Normally, a business settling a lawsuit—particularly a patent-related lawsuit, and for a tech leader like Apple (NASDAQ:AAPL)—would be cause for celebration. But for Apple investors, the potential settlement between Apple and the California Institute of Technology (Caltech), was cause for little more than mild selling. The patent suit news sent Apple down fractionally in Friday afternoon’s trading.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Apple, along with Broadcom (NASDAQ:AVGO), has been struggling with this particular patent suit for the last few years now, according to reports. Now, all three parties have been ordered by courts to file a “joint status,” with a deadline of just a week from today. Previously, Apple and Broadcom tried to get this patent case heard before the Supreme Court, which denied the hearing. Indeed, last year, Apple and Broadcom found themselves facing a major verdict that awarded Caltech $1.1 billion from the two companies, with Apple on the hook for $878 million. Now, however, a settlement may be in the offing that will fundamentally change all of that.

That wasn’t the only distressing development for Apple, as it revealed plans to make a major change in iOS 17 that will leave many iPhone users frustrated. Apple is planning to relocate its red “end call” button from its previous location. Previously, the button was located front and center, and away from other options. Now, it’s being moved to the right, and will be placed among other features. That’s a move that’s left users frustrated, and might well cost Apple some repeat business going forward, especially given the state of Apple consumers’ wallets these days.

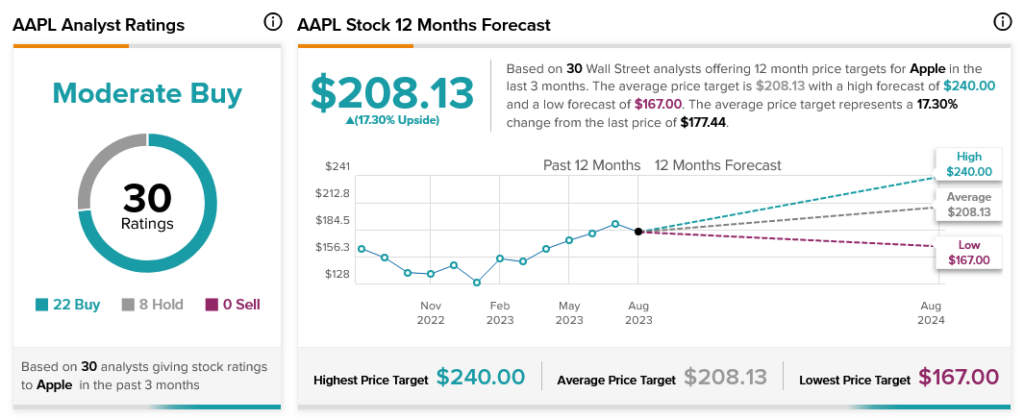

Lawsuits and layouts aside, Apple is still huge with analysts. Apple stock is still a Moderate Buy by consensus figures, thanks to 22 Buy ratings and eight Hold. Further, Apple stock offers a 17.3% upside potential thanks to its average price target of $208.13.