Apple (NASDAQ:AAPL) was engaged in discussions with DuckDuckGo regarding the possibility of replacing Alphabet (NASDAQ:GOOGL)(NASDAQ: GOOG)-owned Google as the default search engine for the private browsing mode in Apple’s Safari browser. However, it eventually dismissed the idea, as reported by Bloomberg. In separate news, Apple recently released an iOS 17 update, which offers critical bug fixes and security enhancements.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The report, highlighting the transcripts unsealed by the judge presiding over the U.S. government’s antitrust trial involving Google, revealed that Apple also considered acquiring Microsoft’s (NASDAQ:MSFT) Bing, its search engine, in 2018 and 2020.

While the Google trial is bringing negative headlines for Apple, the company, in a positive development, rolled out an operating system update labeled iOS 17.0.3, specifically designed to tackle the overheating problem experienced by iPhone 15 models.

Notably, Apple recently launched four new models of the iPhone 15. Wall Street analysts, including Goldman Sachs’ Mike Ng and Morgan Stanley’s Erik Woodring, are upbeat about the early demand trends for iPhone 15 models and reiterated a Buy rating on Apple stock following the launch last month. Though these analysts are bullish about Apple’s prospects, it’s essential to consider the overall consensus rating among analysts for Apple’s shares.

What is the Future Outlook for Apple Stock?

Wall Street is cautiously optimistic about Apple stock. The company will likely benefit from its large installed base of devices, strength in its service revenue, and increased demand for the iPhone 15. However, AAPL’s high valuation could restrict the upside potential.

Citing Apple’s expensive valuation, KeyBanc analyst Brandon Nispel downgraded AAPL stock to Hold from Buy on October 3.

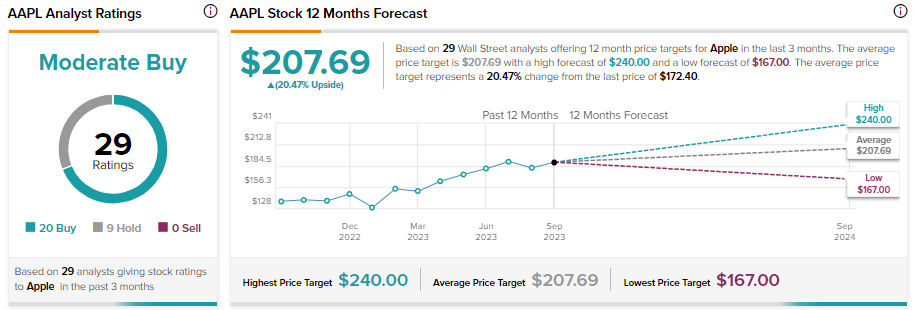

While Nispel remains sidelined, Apple stock, in total, has received 20 Buy and nine Hold recommendations for a Moderate Buy consensus rating. Analysts average price target of $207.69 implies an upside potential of 19.60% from current levels.