Most of The Big Tech cohort have been stepping up to dial in their latest earnings reports over the past couple of weeks and It’s almost time for Apple (NASDAQ:AAPL) to grab hold of the mic. The company will deliver its latest quarterly statement once trading comes to a halt on Thursday with the print coming at a bit of a difficult time.

Apple has been facing pressure in the Chinese market where iPhone sales are anticipated to be weaker compared to the same period a year ago, leading to a slight decline in revenue. Competition from Huawei and a less-than-exciting upgrade cycle for the iPhone 15 have been weighing hard on Apple in this key region.

As such, Wedbush analyst Daniel Ives expects the Street will be “trying to gauge just how soft the China numbers are.” For sentiment to get a boost, much will rest on CEO Tim Cook’s commentary on the conference call. While Ives is not expecting “any fireworks” for iPhone unit growth in China for the June quarter outlook (the “whisper bogey” is iPhone revenue of ~$35 billion and total revenue around $80 billion), he anticipates a long-term “cautiously optimistic outlook” on China.

The good news is that the next iPhone release is coming soon and it should be a much better cycle than the current one. That’s because the upcoming model will be the “AI driven” iPhone 16 which should help the company “return to growth again in China with tailwinds into FY25.”

So, for Ives, right now it’s all about seeing the forest through the trees. Once Apple navigates through the rough terrain of the next 1-2 quarters, things look brighter on the other side. There lie “easier comps, AI announcement at WWDC, stronger upgrade cycle for iPhone 16, and the monetization opportunity of the golden installed base in Cupertino.”

“While some patience is required to navigate this China weakness, we believe the seeds for an Apple growth turnaround are being planted in the field by Cook & Co,” Ives summed up.

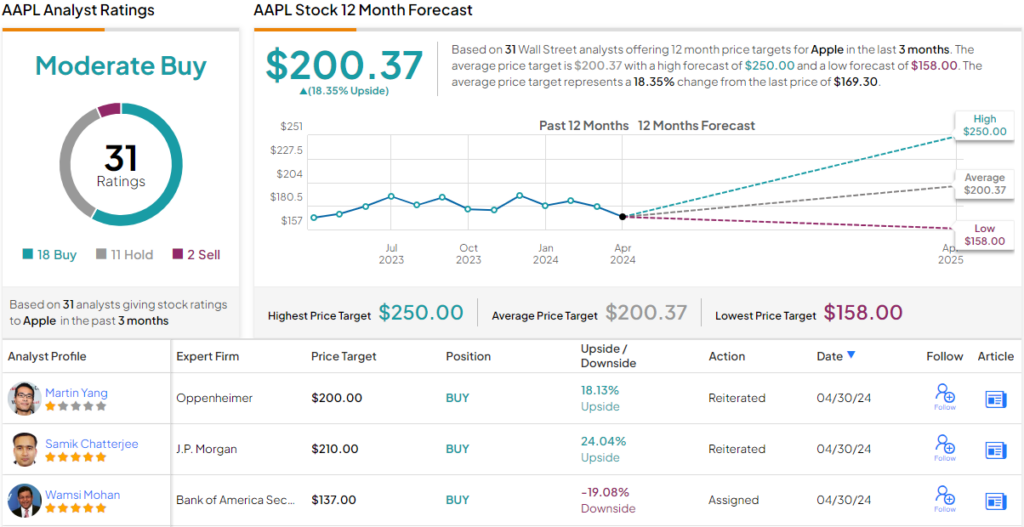

To this end, Ives maintained an Outperform (i.e., Buy) rating on Apple shares along with a $250 price target. The implication for investors? Upside of ~48% from current levels. (To watch Ives’ track record, click here)

The Street’s average target is a more modest $200.37, yet its still suggests the shares will climb 18% higher in the months ahead. Rating wise, based on 18 Buys, 11 Holds and 2 Sells, the analyst consensus rates the stock a Moderate Buy. (See Apple stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.