deal in the Future

Though the recent quarter wasn’t bad, it certainly left much to be desired. Nonetheless, with the Vision Pro selling quite reasonably well, look for the new spatial computing device to become a bigger part of the Apple revenue pie each and every year.

Though the Vision Pro probably won’t surpass iPhone sales in the next three to five years, I think it could give the Mac segment a good run for its money. This is especially true if Apple’s innovators can reduce the size and power requirements of the device (a smaller form factor with no detached battery would certainly help the device become more than just a “niche product”).

Though it’ll take time for sales in Vision Pro to march higher, I believe that advancements on the software side could act as a driver on the share price in the near-to-medium term. We’re likely more than a year away from the next iteration of Apple’s spatial computer. However, 2024 could see some significant software improvements (especially when it comes to AI) until then.

Whether we’re talking about more sophisticated updates to visionOS (the Vision Pro’s operating system) or a growing number of apps (perhaps some of them will be so-called “killer” apps?), the enthusiasm surrounding the product has the potential to grow at an exponential rate from here.

In the meantime, I think the Vision Pro’s App Store (there were 600 apps on day one of the release) library is looking quite robust. As more developers get their hands on the visionOS tools, I’d look for the number of apps and games to surge into year’s end. That alone could make the Vision Pro a massive driver of the stock as investors anticipate greater sales in the future in response to the rapidly advancing software ecosystem.

WWDC 2024 May be That Much-Awaited AI Reveal

Following the release of Apple’s latest results, CEO Tim Cook teased analysts, hinting that generative AI products will be coming later in the year. It’s no mystery that Apple has been investing “tremendous time and effort” (as per Tim Cook) into AI integration. And though it would have been nice to have some more specifics from Cook, like a specific date and features, I believe the AI premium that many Magnificent Seven stocks now command will be commanded by Apple once its new AI innovations are finally unveiled.

Mark Gurman of Bloomberg thinks iOS 18 (the next update to iPhone’s operating system that could be a highlight of this year’s WWDC) could represent the “biggest” update in its history, thanks in part to AI. We can only speculate at this point, but I think he’s right on the money. More details on the update may very well help drive the stock above $200, perhaps toward the $250 Street-high target currently held by Wedbush analyst Daniel Ives.

Ives sees the Vision Pro as Apple’s “first major push” into the realm of AI. If he’s right, other analysts on Wall Street may find themselves racing to upgrade their targets to prices more in line (or maybe exceeding) that of Ives’.

Undoubtedly, ChatGPT-like Siri Updates and a potential AI App Store could propel Apple stock from an AI underdog to one of the top contenders, perhaps even a leader. This is especially likely given that a vast majority of Apple’s “golden” installed base will actively use such technologies if they are featured as part of iOS 18.

Is AAPL Stock a Buy, According to Analysts?

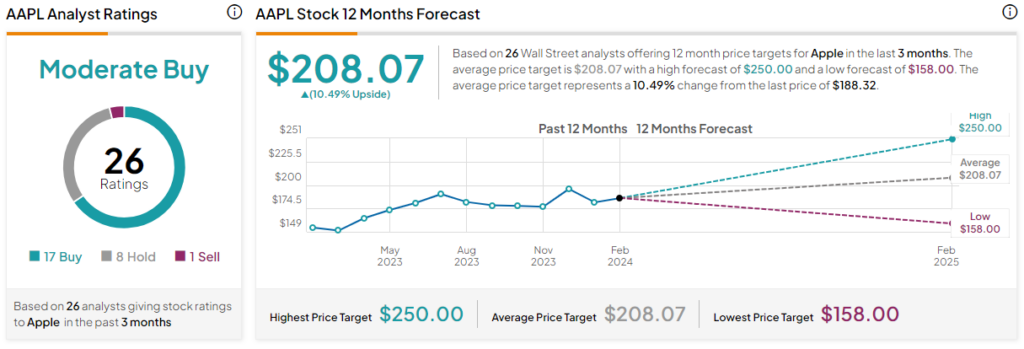

On TipRanks, AAPL stock comes in as a Moderate Buy. Out of 26 analyst ratings, there are 17 Buys, eight Holds, and one Sell recommendation. The average AAPL stock price target is $208.07, implying upside potential of 10.5%. Analyst price targets range from a low of $158.00 per share to a high of $250.00 per share.

The Bottom Line

It’s easy to be less-than-upbeat on Apple stock as the iPhone maker’s sales growth and shares stall. That said, if you look to Apple’s near future, it’s clear that selling AAPL stock right here could prove to be a mistake, especially if Ives’ predictions come true.

For now, I’d look to WWDC 2024 and Vision Pro news as potential catalysts to help drive shares higher on the year. Could 2024 be Apple’s year of AI? I think it could be.